The MLP Newsletter for Advisors • Fall 2017

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the MLP Newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the MLP Newsletter includes valuable information and expert opinion about MLPs that you cannot get anywhere else.

The Master Limited Partnership Association (MLPA) is a trade association representing the publicly traded limited partnerships (PTPs) that are commonly known as master limited partnerships (MLPs), and those who work with them.

Advisory Research, Inc. is an institutional investment manager that provides U.S., international, global, and MLP and energy infrastructure strategies for sophisticated investors. Their experienced team of professionals seeks to produce attractive risk-adjusted returns through in-depth research and a diligent investment process. The St. Louis-based MLP & Energy Infrastructure team manages MLPs and energy infrastructure strategies for open- and closed-end mutual funds, public and corporate pension plans, endowments, foundations, and individuals. The team has been managing MLP portfolios since 1995. Advisor Access spoke with the MLP & Energy Infrastructure team’s managing director and senior portfolio manager Quinn Kiley.

The Advisor Access Interview

Advisor Access: After rebounding in 2016 and starting off strong in 2017, MLPs and energy infrastructure have traded sideways or downward for the majority of 2017. Can you explain what has happened?

Quinn Kiley: We continue to believe that the energy industry is working through a difficult recovery process after crude oil prices crashed in 2015/16, finally bottoming in February of last year. For exploration and production (E&P) companies this process requires cost rationalizations, efficiency gains, high grading of projects, and an eventual return of investors to what may well be a derisked industry. We believe we have generally seen this play out in the debt markets, especially for E&P companies, as fixed-income investors have rewarded companies for taking appropriate measures.

The equity markets have been much more cautious, and the implication is that investors are still trying to figure out what the investment rationale is for energy in a range-bound world where OPEC sets a floor for crude oil prices and U.S. production sets a ceiling. The industry has clearly demonstrated its ability to operate in such an environment: Rig counts are up, production volumes are testing previous highs, and many participants are stating a new strategy to live within their cash flows, as opposed to funding growth by relying on access to capital markets. Our expectation is that, in a lower-for-longer commodity price environment, growth for the energy industry should be harder to come by over time. For midstream issuers, like MLPs, the current environment means growing volumes and a need for new infrastructure or expansion of existing facilities.

AA: Does the declining performance line up with the fundamentals for the midstream sector?

QK: We continue to see fundamentals improving despite declining performance year-to-date. We have seen an ongoing shift by MLPs toward higher coverage on their distributions, less debt on their balance sheets, and less reliance on the capital markets for equity to support growth plans. This has resulted in a multiyear period of distribution cuts and reductions in growth outlooks. Until MLPs convince investors that distribution cuts and lower growth rates are behind us, it will be hard for MLPs to find a bid. On the positive side, the average MLP has a good fundamental outlook and is attractively valued. We expect better times ahead.

AA: How are investors reacting to the volatility they have seen over the past couple of years?

QK: Our investor base is very quiet, with little buying or selling. In general, we believe MLPs are struggling to find a “new buyer” after ten years of lackluster returns combined with high volatility. Investors who already own MLPs generally understand them and are likely to hold onto them for their tax-advantaged yields.

Alternatively this wasn’t true in the years leading up to the energy crisis, when investors were buying MLPs for their growth expectations. When the asset class saw tremendous selling in 2015/2016, it was these weaker hands exiting the asset class.

AA: The current administration was widely predicted to be positive for the energy business. How has this played out so far?

QK: We believe some energy investors were counting on energy-friendly legislation from this administration. At this point, it appears that much of the administration’s political capital is gone and the odds of meaningful legislation are shrinking.

Even so, the administration is pro-energy, with the composition of the current cabinet emphasizing that point. The regulatory environment is improving, which is a stark shift from the previous administration. One remaining negative is that state permitting remains challenging. There is only so much that can be done at a federal level.

One recent positive at the federal level was the confirmation of new appointments for the Federal Energy Regulatory Commission (FERC). Now with a quorum, the commission can approve submitted projects that have been stalled. This should be positive for energy infrastructure companies.

AA: From a valuation standpoint, how should we think about the midstream asset class?

QK: Valuation looks reasonably attractive for MLPs, and they are moderately undervalued in comparison to their own history. At the end of August, MLPs were 35.5% below their all-time high prices, while other yield investments available to U.S. investors are near all-time highs.

MLPs have sold off significantly in the third quarter. At the low on August 21, MLPs were down approximately 18.3% on a total return basis from the most recent high prices in February 2017. The pullback was very similar in depth and duration to the pullback we witnessed in the summer of 2011. Like the pullback in 2011, we suspect this pullback is a pause in the middle of a longer-term rebound for MLPs. MLPs are equity securities, and it is reasonable to expect 10% corrections approximately once a year, and larger corrections approximately every three years.

