Today’s featured company is:

Building the Future of Energy

Southern Company (NYSE: SO) is an energy company providing electric and gas service to nine million customers across the United States through its subsidiaries. The company is focused on making, moving, and selling reliable, low-cost energy solutions from traditional and renewable power sources, as well as providing superior customer service. Recognizing the rapid evolution of the energy sector, including new technologies, customer preferences, and environmental, social, and governance initiatives, Southern Company is working to advance its solar, wind, and nuclear holdings, develop microgrids, and significantly reduce its systems' greenhouse gas emissions.

- Serving 9 million customers through 7 major subsidiaries across the U.S.

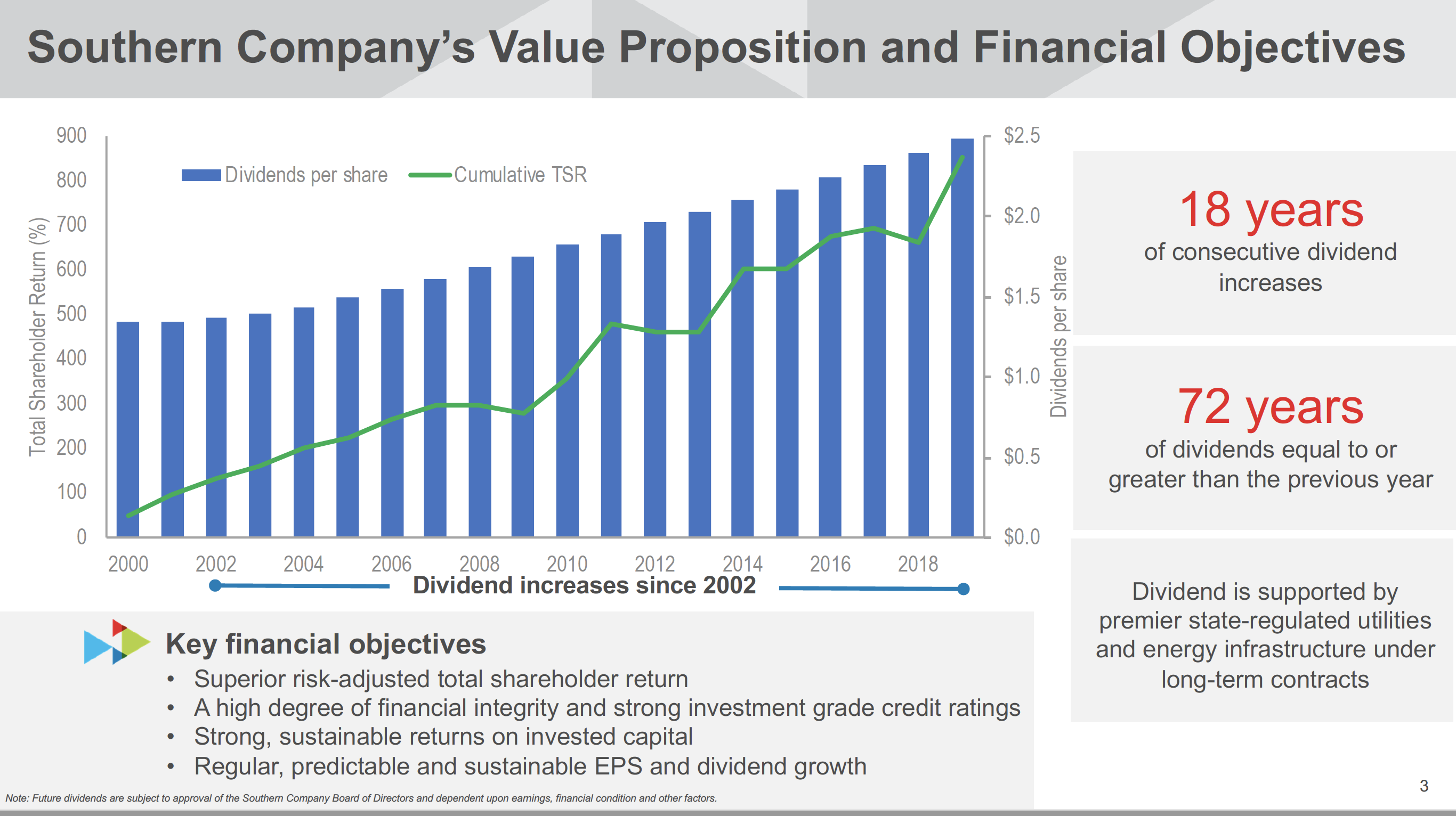

- 288 consecutive quarterly dividends equal to or greater than those in the previous quarter (more than 70 years)

- Approximately 44,000 megawatt generating capacity

- Developing microgrids and deploying energy storage systems throughout the U.S.

- Subsidiary Southern Power provides 11,300 MW of wholesale solar, wind, fuel cell and natural gas generation in 12 states

- Subsidiary PowerSecure provides distributed infrastructure technologies in 32 states

Advisor Access spoke with Southern Company’s chairman, president and CEO, Tom Fanning, about the company’s business model, culture, and plans for future growth.

