The REIT Newsletter for Advisors • Spring 2018

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the REIT newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the REIT Newsletter includes valuable information about REITs that you cannot get anywhere else.

Nareit is the worldwide representative voice for real estate investment trusts—REITs—and publicly traded real estate companies with an interest in U.S. real estate and capital markets.

Calvin Schnure is Nareit’s Senior Vice President, Research & Economic Analysis.

Interest Rates, Real Estate and REITs

by Calvin Schnure

Interest rates remain in the financial news headlines, with the Federal Reserve raising its target for short-term rates and the yield on the 10-year Treasury note hitting 3 percent, from a low of 1.45 percent in mid-2016. The interest rate environment has important implications for the economic outlook, for real estate markets, and for REITs. What risks and opportunities lie ahead?

One overarching theme is that the Fed’s rate increases are lifting rates from the ultra-low levels of the past several years into a range more typically associated with normal economic growth. The low rates were a deliberate attempt to stimulate the economy during the depths of the financial crisis and its immediate aftermath; current moves are not aimed at slowing an overheating economy, but rather at removing the “juice” that could lead to overheating down the road.

It’s like the Fed is easing its foot off the accelerator, but not hitting the breaks. To continue the driving analogy, keep in mind you can travel farther at a safe speed; go too fast and you risk being pulled over by a police car—or spinning off the road at the next turn. The Fed’s policy is designed to keep the economy on a safe growth path, which is good for real estate and REITs.

Financing conditions remain favorable for real estate even with the rise in long-term interest rates. Mortgage rates are still below the levels seen in past real estate expansions, and good projects will still be feasible even if rates rise modestly in the months ahead.

REIT share prices have often responded negatively to recent increases in interest rates. Operating performance of REITs, however, has continued to improve, with occupancy rates at record highs in most property sectors, steady rent increases, and funds from operations (FFO, a common earnings metric for REITs) continuing to reach new highs.

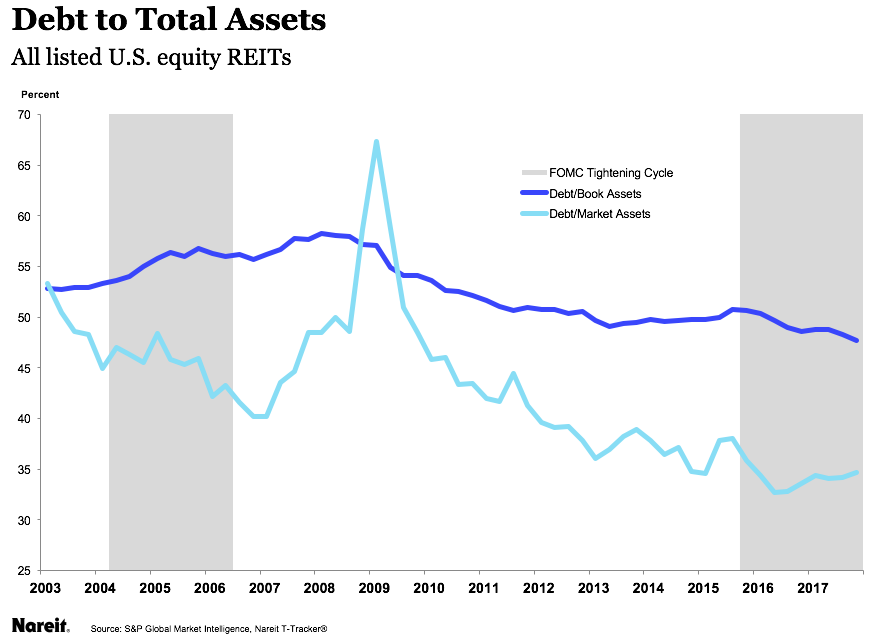

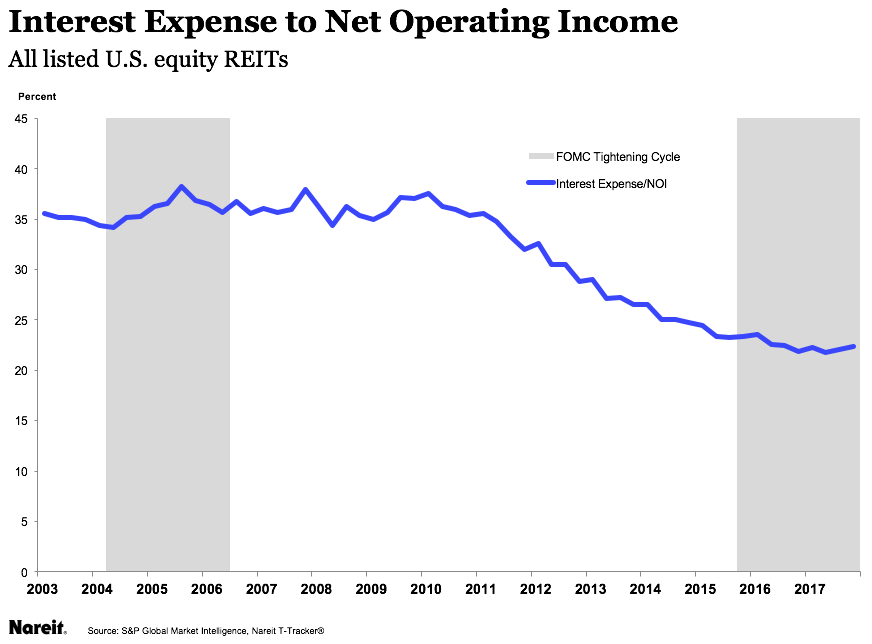

REITs are well prepared for the interest rate environment ahead. They have relied more heavily on equity than debt to finance acquisitions, which has reduced leverage to its lowest level in decades (chart). With less debt and low interest rates, interest expense has fallen to 22 percent of net operating income (NOI), compared to 38 percent a decade or more ago (chart). Moreover, REITs have extended the average maturity of their debt to 75 months, from 60 months in 2008, thus locking in favorable financing rates well into the next decade.

The most important challenge in investing is to balance risks and opportunities appropriately. The economy has plenty of momentum, with little risk of overheating, which is likely to support the demand for real estate in the months ahead. REITs are enjoying high occupancy rates and rising earnings. REIT balance sheets are well capitalized, which will protect them against any bumps in the road while allowing them to pursue attractive investment opportunities. That’s a favorable risk/reward combination for most investors.