The REIT Newsletter for Advisors • Winter 2022

REIT Volatility as Friend, Not Foe

A CenterSquare Insights Brief

Market volatility creates opportunity. For real estate investors, this opportunity is often presented in the listed REIT (real estate investment trust) universe. Yet, some investors who place these REITs within their equities bucket (citing the volatility of asset prices as their rationale) are missing their chance to take advantage of this instability. Their approach ignores the fact the same volatility exists – although it may not be properly measured – in the private real estate markets.

A robust 2021 study tracking 22 years of performance for the $32 trillion of retirement assets in the United States found that, after adjusting for valuation lags, REITs and private real estate demonstrate similar levels of true volatility, at 18.9% and 17.9%, respectively.1 However, the measured volatility of private real estate and listed REITs is usually not in tandem, with REITs often hitting bottom as the private market peaks. This absence of synchronization between what are essentially the same assets in different wrappers can create an attractive asset allocation opportunity for astute investors to capitalize on valuation dislocations.

Valuation Dislocation Opportunity

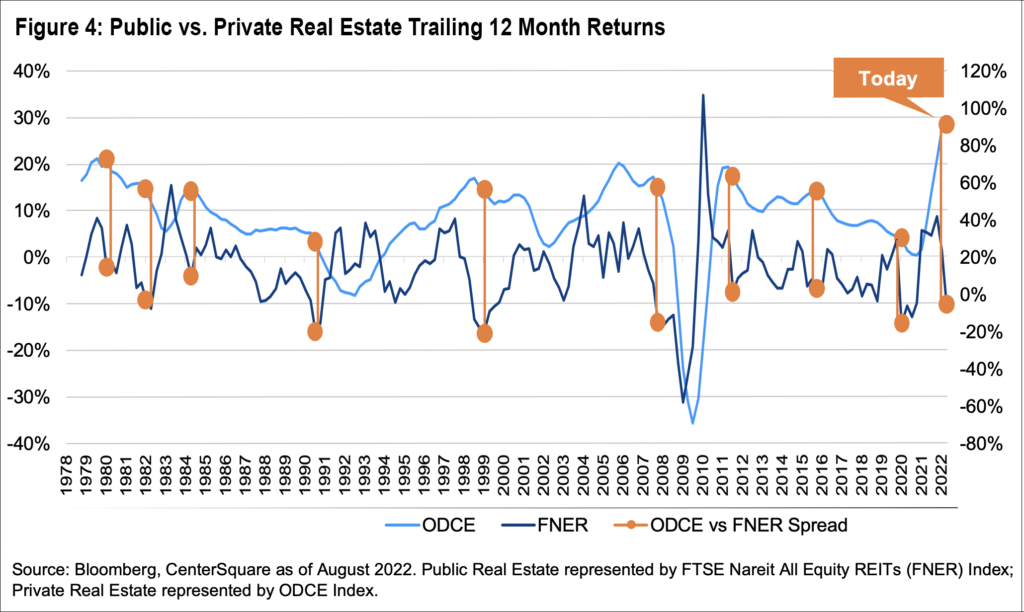

Today, amidst a unique environment of heightened economic and geopolitical uncertainty, we recognize REITs as an attractive entry point into real estate. While the REIT market has already incorporated the reality of current and looming risks into its valuations in real-time, the private markets have lagged. To wit, the NCREIF Open-End Diversified Core Equity (ODCE) Index, the most widely used index in the private real estate markets, showed a positive 12% total return for the first half of this year, primarily driven by an appreciation return of over 10%. During that same time, the total return for listed REITs, as measured by the FTSE Nareit Equity REITs Index, was -16% despite similarities in the performance of the underlying portfolios.

While listed markets can initially overreact (hence creating opportunities), we believe they provide directional insight into how valuations for real estate may change over time. We analyze this phenomenon quarterly through our Cap Rate Perspective brief, which assesses valuations across public and private real estate. Here we have consistently noted that when REITs are trading at these deep discounts, one of two dynamics is at play: Either net asset values (NAVs) are going to fall to align with the market decline, or REITs are misaligned, trading at a true discount and will rebound. In either scenario, the marginal dollar is better invested in the REIT market.