Advisor Access: Let’s start with the basics. Please describe Southern Company’s core business and strategy.

|

Tom Fanning: Southern Company is a leading energy company serving nine million customers through our subsidiaries. Clean, safe, reliable, and affordable are the benchmarks we use to evaluate our value proposition to customers. We do this through electric operating companies in three states, natural gas distribution companies in four states, a competitive generation company serving wholesale customers across America, and a leading distributed energy infrastructure company.

For more than a century, we have delivered the energy resources and solutions our customers and communities need to drive growth and prosperity. Further, we understand that meeting the requirements of our customers, our neighbors, and our communities creates a special responsibility to look beyond our own self-interest. We must be bigger than our bottom line, be citizens wherever we serve, and create an environment in which the communities we serve are better off because we are there.

AA: A tagline for the Company is “building the future of energy.” What does this mean for Southern Company and why is it important?

TF: Innovation represents an enormous advantage for Southern Company. Southern Company remains the only company in America, in our industry, that does proprietary, robust research and development. In fact, this year was a milestone year for Southern Company’s research and development organization as we celebrated our fiftieth year of leading industry innovation.

Our efforts have a simple goal: increase the value of energy to our customers.

Southern Company is implementing an “all of the above” strategy as it relates to fuel. On one hand, we're the only company in America building new nuclear, which must be part of the solution to this nation's energy future. Second, we are investing in a variety of technology solutions to deploy more low- to no-carbon-emitting energy resources. Third, we are the second-largest owner of solar in the United States, and we have increased our investment in wind.

When I became chairman and CEO in 2010, approximately 70% of our energy came from coal and approximately 11% from natural gas. Now it’s about 50% natural gas and about 22% coal. At the same time, renewables have increased from around 2% of our generation mix to 12% today. The importance of renewables in the energy portfolio going forward is so important. Continued development and deployment of a diverse portfolio of energy resources helps us to reliably and affordably serve our customers.

At Southern Company, we maintain a commitment to real science and technology development. We are putting out an entire portfolio of new ideas that I think will have profound consequences in the future.

AA: Southern Company has a very robust capital investment plan over the next several years. Could you talk a little bit about what you are investing in?

TF: While the Vogtle Unit 3 & 4 nuclear construction project is very important for Southern Company, and certainly garners a great deal of interest from investors, it only represents about 10% of our $38 billion capital investment plan over the next five years. This capital investment plan, which supports our 4–6% earnings per share growth objective, is primarily comprised of regulated investment, with 95% of investments being made through our seven state-regulated electric and gas subsidiaries.

The majority of these expenditures will support increased resilience and smart grid investment on the transmission and distribution systems at our electric utilities, environmental remediation related to ash pond closures at our coal units, and pipeline replacement and improvement programs at our state-regulated gas companies. We expect the durability of our earnings per share growth rate to remain strong beyond the next five years as well, as we continue modernizing our generating fleet to renewable and natural gas generation and finish the ash pond closure process within our coal fleet.

AA: Southern Company has paid a remarkable 288 consecutive quarterly dividends that have been equal to or greater than those in the previous quarter. Can you talk a bit about why the dividend is so important to Southern Company?

TF: This year represents our eighteenth consecutive annual dividend increase, and for seventy-one years—dating back to 1948—Southern Company has paid a dividend that was equal to or greater than that of the previous year. We have never decreased our dividend. This is a record we are very proud of.

When you look at Southern Company’s value proposition, we pride ourselves on maintaining a high degree of financial integrity and strong, investment-grade credit ratings, coupled with regular, predictable, and sustainable earnings per share and dividend growth. This supports our objective of providing superior risk-adjusted total shareholder return to investors over the long term.

And why is that important? When you have that type of investment, the compounding effect of the dividends every year is enormous. Over 70% of Southern Company’s total shareholder return over the last twenty years has come from the dividend.

AA: The energy mix of your portfolio has evolved dramatically over the last decade. Can you describe what has changed and why?

TF: Our generation portfolio has seen a drastic transformation over the past decade as our fleet has transitioned from coal to natural gas and renewable generation. Year-to-date 2019, generation from coal represents 22% of our total generating mix—down from nearly 70% of our generating mix in 2007.

Our goal at Southern Company is to provide clean, safe, reliable, and affordable energy to the customers we have the privilege to serve. We work with regulators within each of the jurisdictions that we serve to perform long-range generation planning in support of that goal.

The decision to reduce generation from coal-fired power plants—and to retire coal plants in some cases—is made within the state regulatory framework for each utility.

Three primary economic drivers of the shift in energy mix for our regulated utilities are: 1) persistently low natural gas prices, which favor lower-emitting natural gas generation; 2) the cost of environmental controls for coal units required to comply with state and federal environmental regulations; and 3) the continued decline in the cost of renewable generation as solar and wind technology matures. Along with a quantitative economic review, we also consider other qualitative factors, such as fuel diversity, impacts to local communities, and operational flexibility when making major generation decisions.

