FEATURED COMPANY

Providing Consumer-Focused

and Digitally Enabled Health Care

CVS Health (NYSE: CVS) is the leading health solutions company that helps people navigate the health care system—and their personal health care—by improving access, lowering costs and being a trusted health partner. The company touches millions of lives with in-home, in-store and virtual care services and is building on existing relationships to deliver personalized care in a seamless, full-circle way. The company recently announced a definitive agreement under which CVS Health will acquire Signify Health, a leader in health risk assessments, value-based care and provider enablement.

- Ranked #4 on the 2022 Forbes list published in June

- Market cap of ~$130 billion as of September 2022

- Largest pharmacy in the U.S. based on total prescription revenue in 2021

- 9,000+ retail locations with more than 1,100 walk-in clinics

- ~74 million COVID-19 vaccines and ~55 million COVID-19 tests administered

- ~134 million members with Aetna and Caremark

- ~4.8 million consumers visit CVS Health locations daily

- Nearly 9% Total Revenue growth in 2021

- 10% dividend increase beginning in February 2022

CLICK HERE FOR THE INVESTOR FACT SHEET

Advisor Access spoke with CVS Health’s Executive Vice President and Chief Financial Officer Shawn Guertin.

Advisor Access: CVS Health is a large, diversified healthcare company, #4 on the Fortune 500 list. Please tell us about the company’s holdings beyond the retail drug stores that everyone is familiar with.

Shawn Guertin: Our foundational business primarily comprises three distinct, but increasingly integrated segments—Health Care Benefits, Pharmacy Services and Retail/Long-Term Care [LTC].

The Health Care Benefits segment offers a range of insured and self-insured medical, pharmacy, dental and behavioral health products and services. The Pharmacy Services Segment provides a full range of pharmacy benefit management solutions to employers, health plans, government employee groups and government sponsored programs. In the Retail/LTC segment, we operate over 9,000 local touchpoints offering a wide assortment of health and wellness products and general merchandise, and annually serve over 5 million long-term care patients. Our community touchpoints offer prescription fulfilment services, patient care programs, health care services through walk-in medical clinics, medical diagnostic testing, vaccination administration, and pharmacy services to long-term care facilities.

We are constantly enhancing our broad array of offerings to help people with their health wherever and whenever they need us. We help people navigate the health care system—and their personal health care—by improving access, lowering costs and being a trusted partner for every meaningful moment of health.

AA: CVS Health recently reported strong second quarter results—total revenues increased 11% compared to the prior year—and raised its guidance for 2022 full-year earnings per share and cash flow. To what do you attribute this success?

SG: Our impressive second quarter performance reflects strong results and continued positive momentum across all of our core businesses.

We had a strong quarter in Health Care Benefits with revenue growth of nearly 11% year-over-year and adjusted operating income of $1.8 billion. We generated membership growth across all product lines versus the prior year.

In Pharmacy Services, revenue grew nearly 12% compared to the prior year and delivered adjusted operating income of $1.9 billion. Specialty pharmacy revenue was up nearly 21% year-over-year. We are a leader in specialty pharmacy with programs that drive value in the marketplace, provide substantive savings to customers and differentiate us as we pair programs with digital assets.

In the Retail/LTC segment, our deep customer relationships, high-quality patient interactions, resilient supply chain and agile operating model all contributed to the strong quarterly performance. We delivered over 6% revenue growth versus the prior year and $1.9 billion in adjusted operating income. Our front store sales grew more than 9%, driven by strength in consumer health sales, including strong COVID over-the-counter tests and sales of cough, cold and flu products. Our retail script growth trend is remarkable as we have consistently increased market share year-over-year since the first quarter of 2020.

Each segment contributed, meaningfully, to our second quarter 2022 consolidated results and we were pleased to raise our full year 2022 GAAP and adjusted earnings per share guidance.

AA: How has the pandemic changed approaches to healthcare, and how has CVS adjusted its strategy to accommodate changing trends?

