FEATURED COMPANY

Creating Shareholder Value

through Clean Energy

For CMS Energy (CMS:NYSE), a leading energy provider in Michigan’s lower peninsula, it all comes down to delivering across the Triple Bottom Line: people, planet, and profit. Through the company’s largest subsidiary, Consumers Energy, CMS is targeting ESG (environmental, social, and corporate governance) and sustainability as a driver of growth for investors and the means by which it will sustain its mission to deliver safe, reliable, affordable, and clean energy to its customers.

- 6.8 million residents in Michigan’s lower peninsula served by subsidiary Consumers Energy

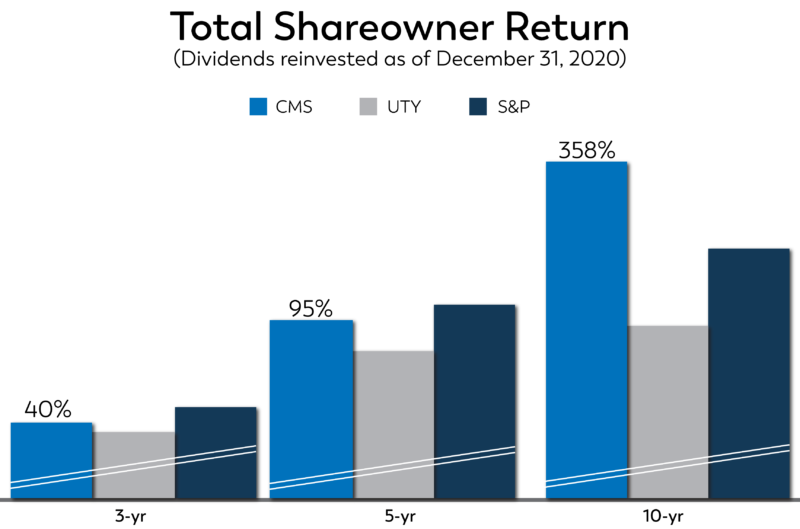

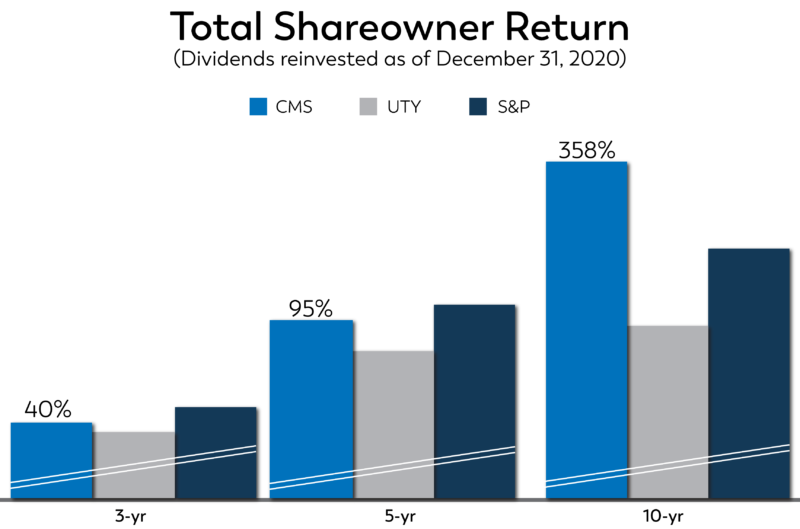

- Adjusted earnings per share (EPS) growth of 6% to 8%; premium total shareholder return of 9% to 11%

- 2020 revenues of $6.7 billion; assets totaling $29.7 billion; ~8,500 employees

- Residential electric and natural gas customer growth of about 1% annually

Advisor Access spoke with Garrick Rochow, Chief Executive Officer of CMS Energy.

Advisor Access: For readers unfamiliar with your company, can you share an overview of CMS Energy and the value proposition it offers to investors?

Garrick Rochow: CMS Energy operates primarily as a regulated utility, Consumers Energy, serving 6.8 million residents in all 68 counties in Michigan’s lower peninsula. Consumers Energy is our largest subsidiary.

At CMS Energy, we strive to lead in everything we do. It’s leadership that drives our purpose: to deliver world class performance and hometown service that’s centered on our “Triple Bottom Line”—people, planet, and profit—and our commitment to ESG (environmental, social, and corporate governance) and

sustainability.