Given our improving fundamental view and the undervaluation for MLPs, we are encouraging investors to buy this dip. MLPs remain well off their previous high prices, and are undervalued in our opinion. We believe this sets the stage for very respectable 7–11% per annum returns over the longer term. In the near term, we are experiencing some turbulence in returns as MLP management teams adjust their business strategies to fit the post-energy crisis environment, and MLP investors get comfortable with those changes.

AA: Can you discuss the opportunity for natural gas and natural gas liquids infrastructure?

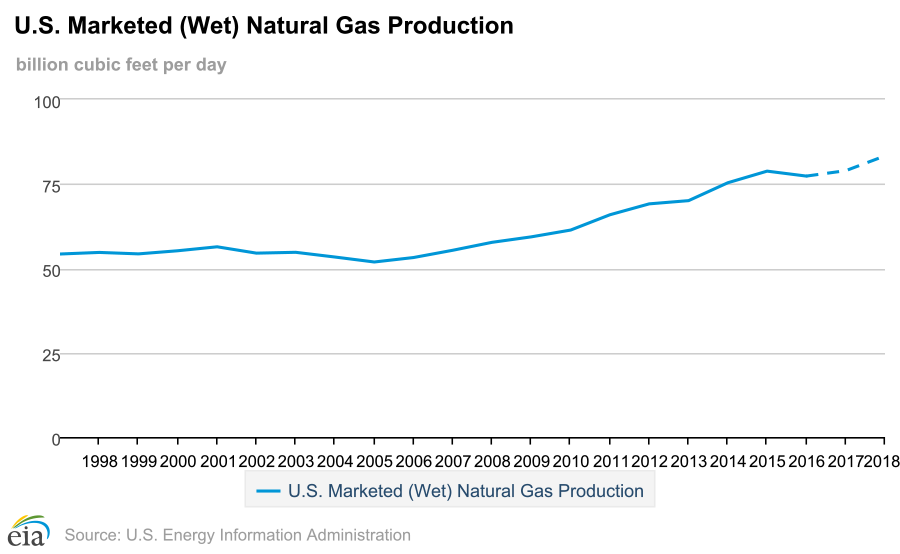

QK: We believe the best opportunity revolves around the continued buildout of natural gas and natural gas liquids (NGLs) energy infrastructure. As depicted in the chart below, natural gas production is expected to hit all-time highs in 2018, boosted by growing production from the Marcellus Shale and associated gas in the Permian Basin. Demand is also expected to rise, bolstered by increased exports to Mexico.

Additionally, the low cost of shale gas is supportive of increasing demand for natural gas liquids. American producers using natural gas feedstock are expected to replace the more expensive oil-based feedstock that European and Asian producers currently use. According to a June 25 Wall Street Journal article*, U.S. petrochemical exports are expected to hit $110 billion by 2027, compared to just $17 billion last year. As U.S. world-scale petrochemical plants come online over the next few years, feedstocks from natural gas liquids will be in high demand. The implication for MLP and energy infrastructure investors is that existing natural gas midstream assets will be exposed to growing demand, and new infrastructure may be needed as well.

AA: It is widely assumed interest rates will rise in coming years. How have MLPs performed historically in rising rate environments?

QK: Contrary to what many investors might believe, MLPs have typically performed well in a rising rate environment. As the certainty of MLP distributions increase and the growth of the distributions decreases, MLPs take on more of the characteristics of high-yield bonds, but with modest growth attributes, and will become less tied to the commodity or equity markets.

We expect this transition will become more apparent moving forward. MLPs have typically outperformed other yield-oriented securities during periods of rising rates. We attribute this to the growth component of their total return, and the fact that rising rates often result from economic growth, which is a key driver of MLP fundamentals. Over the Alerian MLP Index’s history, MLPs have not correlated meaningfully with Treasury rates until those rates are 5.5% or higher. While rising rates could result in poor returns for other yielding asset classes, we believe MLPs can post gains given their attractive valuation and the current low rate environment.

AA: Thank you, Quinn.

* Source: Christopher M. Matthews, “The Shale Revolution’s Staggering Impact in Just One Word: Plastics,” Wall Street Journal, June 25, 2017

Quinn T. Kiley, with seventeen years of investment experience, is managing director and senior portfolio manager with the Advisory Research MLP & Energy Infrastructure team. His responsibilities include portfolio management of various energy infrastructure assets and oversight of the energy infrastructure research process.

ABOUT ADVISOR ACCESS

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision.