The MLP Newsletter for Advisors • Winter 2018

Click HERE to download a printable PDF of this newsletter.

As an investment advisor, you have been subscribed to the MLP Newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the MLP Newsletter includes valuable information and expert opinion about MLPs that you cannot get anywhere else.

The Master Limited Partnership Association (MLPA) is a trade association representing the publicly traded limited partnerships (PTPs) that are commonly known as master limited partnerships (MLPs), and those who work with them.

Cohen & Steers is a global investment manager specializing in liquid real assets, including real estate securities, listed infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions.

Tyler Rosenlicht, CFA, is Senior Vice President, Head of Midstream Energy & MLPs for Cohen & Steers.

5 Key Questions for Midstream Energy in 2019

Don’t expect the disconnect between midstream stock prices and earnings trends to last forever. Here’s why.

The end of the Easy Money Era has been challenging for many asset classes in 2018. But for midstream energy investors, this year has been a punch to the gut. Through December 17, 2018, the Alerian Midstream Energy Index was down 13.8% year to date, putting it more than 40% below its 2014 high on a price-only basis.

Yet even with oil prices faltering, many master limited partnerships (MLPs) and other midstream businesses are exceeding earnings expectations. To help investors make sense of what’s going on, we’ve answered five key questions for 2019.

1. Why was 2018 so challenging, and why should 2019 be different?

It seemed this year was a game of Whack-A-Mole for the midstream sector. Every time it began to rise, a sentiment killer surfaced: rising interest rates, the Federal Energy Regulatory Commission’s ruling on the tax treatment of MLPs, some poorly received mergers and distribution cuts, a Colorado ballot initiative aimed at curtailing drilling activity, declining crude prices and, finally, tax-loss selling.

These headlines distracted investors from an otherwise strong fundamental environment. In 2018, the U.S. became the world’s largest producer of crude oil for the first time since 1973, while the Energy Information Administration (EIA) projected that U.S. production of crude oil, natural gas and natural gas liquids (NGLs) could rise between 20% and 30% through 2022. In addition, significant pricing differentials—which typically signal constraints in pipeline capacity—materialized across North America, offering a positive harbinger for midstream cash flows.

This combination of poor stock price performance and strong underlying earnings trends has left cash flow multiples near crisis levels, roughly 15–20% below our estimate of intrinsic fair-market value.* We realize building value may take time, but for investors looking to diversify, we believe this kind of upside potential, along with strengthening fundamentals and a history of low equity correlations, is attractive.

2. What does it mean to be “energy independent,” and how is that good for midstream?

Contrary to popular opinion, U.S. energy independence does not mean America will produce enough oil and gas to shut its borders and retreat from global trade. The U.S. will likely produce more than it consumes, but not necessarily the right mix of products. That creates opportunities for U.S. energy exports, which we already see in liquefied natural gas. North America’s abundant, excess natural gas production is currently exported to Europe and Asia as a replacement for coal-fired electric generators. We believe these exports are an important opportunity for midstream companies that develop and own the infrastructure assets that facilitate this trade.

3. What are price differentials telling us about tomorrow’s infrastructure needs?

Commodity price differences between two locations—called price differentials—are often a meaningful sign of how energy flows are evolving and where there are bottlenecks in infrastructure. The past year has seen wide and often volatile differentials. For instance, in September, when crude oil was trading at $75 on the Gulf Coast, producers selling in the Permian (West Texas) were receiving only $51. Only 500 miles separates these two locations, and pipeline tariffs are typically $2—so this $24 difference was a clear sign to us that existing pipelines were full, and that a lot of crude oil had to be shipped at higher costs by rail and truck.

Wide differentials are generally good for midstream companies. In these situations, pipelines tend to operate at full capacity, and firms with trucks and rail can earn outsize profits. In the long run, midstream companies may build new pipelines with long-term contracts offering attractive returns on investment, which is how the sector has historically created value over time.

4. How far are we on the path to Midstream 2.0?

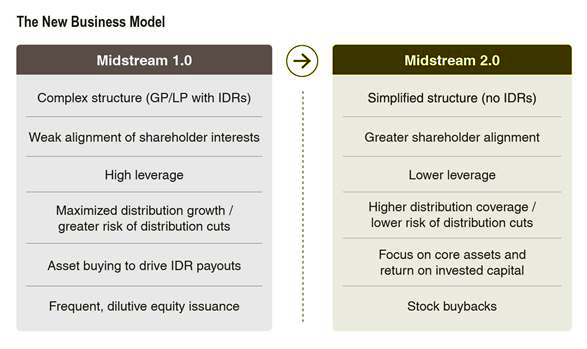

We’ve published several papers over the past year about how midstream companies are simplifying their business models. This trend was catalyzed by the collapse in energy prices in 2014–15, which exposed the old MLP models as having misaligned management incentives, weak corporate governance and a heavy reliance on access to capital.

Having learned their lesson, most midstream companies have taken steps to become more self-sustaining—removing the dual share class structure, eliminating burdensome incentive distribution rights (IDRs), and aligning their boards of directors around one set of investors. The result has been improved corporate governance with a focus on return on invested capital. We call this new era for the industry “Midstream 2.0.”

The announcement phase of these changes is almost complete, and we are now moving to the execution phase. We believe investors will eventually wake up to the improvements that come with Midstream 2.0—namely better managed, more stable business models that are less dependent on capital markets. We believe these changes should produce better outcomes for investors over the long run.

5. Is midstream energy something I should own now?

Very much so.

The midstream asset class is trading at discounts to its intrinsic value, coupled with a strong supply-demand backdrop.

Companies that have adopted the 2.0 model are just starting to see tangible benefits, including a lower cost of capital and a broader investor base, which may begin to pay off via better valuation multiples.

Finally, based on where we are in the economic cycle, we believe the relatively predictable, inflation-linked cash flows of midstream businesses can provide a valuable defense against economic uncertainty. According to our analysis of asset-class performance across different phases of the cycle since 1991, midstream energy has outperformed broad equities by a staggering 19% annually in late-cycle periods.**

We believe this rare combination makes midstream energy one of the most compelling investment opportunities in the market today.

* Current valuation of 9.8x EBITDA for the Wells Fargo Index at 11/30/2018, compared with our fair value estimate of 12-13x based on multiples of recent private equity transactions.

** 1/1/1991 to 9/30/2018. Source: Thomson Reuters Datastream, Cohen & Steers. Data represents past performance, which is no guarantee of future results. Based on monthly returns for the Thomson Reuters Datastream World Pipelines Index versus the Thomson Reuters Global Equity Index. Late-cycle defined by periods of growth above potential and rising, as measured by our proprietary Leading Economic Index.

Tyler Rosenlicht, Senior Vice President, is a portfolio manager for Cohen & Steers’ infrastructure portfolios with an emphasis on MLP and Midstream Energy strategies. He has nine years of investment experience. Prior to joining the firm in 2012, Mr. Rosenlicht was an investment banking associate with Keefe, Bruyette & Woods and an investment banking analyst with Wachovia Securities. Mr. Rosenlicht has a BA from the University of Richmond and an MBA from Georgetown University. He is based in New York.