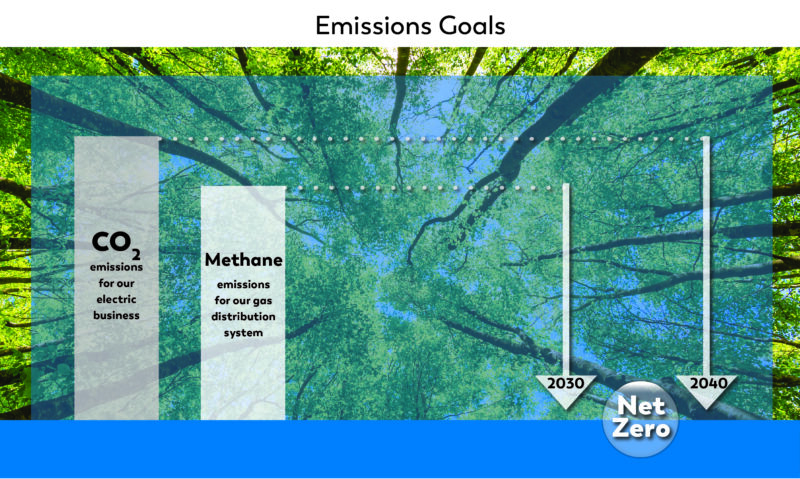

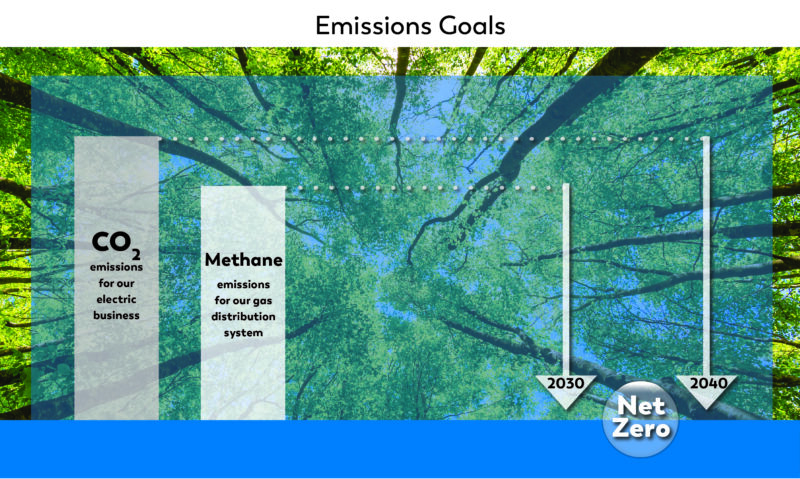

We work to execute a simple but unique investment thesis. It starts with our commitment to lead the clean energy transformation in Michigan, and nationally. Our net zero

methane and

carbon targets by 2030 and 2040, respectively, require significant investment to update our expansive electric and natural gas systems. We’re proud of our recent pledge to deliver industry-leading net zero methane and carbon emission energy for our customers, our investors, and our planet. It’s the opportunity of our generation and includes eliminating our use of coal-fueled power generation by 2025.

Our capital investments are supported by constructive energy legislation and alignment with the Michigan Public Service Commission. This strong regulatory and legislative framework is why Michigan consistently ranks as a top-tier regulatory jurisdiction. However, we recognize investment opportunities and a supportive regulatory environment are not enough. We also prioritize affordability for our customers, who rely on us to deliver safe, reliable, affordable, and clean energy.

Over the past two decades, we’ve demonstrated consistent cost management as we’ve invested in the safety and reliability of our systems, while also improving customer service. Our ability to manage costs is not driven from the top down but from the bottom up. CMS Energy’s approximately 8,500 co-workers are committed to excellence and delivering the highest value to our customers. This is embedded in our culture and was built in partnership with our union, which makes up over 40% of our workforce.

These unique elements in the CMS Energy story enable us to deliver for customers, investors, and the communities we serve. Our service is more than just delivering electricity and gas—it’s light and heat, economic vitality, and the quality of life that our customers and communities have come to expect.

We consistently deliver earnings and dividend growth year over year, regardless of weather, a global pandemic, Michigan’s political landscape, or other external factors. Our adjusted EPS growth of 6% to 8%, combined with our dividend, enables a premium total shareholder return of 9% to 11%. We plan to continue delivering industry-leading results while targeting the high-end of our EPS guidance range in 2022 and beyond, along with a dividend payout ratio of ~60%.

AA: As natural gas prices continue to increase through the pandemic, how does CMS Energy manage costs while focusing on the financials?