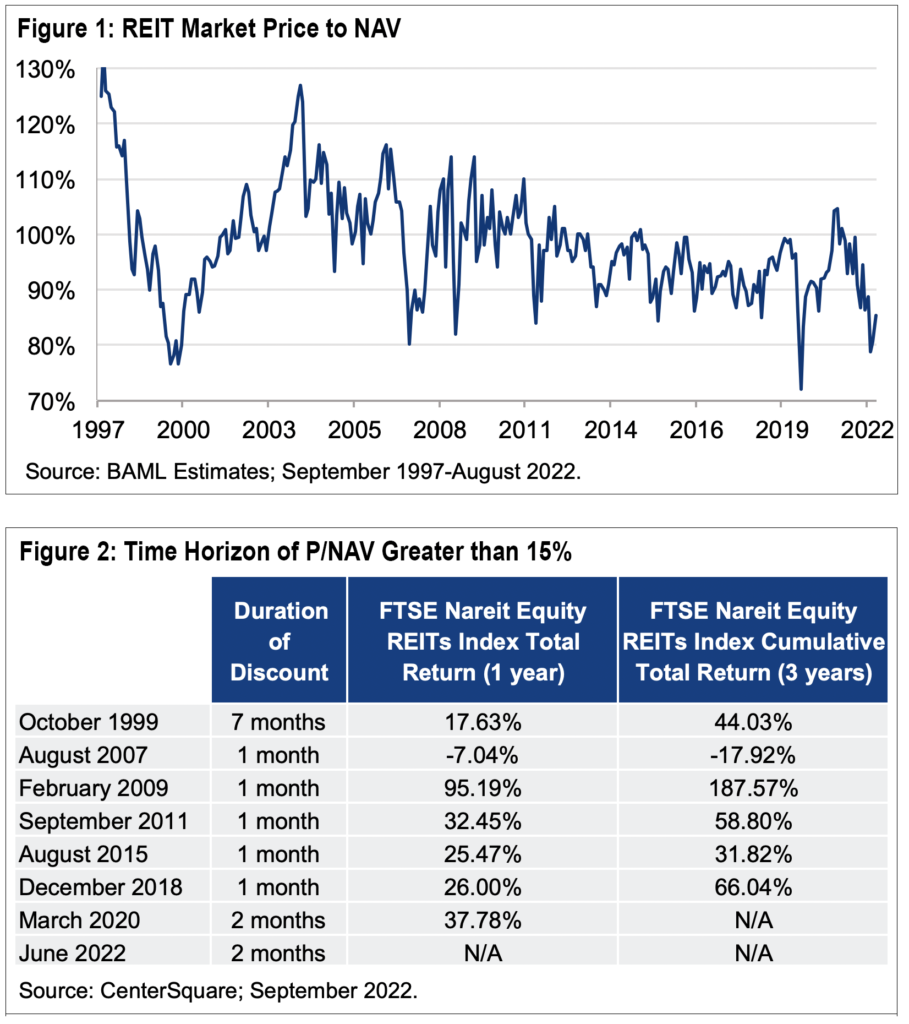

We have seen this scenario play out historically. During the last 25 years, REITs have only traded at a 15% or greater discount to NAV seven times and have delivered extraordinarily strong returns six out of those seven times after reaching this level (Figure 1). The only exception was in 2007 during the Global Financial Crisis, when REITs had to undertake dilutive equity issuances due to elevated levels of leverage (Figure 2). However, that is not the case today. The REIT market’s Debt-to-Asset Value in June 2022 was 29%, well below February 2007 levels of 46%.