We have also set a goal to reduce greenhouse gas emissions 50% by 2030, and to achieve low to no greenhouse gas emissions by 2050, from 2007 levels. These goals are a continuation of our trajectory of lower carbon emissions over the past decade. I am confident we are prepared and well positioned to meet the needs of customers well into the future, and to succeed in this transition to a low-carbon future.

AA: Southern Company’s subsidiaries consistently rank among the top of the industry with regards to customer satisfaction. Why is customer satisfaction so important to Southern Company?

TF: Our pledge to put the customer at the center of everything we do is the key to our success. I like to frame our day-to-day actions in two ways—the “whats” and the “hows.” At Southern Company, our “whats” are the things we do every day to make, move, and sell energy in a reliable, low-price manner with some of the best customer service in the U.S. But the “whats” alone are not enough.

As important, and potentially more powerful, than what we do in life is how we do it. Southern Company’s culture revolves around what we have termed “Our Values: Safety First, Unquestionable Trust, Superior Performance, and Total Commitment.”

We know that our culture—not rules and procedures—drives our behavior. It sets an institutional guidepost, a common set of principles, a common set of expected behaviors that define how we should interact with each other. Further, we believe that we need to be leaders in improving the human condition—making a difference on a personal level, touching people’s hearts in a positive way. These are the things that propel any enterprise forward and create sustaining value.

AA: Is there anything else you’d like investors to know about Southern Company?

TF: The energy sector is rapidly evolving, driven by innovation, technology advancements, customer preferences, resiliency efforts, and environmental, social, and governance initiatives. With evolution comes tremendous opportunity, and Southern Company, with our customer-centric business model, is well poised to provide continued value to our customers and communities in this changing landscape.

We recognize that innovation and technological progress is fundamental to the advancement of society, and that change is inevitable, so we choose to actively engage in the future. Sure, some will ignore it or spend their resources attempting to prevent inevitable change from happening. Instead, we have made a promise not only to prepare for and respond to what the future will bring, but more than that, to embrace change and take action to ensure we will be the leaders who influence the future, who continue to serve our customers, and who ensure that those advances improve the quality of life for all.

That is why we are so excited about the future of Southern Company.

AA: Thank you, Tom.

Thomas A. (Tom) Fanning is chairman, president and chief executive officer of Southern Company, America’s premier energy company. Elected to the board of directors in July 2010, he became president of Southern Company in August 2010, and assumed the additional responsibilities of chairman and CEO in December 2010. He has worked for Southern Company for more than 38 years and has held 15 different positions in eight different business units, including numerous officer positions with a variety of Southern Company subsidiaries in the areas of finance, strategy, international business development and technology. Fanning is co-chair of the Electricity Subsector Coordinating Council, which serves as the principal liaison between the federal government and the electric power sector to protect the electric grid from threats that could impact national security, including cyber and physical terrorism as well as natural disasters. He also collaborates with the Tri-Sector Executive Working Group, which was formed by the electricity, finance, and communications sectors to enhance national and economic security by developing a cross-sector strategic framework to address existential threats, risk and consequence management. Fanning earned bachelor’s and master’s degrees in industrial management and also was awarded an honorary Doctor of Philosophy degree from Georgia Tech. His executive education includes programs at the International Institute for Management Development in Lausanne, Switzerland, Harvard Business School and the University of Virginia Darden School of Business. Fanning lives in Atlanta with his wife, Sarah, and has four children.

Analyst Commentary

“Despite stellar year-to-date performance, Southern could still be cheap versus peers if Vogtle construction remains on track and Georgia Power is able to constructively settle the pending rate case.”

—Greg Gordon, Evercore ISI

Oct 30, 2019

“Southern stock rose 2.8% after its premarket call, as investor sentiment on SO is the hottest its been in years.”

—Steve Fleishman, Wolfe Research

Oct 30, 2019

“If management is able to successfully navigate through several upcoming milestones, we could see further upside to shares even after taking in to account outperformance year-to-date versus peers.”

—Julien Dumoulin-Smith, Bank of America Merrill Lynch

Oct 31, 2019

“We seek a potential entry point on the heels of a very strong year-to-date performance. Fundamentals remain very sound; the value of SO is coming to light as risks moderate.”

—Shar Pourreza, Guggenheim

Oct 30, 2019

Disclosures

This communication contains forward-looking statements; please read Southern Company's complete forward-looking statement disclaimer HERE.

Investors and others should note that Southern Company posts important financial information using the investor relations section of the Southern Company website, https://www.southerncompany.com, and Securities and Exchange Commission filings.

The information contained in this facsimile message is intended only for the use of the individuals to whom it is addressed and may contain information that is privileged and confidential. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone at (707) 933-8500.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements. This information may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. Southern Company has paid Advisor Access a fee to distribute this email. Southern Company had final approval of the content and is wholly responsible for the validity of the statements and opinions.

Please add "donotreply@advisor-access.com" to your address book and whitelist us.

CLICK HERE if it's okay to share your name with this company.

CLICK HERE to confirm your subscription to Advisor Access.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.

Copyright © 2019 Advisor Access. All rights reserved.