GR: We’re often asked about natural gas prices and the impact on our business, and more importantly, our customers. It’s important to understand how our gas business is uniquely positioned to protect against short- and long-term price volatility. We have one of the largest natural gas storage fields in the U.S., and compression resources to match. That’s a significant advantage. We begin purchasing and injecting natural gas into our storage fields in April and continue when natural gas prices are low throughout the summer.

By October, our fields are full and ready to meet our customers’ heating needs throughout the winter, enabling us to avoid buying at spot prices. This saves our customers money while keeping them safe and warm all winter because of the operational certainty of storage. The financial protection of a pass-through clause enables us to seek recovery of any under-recovered balances in the following plan year.

AA: There is an ever-growing industry focus on ESG and sustainability. How does ESG fit into the CMS Energy model? How does this focus impact your bottom line?

GR: ESG is nothing new for us. We’ve focused on the Triple Bottom Line for some time, and our 20-year

Integrated Resource Plan (IRP), filed in June, demonstrates our commitment to all three pillars—people, planet, and profit. We plan to fully exit coal by 2025, which will reduce our carbon emissions by more than 60% from 2005 levels. We’re committed to our net zero carbon emission target by 2040, and our IRP, as filed, positions us well to achieve that target.

We plan to add nearly 8,000 megawatts of incremental solar and 2,500 megawatts of demand-side resources, and by 2040 our plan will have generated approximately $650 million in customer savings. Our Triple Bottom Line naturally embodies an ESG mindset, and we have short- and long-term goals to ensure we deliver for our customers, our planet, our investors, and the communities we serve.

Beyond our

environmental efforts, we maintain a strong focus on

social and

governance factors. Environmental justice, a just transition, and diversity, equity, and inclusion, are critical priorities for our communities, co-workers and investors. With our IRP, we evaluated environmental justice impacts to ensure our plans don’t adversely affect communities, and just as we’ve done with other plant closures, we’ve committed to support our impacted employees and communities when our plants close. We’ll work with our co-workers to provide retention incentives and placement plans, and with our communities to transition local economies.

Our focus on

diversity, equity, and inclusion includes seven employee resource groups working together to make our company better. About one in five co-workers are engaged with one or more of these resource groups. This, coupled with our commitment to safety and other diversity and inclusion efforts, ensures we remain focused on making our company truly a safe and great place to work, where all co-workers are seen and belong. Our efforts continue to be recognized nationwide, and most recently by Forbes

® as the #1 utility in the U.S. for America’s Best Employers for Women and America’s Best Employers for Diversity. I’m proud of how our company cares for people.

I would also note that our Chairman of the Board position is separate from the president and CEO. Other than the president and CEO, our diverse Board is independent (>90%). We have a separate committee dedicated to governance, sustainability, and public responsibility. These checks and balances are necessary at the Board level and in senior management to ensure we make the right decisions every day for our customers, co-workers, investors, and the planet.

AA: Has CMS Energy been affected by the economic slowdown associated with the COVID-19 pandemic?

GR: Our residential electric sales, which is our highest margin customer class, are above pre-pandemic levels and our commercial and industrial classes are recovering rapidly. New connections for our natural gas and electric businesses have been up more than 15% since 2019, with an additional 20% of new requests in the queue through September. We also continue to see the number of our residential electric and natural gas customers grow by about 1% annually.

The state of Michigan also continues to experience growth. In fact, we’ve attracted more than 75 megawatts of new or expanding business in Michigan this year alone. This new load is expected to generate more than 1,200 jobs and more than $1 billion of investment in our state. That’s in addition to more than 400 megawatts of new and expanding load attracted to our service territory since 2015 through the proactive efforts of our economic development team. Michigan and Grand Rapids, the heart of our electric service territory, continue to thrive with unemployment rates well below the national average.

AA: How does CMS Energy maintain affordable bills for customers to maintain its EPS growth?

GR: Our model is structured to enable sustainable long-term and industry-leading growth. Every day, our co-workers show up to deliver safe, reliable, affordable, and clean energy for our customers. Co-workers are empowered to search for, identify, and eliminate waste wherever it is—whether in the form of cost reductions or productivity. Through this commitment, we’re able to reduce costs sustainably so we can continue to invest in new infrastructure while keeping customer bills affordable and driving continued growth.

AA: Is there anything else you’d like investors to know about CMS Energy?

GR: We see tremendous short- and long-term opportunity to deliver for all stakeholders. As we double down on leading the clean energy transformation, we remain focused on our growing renewable portfolio through

programs like our Voluntary Green Pricing Program, which would add another 1,000 megawatts of owned renewable generation and further upside to our plan. This program is in high demand, and the initial tranche of approximately 125 megawatts is oversubscribed and will help our customers meet their aspirational carbon goals.

As we prepare for the

grid of the future, we have highly visible and detailed capital plans outlined in our recently filed Electric Distribution Infrastructure Investment Plan (EDIIP). This plan provides a five-year capital investment view of planned projects down to the circuit level to ensure the reliability and resiliency of our electric infrastructure.

Our commitment to identify and eliminate waste helps us keep bills affordable. In 2020 alone, through a company-wide cost reduction effort and by leveraging what we call the CE Way, we realized more than $100 million in savings, roughly half of which have proven sustainable. We empower our co-workers to deliver excellence through the CE Way, and identify and eliminate waste to improve reliability and deliver better customer service. The CE Way is in our DNA and creates tremendous customer value. In 2021, we expect to see an additional $40 million-plus in cost savings supported by continued execution on the CE Way, which will deliver savings both near-term and well into the future.

We also continue to focus on electric vehicles (EVs) and growing demand in Michigan. As such, we grew our EV program with

PowerMIFleetTM this year. This is part of our long-term planning and collaboration with Michigan businesses, governments, and school systems looking to electrify their vehicle fleets. Nearly 20 customers signed up this year, and another 50 have indicated an interest in the next tranche, exceeding our expectations. This is an important contribution to our long-term sales growth. Our EV program also includes an ongoing

PowerMIDriveTM program to help our customers transition to electric vehicles more affordably.

These are just a few examples of how we continue to deliver excellence and position the business for sustainable, long-term growth. To learn more about our ESG and sustainability efforts, you can read our annual

ESG and Sustainability Report and view our

ESG investor presentation, which are posted on our website.

AA: Thank you, Garrick.

Garrick J. Rochow is president and chief executive officer of CMS Energy and its principal subsidiary, Consumers Energy, which serves 1.9 million electric customers and 1.8 million natural gas customers. He was elected to this position in December 2020. Rochow previously was executive vice president of operations, responsible for the company’s electric and natural gas distribution and transmission operations, generation and compression operations, operations performance, regulatory compliance, and planning and scheduling. Previously, Rochow served in several operations leadership roles: He was Consumers Energy’s senior vice president of distribution and customer operations; Consumers Energy’s vice president of customer experience, rates, and regulation and quality, and chief customer officer, after serving as vice president of energy delivery. In his energy delivery role, he led engineering and planning of the company’s electric and natural gas distribution systems. Rochow joined Consumers Energy in 2003 and previously served as combustion turbine business manager at the Zeeland generating facility and site production manager at the Campbell Generating Complex. Rochow began his utility career as an environmental lead at the Holland Board of Public Works, where he served as a maintenance superintendent and managed steam turbine and boiler outage responsibilities. Rochow graduated from Michigan Technological University with a bachelor’s degree in Environmental Engineering and earned a master’s degree in Business Administration from Western Michigan University. He also has attended an executive education program at the University of Wisconsin-Madison’s Wisconsin School of Business.

DISCLOSURES

The information in this document is current as of December 7, 2021. This document contains forward-looking statements that are subject to risks and uncertainties. It should be read in conjunction with the “Forward-Looking Statements and Information” and the “Risk Factors” sections of CMS Energy’s most recent Form 10-K and as updated in reports CMS Energy files with the Securities and Exchange Commission, which are incorporated herein by reference and discuss important factors that could cause CMS Energy’s results to differ materially from those anticipated in such statements.

The document also includes non-GAAP measures when describing CMS Energy’s results of operations and financial performance. All references to earnings per share are on a diluted basis. Adjustments could include items such as discontinued operations, asset sales, impairments, restructuring costs, changes in accounting principles, changes in federal tax policy, regulatory items from prior years, unrealized gains or losses from mark-to-market adjustments recognized in net income related to CMS Enterprises’ interest expense, or other items. Because CMS Energy is not able to estimate the impact of specific line items, which have the potential to significantly impact, favorably or unfavorably, CMS Energy’s reported earnings in future periods, CMS Energy is not providing reported earnings guidance nor is it providing a reconciliation for the comparable future period earnings. The adjusted earnings should be considered supplemental information to assist in understanding our business results, rather than as a substitute for the reported earnings. References to earnings guidance refer to such guidance as provided by the company on October 29, 2021.

Investors and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section, www.cmsenergy.com/investor-relations, a channel of distribution.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.