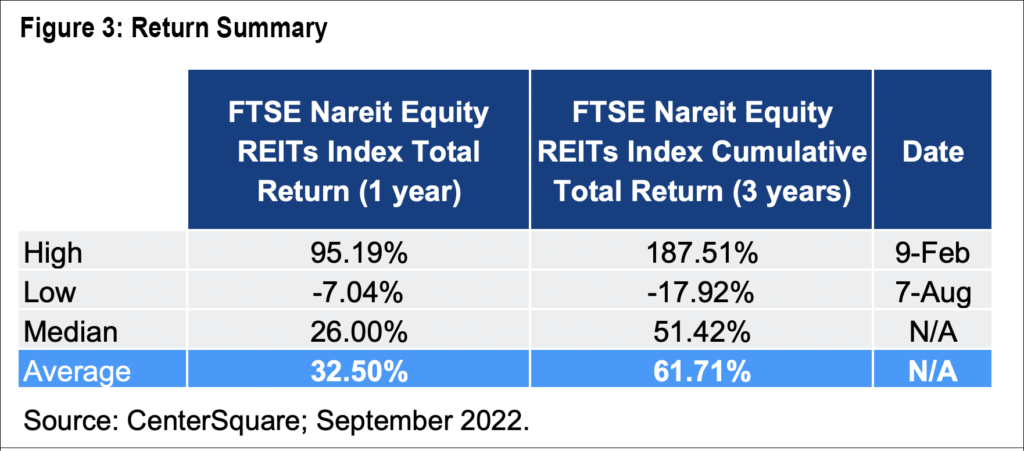

As of July 2022, REITs were trading at a 19.4% discount to NAV. The average total return following such a deep discount period historically was 33% after one year and 62% after three years (Figure 3). Thus, we see opportunity ahead for significant REIT price appreciation.

A Canary in the Coal Mine

The discrepancy in returns between the public and private markets this year is not a new phenomenon. In fact, we have observed this relationship repeatedly in the past. The public market rapidly incorporates changes in valuation, then the private market follows at a meaningful lag. This phenomenon has historically resulted in the private market peaking while the REIT market is concurrently bottoming, creating an opportunity for tactically reallocating capital between private and public real estate exposures (Figure 4). In fact, looking at quarterly total returns since 1978, after the REIT market bottoms, the historical outperformance of REITs versus ODCE funds one year forward has been 42.8%. Even excluding the outsized impact of the Global Financial Crisis the outperformance of REITs versus ODCE funds one year forward after the bottom has been 26.2%.

We find ourselves today in a similar position where the REIT market seems to be bottoming after adjusting implied real estate valuations for macroeconomic headwinds, all while the private market is still posting strong results. During these periods when the state of the capital markets is in flux and private markets are slow to adjust, we look to the public markets to directionally indicate the path for pricing. Accordingly, today public markets are pointing to cap rate expansion in the private markets where the movement will be most acute for deals that were underwritten assuming low debt costs and aggressive persistent growth. Investors who track REIT market movement should recognize this pattern and focus private real estate investment dollars in sectors driven by favorable structural thematics and strong value-add business plans.

Conclusion

Given today’s backdrop of macroeconomic and geopolitical instability, uncertainty feels more permanent than ever before. Yet, this volatility can be counteracted by investors paying attention to the REIT market which has historically 1) outperformed after periods of deep discount and 2) predicted the direction of private market valuations. To capture the upside of today’s market volatility, an actively managed REIT strategy allows investors to recognize and act upon price dislocation in both the private and public markets in real time. To exclude or misplace a REIT allocation is omitting a valuable instrument in a performance toolkit. And in these unstable times, investors can use all the tools they get.

1 CEM Benchmarking, 2021: Asset Allocation and Fund Performance of Defined Benefit Pension Funds in the United States 1998-2019.

Disclosures

Any statement of opinion constitutes only the current opinion of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.

