The REIT Newsletter for Advisors • Spring 2017

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the REIT newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the REIT Newsletter includes valuable information about REITs that you cannot get anywhere else.

The National Association of Real Estate Investment Trusts (NAREIT®) is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets.

The Spring 2017 issue features an article by the research department at Cohen & Steers Open-End Mutual Funds.

Rising Rents Matter More to REITs

Than Rising Rates

Rate hikes get a lot of attention, but for REITs they’re often not the big story. The big stories today are 77 consecutive months of job growth, a nine-year low in unemployment, and a strengthening economy, giving landlords greater ability to raise rents. When rents are rising, history shows that REITs can deliver strong returns—despite higher interest rates.

The perception that REITs always underperform when interest rates are rising is simply not supported by historical data. Higher rates may unsettle markets in the short term, but what tends to matter more for REITs in the long run is the direction of the economy and job growth. Historically, REITs have had strong returns in periods of monetary tightening and rising bond yields, as this is usually a reflection of accelerating inflation and economic growth.

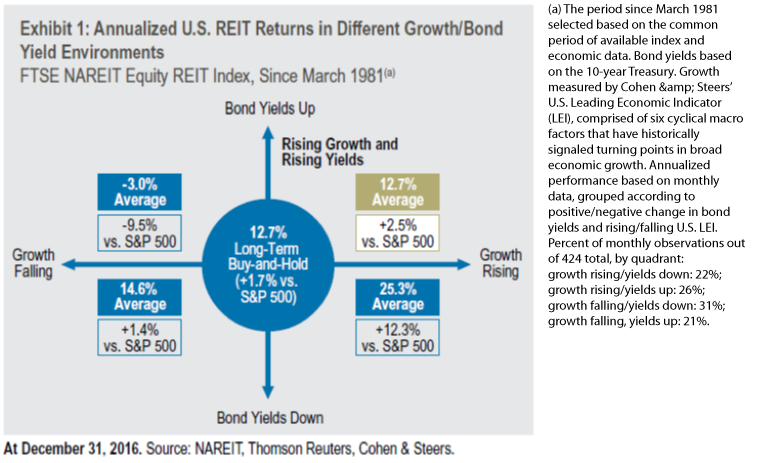

Rising yields with growth have been a positive combination for REITs: The chart below shows annualized returns of the U.S. REIT market since 1981, grouped according to changes in the 10-year Treasury yield and U.S. Leading Economic Indicators over one-month periods. In months when growth was improving and bond yields were rising, REITs outperformed the S&P 500, averaging 12.7%—consistent with their long-term buy-and-hold return.

It is already a widely accepted view in the investment community that commercial real estate is a core asset class with unique investment attributes and return drivers and that an investment in listed Equity REITs is an investment in real estate. As evidence of this, in the defined contribution market, where the growing use of target-date funds remains the dominant investment-related trend, it is estimated that more than 90% of these products feature Equity REIT allocations. With respect to financial advisors, a NAREIT-sponsored survey conducted by market research firm APCO Insights in 2015, found that 70% of registered investment advisors recommend stock exchange-listed Equity REITs to their clients.

What happened in the last rate-hike cycle?

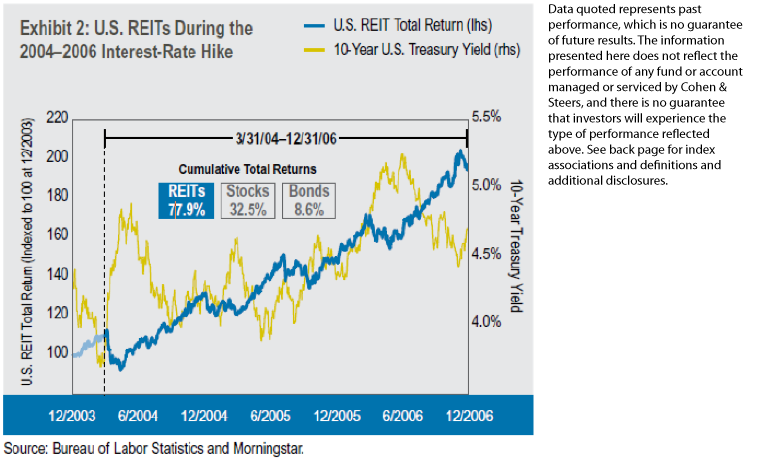

In March 2004, a strong jobs report caused a spike in Treasury yields, causing REITs to sell off and lag the S&P 500 over the next month. As markets digested the data and volatility subsided, REITs recovered. Over the next two years, the Federal Reserve raised interest rates 17 times, from 1.0% to 5.25%. From the 10-year Treasury yield low in March 2004 through the end of 2006, REITs had a cumulative return of 78%, widely outperforming U.S. stocks and bonds.

Opportunity Amid Rate-Driven Volatility

Too often, we see investors focus on short-term changes in interest rates, yet lose sight of the bigger picture. As investors adjust asset allocations for the shifting market environment, we believe REITs offer attractive characteristics.

Attractive yields with growth potential: As of year-end 2016, real estate was the third highest yielding sector in the S&P 500 at 3.5%, compared with the S&P average of 2.1%. The broad U.S. REIT market, represented by the FTSE NAREIT Equity REIT Index, had a dividend yield of 3.9%. REITs have historically provided steady dividend growth along with capital-appreciation potential.

Inflation protection: REITs have historically exhibited a positive association with inflation surprises due to the impact of higher replacement costs on property values, as well as the ability of landlords to raise rents.

Potential diversification benefits: Since 1990, REITs have had a 0.55 correlation with broad equities and a 0.19 correlation with bonds. Combining assets with different performance drivers has the potential to improve risk-adjusted returns.

Hitting the Reset Button on Real Estate

We believe key policy changes could be game changers for the U.S. economy, raising the potential for real estate fundamentals to strengthen. On the demand side, more fiscal spending and lower taxes could drive job growth, corporate profits, and consumption due to wage inflation. On the supply side, higher inflation may pressure the environment for construction—higher costs for labor, raw materials, and financing would, in turn, mean a higher cost to replace aging real estate, raising the value of existing properties. Against this backdrop, we believe interest rate-driven volatility could create attractive opportunities for allocating to U.S. REITs.

— Cohen & Steers Open-End Mutual Funds