SG: The pandemic has forced health care delivery to evolve rapidly. We are increasingly seeing consumers attracted to new, more convenient sites of care, such as virtual and in-home care. We’re also responding to what we’re hearing from employers in the marketplace where we’re seeing a continued focus on access, lower cost sites of care, transparency, flexibility, digital connectivity and really strong service. Increasingly, we are focusing on using technology to improve the consumer experience and create greater convenience.

The home health market continues to grow rapidly as a result of increasing consumer preference for in-home care, accelerated by the pandemic. The home, specifically, has high impact as a site of care and is expected to drive better clinical outcomes for many procedures as well as long-term care.

We are seeing similar trends in the virtual care space. Virtual care continues to be an important way for consumers to access alternative sites of care that are affordable and convenient—particularly as it relates to behavioral health services, which remain elevated since the start of the pandemic.

It’s clear that consumers are increasingly attracted to these offerings, and members that use these solutions are very pleased with the experience, as is evident in our results.

AA: CVS Health announced recently the launch of Virtual Primary Care™, which will give members access to primary care, on-demand care, chronic condition management and mental health services virtually, with the option of being seen in-person when needed at an in-network provider, including MinuteClinic. How does this build on CVS’ current virtual care offerings?

SG: CVS Health has a longstanding history with virtual care solutions. MinuteClinic, which began piloting telehealth services in 2015, offers virtual visits for on-demand general medical and limited mental health services. Aetna has provided virtual care solutions for the last decade and was the first to offer a nationwide virtual care solution that allows members to access primary care and other health services remotely and in person. Aetna’s virtual care solutions will continue to be an available option to Aetna plan sponsors. Caremark will introduce virtual specialty care solutions on the platform in 2023.

CVS Health Virtual Primary Care complements Aetna’s virtual care strategy currently in the market and MinuteClinic’s virtual and in-person care solutions. The offering connects CVS Health’s services, clinical expertise and data for a more coordinated and consumer-centric health care experience.

With the introduction of CVS Health Virtual Primary Care, Aetna is offering plan sponsors greater benefit options to meet their members’ evolving needs. Additionally, Caremark members will now have a solution that will allow them to access more CVS Health services and capabilities. By combining health services, a coordinated care team and clinical data on a single digital platform, CVS Health Virtual Primary Care will help all members receive health guidance and care coordination that directs them to the lowest cost, clinically appropriate care.

AA: What are the greatest areas of growth for CVS Health?

SG: There are several key opportunities for growth in the near term and long term, both in our existing businesses and as we look to grow to execute on our strategy.

In Health Care Benefits, strong continued membership growth continues to reflect the end-to-end value of our assets, increasingly working together, one customer at a time, at a national scale. Our Medicare business remains one of our strongest growth segments, and we are focused on maintaining above-market growth in this business. In Pharmacy Services, we are a leader in specialty pharmacy with programs that drive value in the marketplace, provide substantive savings to customers and differentiate us as we pair programs with digital assets. Importantly, we’re positioned to continue to provide industry-leading drug trends as well as grow our specialty pharmacy business. In Retail/LTC, our deep customer relationships, high-quality patient interactions, resilient supply chain and agile operating model all continue to contribute to strong performance. Despite a challenging retail environment, we continue to expand services and bring new customers to CVS Health.

At our Investor Day conference last year, we announced our plans to expand our health services offerings in three key categories: primary care, provider enablement and home health. There are multiple pathways to achieving growth in these areas and inorganic growth is certainly part of our strategy. We are continuing to evaluate complementary health services and care delivery capabilities to enhance our overall portfolio and are taking a disciplined approach both strategically and financially. Recently, we announced a definitive agreement under which CVS Health will acquire Signify Health, a leader in health risk assessments, value-based care and provider enablement. This represents a successful first step in the path towards our strategy, and a great platform for continued future growth in the areas we’ve highlighted.