Material in this publication is for general information only and is not intended to provide specific investment advice or recommendations for any purchase or sale of any specific security or commodity. Due to, among other things, the volatile nature of the markets and the investment areas discussed herein, investments may only be suitable for certain investors. Parties should independently investigate any investment area or manager, and should consult with qualified investment, legal, and tax professionals before making any investment. Some information contained herein has been obtained from third party sources and has not been independently verified by CenterSquare Investment Management LLC (“CenterSquare”). CenterSquare makes no representations as to the accuracy or the completeness of any of the information herein. Accordingly, this material is not to be reproduced in whole or in part or used for any other purpose. Investment products (other than deposit products) referenced in this material are not insured by the FDIC (or any other state or federal agency), are not deposits of or guaranteed by CenterSquare, and are subject to investment risk, including the loss of principal amount invested.

For marketing purposes only. Any statements and opinions expressed are as at the date of publication, are subject to change as economic and market conditions dictate, and do not necessarily represent the views of CenterSquare or any of its affiliates. The information has been provided as a general market commentary only and does not constitute legal, tax, accounting, other professional counsel or investment advice, is not predictive of future performance, and should not be construed as an offer to sell or a solicitation to buy any security or make an offer where otherwise unlawful. The information has been provided without taking into account the investment objective, financial situation or needs of any particular person.

Any indication of past performance is not a guide to future performance. The value of investments can fall as well as rise, so investors may get back less than originally invested. Because the investment strategies concentrate their assets in the real estate industry, an investment is closely linked to the performance of the real estate markets. Investing in the equity securities of real estate companies entails certain risks and uncertainties. These companies experience the risks of investing in real estate directly. Real estate is a cyclical business, highly sensitive to general and local economic developments and characterized by intense competition and periodic overbuilding. Real estate income and values may also be greatly affected by demographic trends, such as population shifts or changing tastes and values. Companies in the real estate industry may be adversely affected by environmental conditions. Government actions, such as tax increases, zoning law changes or environmental regulations, may also have a major impact on real estate. Changing interest rates and credit quality requirements will also affect the cash flow of real estate companies and their ability to meet capital needs.

Definition of Indices

FTSE Nareit Equity REITs Index (FNRE)

The FTSE Nareit US Real Estate Index Series is designed to provide the most comprehensive assessment of overall industry performance, and includes all tax-qualified real estate investment trusts (REITs) that are listed on the New York Stock Exchange, the American Stock Exchange and the NASDAQ National Market List. The index constituents span the commercial real estate space across the US economy and provide investors with exposure to all investment and property sectors.

FTSE Nareit All Equity REITs Index (FNER)

The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property.

FTSE Data disclosure: Source: FTSE International Limited (FTSE) © FTSE 2022.

FTSE® is a trade mark of the London Stock Exchange Group companies and is used by FTSE under licence. All rights in the FTSE indices and/or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and/or FTSE ratings or underlying data. No further distribution of FTSE Data is permitted without FTSE’s express written consent. Any statement of opinion constitutes only current opinions of CenterSquare and its employees, which are subject to change and which CenterSquare does not undertake to update.

The REIT ODCE Proxy is a universe of REIT stocks built to resemble the NCREIF Fund Index – Open End Diversified Core Equity (ODCE). The ODCE, short for NCREIF Fund Index – Open End Diversified Core Equity, is the first of the NCREIF Fund Database products and is an index of investment returns reporting on both a historical and current basis the results of 36 open-end commingled funds pursuing a core investment strategy, some of which have performance histories dating back to the 1970s. The REIT ODCE Proxy is proprietary to CenterSquare and uses gateway/infill names in apartments, retail, industrial and office, and then weights them according to the ODCE index to create a proxy.

These benchmarks are broad-based indices which are used for illustrative purposes only. The investment activities and performance of an actual portfolio may be considerably more volatile than these indices and may have material differences from the performance of any of this index.

A direct investment in an index is not possible.

About CenterSquare

Founded in 1987, CenterSquare Investment Management is an independent, employee-owned real asset manager focused on listed real estate, private equity real estate and private real estate debt. CenterSquare is headquartered in suburban Philadelphia, with offices in New York, Los Angeles, London and Singapore, has more than $15 billion in assets under management (August 2022).