The Energy Infrastructure Newsletter • Fall 2023

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

Dividend Trends for Midstream Companies

Are the Strongest in Years

Advisor Access spoke with Stacey Morris, CFA, Head of Energy Research at VettaFi.

Advisor Access: What are some of the key points advisors need to know about the energy infrastructure space today?

Stacey Morris: Energy infrastructure companies are benefiting from company-level tailwinds and a supportive macro energy backdrop. Companies are largely generating free cash flow as growth capital spending has moderated significantly from pre-2020 levels. Free cash flow has enhanced financial flexibility and allowed for debt reduction. With many names having achieved target leverage ratios, excess cash flow has been used for both dividend growth and equity buybacks. The tailwinds from free cash flow generation are expected to remain intact.

From a macro perspective, U.S. energy production is growing more moderately than in the years leading up to the pandemic. This is a good thing for energy infrastructure companies for two key reasons. First, companies do not have to spend several billion dollars to facilitate new production, which supports free cash flow generation. Second, U.S. oil production is not overwhelming global markets and putting downward pressure on oil prices. Stronger oil prices result in better energy sentiment, which has generally been more supportive for midstream equity performance in recent years than significant production growth.

While the broad energy sector has struggled at times in 2023 due to lower oil and natural gas prices, energy infrastructure, particularly master limited partnerships (MLPs), have seen stronger performance. Midstream is unique among energy subsectors in that companies are largely earning fees for providing services, such as transporting hydrocarbons through pipelines, storing commodities, and even loading ships for exports. Midstream’s fee-based business models have provided some insulation from commodity price volatility. At the same time, continued execution on returning cash to shareholders has also been supportive.

AA: Can you discuss the dividend growth trends in the space?

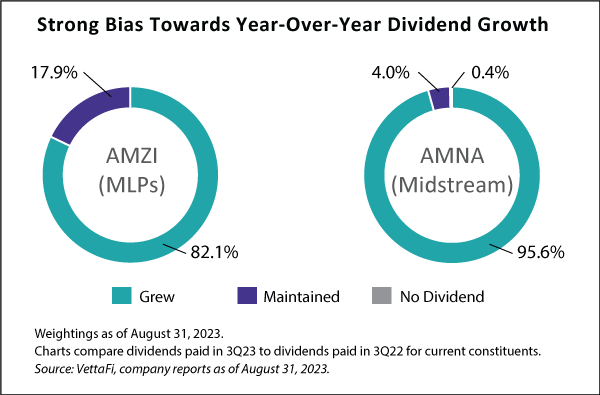

SM: Dividend trends for midstream MLPs and corporations are the strongest they have been for years. Most constituents in our Alerian energy infrastructure indexes have grown their payouts within the last year. Importantly, it has now been more than two years since there was a dividend cut from a constituent of the Alerian MLP Infrastructure Index (AMZI) or the broad Alerian Midstream Energy Index (AMNA).

The pie charts below compare the dividends announced for 2Q23 and paid in 3Q23 with the dividends for the same period in 2022. More than 80% of the AMZI by weighting have grown their distributions on a year-over-year basis. For AMNA, 95.6% of the index by weighting have increased their dividends over the last year.

Even with these strong trends, energy infrastructure yields are still generous. As of August 31, AMZI and AMNA were yielding 7.6% and 6.1%, respectively. For AMZI, the current yield is just slightly below the ten-year average of 7.8%. The positive momentum for dividends adds important context to the generous yields available.

AA: How has buyback activity been in the energy infrastructure space?

SM: Buybacks remain a helpful tool for returning cash to shareholders, albeit many names take an opportunistic approach. AMNA constituents in aggregate repurchased just over $1.9 billion in equity in the first half of 2023. For context, total repurchases in 2022 were $4.5 billion.

In 2023, corporations have been more active with buybacks than their MLP peers. Cheniere Energy (LNG) accounted for almost half of the total repurchases in 1H23, having spent nearly $800 million on buybacks in the first two quarters of this year. Buyback authorizations tend to be more common for the larger companies in the midstream space. Approximately three-fourths of AMZI and AMNA by weighting have buyback authorizations.

AA: Where does energy infrastructure typically fit in portfolios?

SM: Investors will typically allocate to energy infrastructure within the income sleeve of a portfolio, usually at 3-5% depending on income requirements and risk tolerance. Within an income portfolio, energy infrastructure can provide diversification benefits given relatively low long-term correlations with other income investments such as bonds and utilities. Midstream can also be attractive in income portfolios as a source of yield that is not tied to interest rate levels.

Energy infrastructure can also fit in a real assets allocation. This space tends to do well in periods of elevated inflation as seen in 2021 and 2022. Beyond real asset and energy exposure, midstream companies typically have annual inflation adjustments built into their contracts, providing another layer of inflation protection.

Midstream can also be used as energy exposure in a broad equity allocation. Relative to a broad energy sector benchmark, midstream tends to perform more defensively given less direct commodity price exposure, while providing more generous yields.

AA: What is the long-term outlook for the energy infrastructure space?

SM: The positive momentum for energy infrastructure is expected to remain intact. Companies are well positioned to continue generating free cash flow, which has supported dividend growth and equity repurchases. Strong dividend trends are expected to remain a feature for this space.

The outlook for U.S. energy production should also be supportive for midstream, while exports provide another avenue for growth. A continued, steady climb in U.S. oil and natural gas production should allow companies to enjoy incremental opportunities without burdensome capital spending requirements. Some of this incremental energy production will ultimately be exported. Several midstream companies are participating in growing U.S. liquefied natural gas (LNG) exports, either directly or through supporting infrastructure. Select companies are also helping meet global demand for petrochemicals by facilitating exports of natural gas liquids.

Energy infrastructure companies are expected to continue pursuing opportunities related to renewable fuels and clean energy, including carbon capture. Many of these initiatives are in early stages, but others are contributing to bottom lines today or will be within the next few years. Midstream companies have an important role to play as the energy landscape evolves and can benefit from decarbonization incentives included in the Inflation Reduction Act. The safe transportation and storage of energy (as well as renewable fuel feedstocks or byproducts like carbon dioxide) will be needed for decades to come.

Finally, consolidation has been a notable theme across the energy sector in 2023, including within midstream. While transactions are difficult to predict, consolidation is likely to remain a trend in the broader energy sector as companies pursue scale, diversification, integration, or additional expertise.