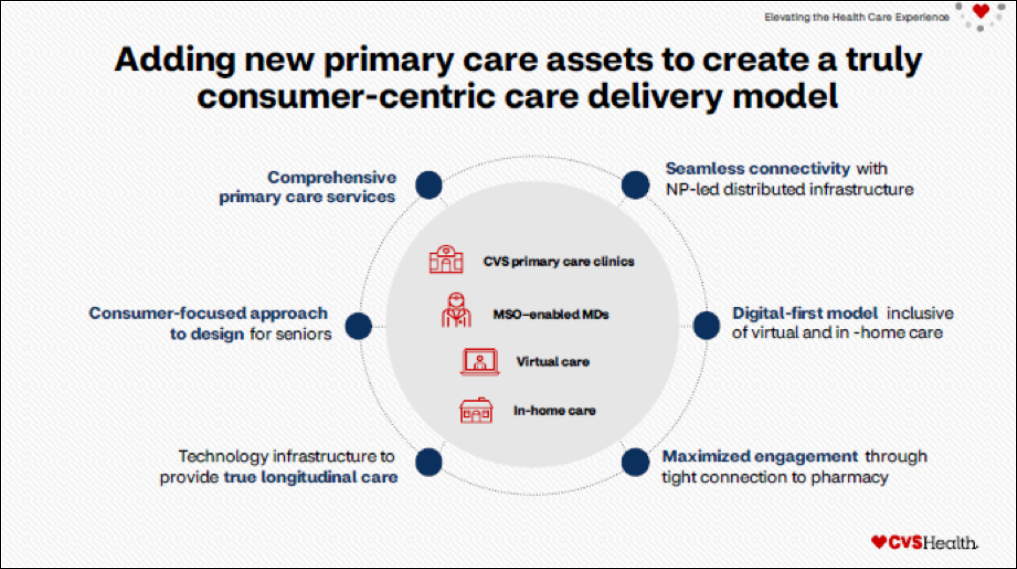

Our vision is to be the nation’s leading health solutions company for consumers. We’ll continue to make this a reality by acquiring new primary care assets through enhanced management services organization (MSO) arrangements and owned primary care assets. Those practices will be supported by a technologically enabled health care ecosystem that is not transactional but integrated across providers and incorporates behavioral health and social determinants of health inequities directly into primary care. Ultimately, we aim to deliver a consumer experience that’s as frictionless as banking or shopping.

AA: CVS Health has set the goal of sourcing 50% renewable energy by 2040. What steps is the company taking to meet this goal?

SG: This August, we announced a partnership with Constellation to enable the expansion of the Mammoth Solar facility, a large-scale renewable energy project in Indiana, and to match the electricity use of 309 CVS Health locations in Illinois and Ohio. This partnership will reduce our carbon footprint by more than 38,000 metric tons each year. We are continuing to develop our pathway to annually convert a portion of our energy use to renewable energy to achieve our goal of sourcing 50% renewable energy by 2040.

AA: What additional actions has CVS Health taken to further its sustainability goals?

SG: The health of the environment impacts the people and communities we serve. We continue to make substantive progress in advancing our sustainability strategy.

In October 2021, CVS Health was among the first of seven global corporations to have our target verified by the SBTi’s Net-Zero Standard. That trajectory sets us on a path to achieve net-zero emissions from our direct operations by 2048 and across our value chain by 2050. We are also committed to achieving carbon neutrality by 2030.

With retail pharmacies, distribution centers, offices and other facilities across the country, our buildings are a significant source of our total energy consumption—and, as a result, a primary focus of our energy conservation efforts. For example, we have upgraded 100% of eligible stores to energy-saving LED lighting and are expanding our efforts to update exterior lighting in our retail stores.

We are also optimizing our digital solutions to reduce paper. In April 2022, we began to offer a new digital receipt prompt at checkout so customers can choose between a printed receipt, a digital receipt or no receipt. With the addition of our work to make our printed receipts shorter, we have seen significant receipt paper savings.

To solve for the single-use plastic bag, we have invested $5 million in the Consortium to Reinvent the Retail Bag’s three-year Beyond the Bag Initiative to identify, pilot and implement new design solutions and models to create an improved customer experience without unintended environmental consequences. In 2021 and 2022, we piloted dispense-and-return systems for reusable bags. The lessons learned from these pilots will inform further iterations of solutions.

Additionally, we strive to reduce the use of plastic and virgin materials and to ensure recyclability for the packaging of all Store Brand products. We have engaged the World Wildlife Fund (WWF) to audit our Store Brand plastic packaging portfolio, and in 2023 we will define a list of problematic or unnecessary packaging and take steps to eliminate them by 2030.

For more information on our ESG efforts, please see our annual ESG Report.

AA: Is there anything else you would like investors to know?

SG: We have been thoughtful and deliberate in setting our vision and strategy for the future, creating a pathway to achieve low double-digit adjusted earnings per share growth over time. You can expect CVS Health to deliver strong sustainable growth in our foundational businesses and additional growth from our new initiatives. We will also drive meaningful cost improvements, generate powerful cash flow and deploy capital strategically.

We consistently achieve these goals with a commitment to sustainable business practices. We are a consumer-focused, purpose-driven company, and our purpose and our people are our competitive edge. We believe that our success depends on our diverse and inclusive workforce. In 2021, 58% of new colleagues and 51% of our overall workforce self-identified as racially or ethnically diverse, more than twice the average of the U.S. population.

With our unique portfolio of assets, financial strength, consumer focus and deep health care expertise, we are confident we will continue to deliver for our members, clients, patients, customers and stockholders.

AA: Thank you for your insights.

Shawn Guertin is Executive Vice President and Chief Financial Officer of CVS Health. In this role, Shawn is responsible for all aspects of the company’s financial strategy and operations, including accounting and financial reporting, investor relations, mergers and acquisitions, treasury and capital planning, investments, risk management, tax, budgeting and planning, and procurement. Prior to joining CVS Health, Shawn spent eight years at Aetna where he was Executive Vice President, Chief Financial Officer and Chief Enterprise Risk Officer. He was the architect of the company’s finance strategy during a period of rapid growth and transformation. He helped Aetna enter new markets and grow through expansion and acquisitions and was a key leader in shaping and affecting the merger with CVS Health in 2018. During his time in the role, he was consistently recognized by Institutional Investor magazine as a top CFO. Prior to joining Aetna in 2011, Shawn served as executive vice president, CFO, treasurer and chief actuary of Coventry Health Care. He has also served in leadership roles at United HealthCare and Travelers. Shawn is a Fellow of the Society of Actuaries and holds a B.A. from Boston University. He previously served on the boards of payroll-services firm TriNet Group Inc. and health care company DaVita Inc. He is an active supporter of Memorial Sloan Kettering and other charitable causes.

CLICK HERE FOR THE INVESTOR STORY DECK

Analyst Commentary

“We remain positive on shares of CVS as we believe they are uniquely positioned as we continue to shift towards VBC [value based care] with cost/quality/convenience as the pillars in a VBC/Consumer environment.”

—Lisa C. Gill, J.P.Morgan

Sept. 5, 2022

“Strong cash flow remains an investment highlight and provide the company with financial flexibility to deliver on growth targets.”

—Ann Hynes, Mizuho Securities

Sept. 8, 2022

“Coming off strong 2Q results that included enterprise-wide beat we see CVS as having room to chug higher from here.”

—Michael Cherny, BofA Securities

Aug. 17, 2022

“We remain bullish on CVS following a definitive agreement to acquire Signify Health, which adds a meaningful presence in the home while furthering VBC [value based care] capabilities.”

—David S. MacDonald, Truist

Sept. 6, 2022

Disclosures

Investors and others should note that CVS Health, Inc. posts important financial information using the investor relations section of the CVS Health website, cvshealth.com, and Securities and Exchange Commission filings.

The information contained in this facsimile message is intended only for the use of the individuals to whom it is addressed and may contain information that is privileged and confidential. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone at (707) 933-8500.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about the industry and markets in which CVS Health. operates, management’s beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. CVS Health has paid Advisor Access a fee to distribute this email. By clicking on any of the links in this email you agree that your contact information may be shared with CVS Health. CVS Health had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online