The Energy Infrastructure Newsletter • Spring 2022

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

Fundamentals for Midstream Companies Strengthen as Global Energy Security Takes Center Stage

Advisor Access spoke with Robert Walker, a Principal of Chickasaw Capital Management, LLC.

Adviser Access: Midstream returns were strong in 2021 after several challenging years and have been strong year-to-date (YTD) in 2022. What is your current outlook for 2022?

Investors saw strong returns in 2021 of 40.2% as measured by the Alerian MLP TR Index (AMZX), but keep in mind this return started from generational lows in valuation. Even with strong YTD Midstream returns of 16.4% through 2/28/22, valuation remains very inexpensive relative to history, and the fundamental picture has only gotten stronger.

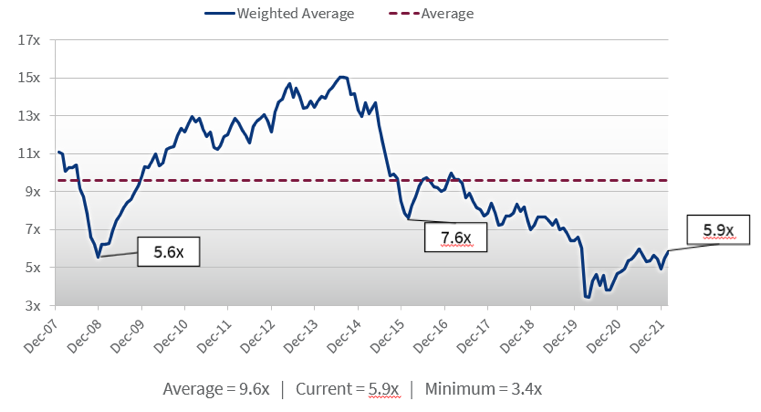

As Exhibit 1 shows, the price to distributable cash flow (P/DCF) for the AMZX resides at 5.9x, below the long-term average of 9.6x.

Source: Bloomberg LP, CCM; Distributable Cash Flow (DCF) data is CCM-calculated consensus of Wall Street estimates. As of 2/28/22.

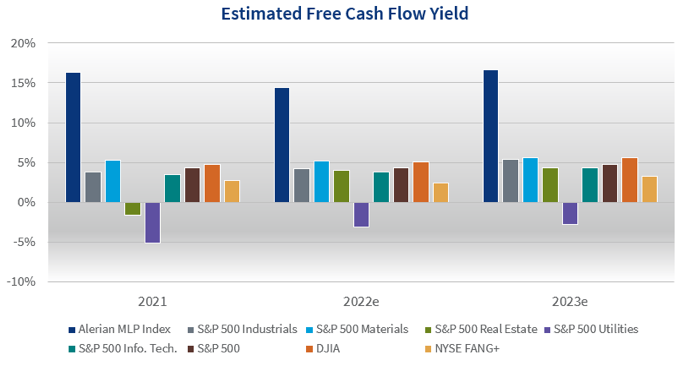

Exhibit 2 displays a free cash flow yield of 14.4% for the AMZX, substantially higher than other market indices.

Source: Bloomberg, LP. 2/28/22. Using Bloomberg definition of Free Cash Flow to Equity of cash flow from operations (CFFO) less capex. BPMP has no consensus estimate; therefore, we use CCM’s estimate.

We retain a positive outlook because the sector has a cheap valuation, much lower debt balances and therefore higher amounts of excess cash flow to return to equity holders, an improved fundamental backdrop due to an increased focus on global energy security, and what we consider to be an underappreciated call option on investing in Energy Transition through Midstream companies, which could be a strong leg for cash-flow growth by the middle of the decade. It is our opinion that now is as an attractive time to invest in Midstream as either the post-2000 NASDAQ bubble or the post-2008 Great Financial Crisis when performance for Midstream was also quite strong.

AA: You mentioned energy security. Can you tell us how you view the conflict between the Ukraine and Russia as impacting U.S. energy and Midstream?

The horrific events unfolding due to Russia’s invasion of Ukraine have caused many assumptions to be re-thought. Focusing specifically on how it has upset the global energy trade, the topic of energy security has become in vogue in the media and global political punditry. Rather than criticizing decisions made in the past, now is the time to rethink our future and the role that U.S. (and North American) energy can play on the global stage.

Midstream companies have spent the past decade building global export facilities for liquefied natural gas (LNG), natural gas liquids (NGLs), crude oil, and refined products, particularly along the U.S. Gulf Coast. Domestic producers are balancing their production with global supplies and the demands from shareholders for greater capital returns. Therefore, we believe production in the U.S. is unlikely to increase much without a political signal from the current administration, but we admit the odds of that occurring have potentially changed since the start of the crisis. Higher volumes to support global energy needs, and potentially displacing previous long-term supply arrangements from bad actors with secure supplies from the U.S., would be a distinct positive for U.S. Midstream assets. In short, the current assumptions for U.S. fuel movements appear to be well-supported with potential upside to expectations if there is a call on domestic production.

Midstream companies have spent the past decade building global export facilities for liquefied natural gas (LNG), natural gas liquids (NGLs), crude oil, and refined products, particularly along the U.S. Gulf Coast. Domestic producers are balancing their production with global supplies and the demands from shareholders for greater capital returns. Therefore, we believe production in the U.S. is unlikely to increase much without a political signal from the current administration, but we admit the odds of that occurring have potentially changed since the start of the crisis. Higher volumes to support global energy needs, and potentially displacing previous long-term supply arrangements from bad actors with secure supplies from the U.S., would be a distinct positive for U.S. Midstream assets. In short, the current assumptions for U.S. fuel movements appear to be well-supported with potential upside to expectations if there is a call on domestic production.

As it relates to the U.S. banning imports of Russian oil and gas, this is incrementally positive on the margin for the U.S. energy industry, but shouldn’t have a tremendous impact as we estimate there was only ~100 thousand barrels per day (MBpd) of Russian oil arriving in a geographically diverse manner across U.S. ports. However, this is clearly something to support as a global, political symbol.

AA: Inflation is also a front-and-center topic. How does this affect Midstream?

The Midstream industry has a long history of executing commercial contracts with inflation protection escalators embedded in them tied to recognized governmental indices, such as the Consumer Price Index (CPI), the Producer Price Index (PPI), or another measure. We have long studied this topic, and believe the vast majority of contracts have these protections. Those that do not typically have more commodity price sensitivity, and therefore should benefit from higher prices. Stating the obvious, inflation escalators are put in place to protect providers from rising costs, which are occurring. But we still believe there will be a net positive tailwind to cash flows in 2022 and 2023 as contracts renew throughout the year and carry forward into the following year, and we don’t think the impact is fully quantified in forward estimates for the securities.

AA: What is the current outlook for dividends and distributions? How might companies also be returning cash to equity holders?

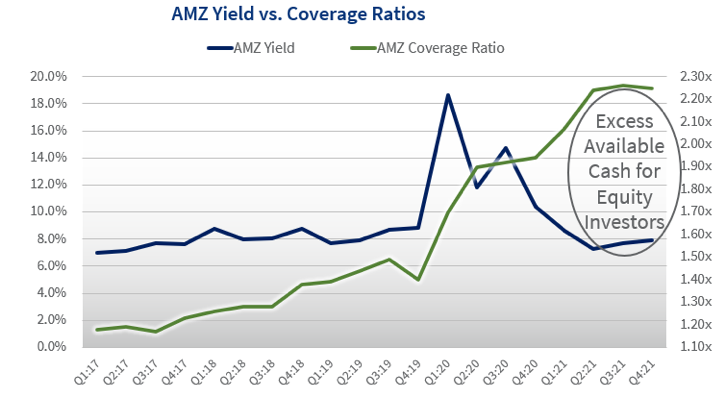

Midstream companies’ equity distributions have never been more well-protected than they currently are. We forecast the AMZX’s estimated 2022 coverage ratio (DCF/distribution or dividend) to be 2.1x, while also factoring in an estimated 6% weighted average growth in distributions this year.*

As seen in Exhibit 3, there is an excess spread between coverage and yields, as a result of companies strengthening their balance sheets during 2020 and 2021. By and large, balance sheets are currently in great shape, and we expect increased returns through share repurchase, special distributions, or other measures from excess coverage ratios. Last year was the first year Midstream companies began to meaningfully use buybacks as a tool, and companies repurchased nearly $2 billion of equity during the year. Looking forward to 2022, we estimate over $10 billion of “firepower” from existing, unused authorizations for companies to continue or strengthen their repurchase activities.

Source: Alerian LP, Bloomberg LP, CCM as of 2/28/22.

We believe companies who use the “all of the above” strategy for cash flow towards modest distribution growth, share buybacks, special distributions, and other equity holder friendly measures will be the outperformers, and we have structured our portfolio accordingly.

We believe companies who use the “all of the above” strategy for cash flow towards modest distribution growth, share buybacks, special distributions, and other equity holder friendly measures will be the outperformers, and we have structured our portfolio accordingly.

AA: Can you talk about how Midstream companies are showing their environmental, social & governance (ESG) credentials and how they are leading in Energy Transition investments?

Midstream executives are in the habit of reminding investors they are in the business of not losing the hydrocarbons their customers demand. This is a moderately low emissions sector more along the lines of sectors one would not think of as large emitters, such as retail, telecom, and consumer products and goods. Even with this relatively strong profile, they have continued to improve their environmental footprints by setting deeper emissions reduction goals for 2030 and 2050, enhancing their networks to certify and transport responsibly sourced natural gas (RSG), and assisting customers in using clean fuels in their processes for creating consumer fuels, to name a few. Additionally, all of the companies we own have ESG or employee, health and safety (EH&S) as part of their short-term and long-term executive incentive compensation.

Turning to Energy Transition, there is not a cleaner emissions future without Midstream assets. Generally speaking, the assets are agnostic to the type of fuel being transported through them, and that makes them mission critical for transporting our current energy mix as well as any changes in fuel source in the future. They also have underutilized assets that can be converted, rights of way that can create economies of scale, and customer connections and delivery points that will further match demand with all types of fuel sources. Since we began tracking announcements on March 31, 2021, there have been over 65 Energy Transition and ESG announcements made by public and private Midstream companies in the subsequent 11 months. Energy Transition is at Midstream’s doorstep, and we believe this is an underappreciated call option for future cash-flow growth in Midstream above current cash flows, as Midstream operators seek ways to creatively use their tangible and intangible assets to support domestic and global energy demand.