The Energy Infrastructure Newsletter • Winter 2022

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

Energy Remains a Bright Light

Amid Overall Market Dimness

By Yves Siegel, Principal, Siegel Asset Management Partners

Investors today face a challenging backdrop with fears of a global recession, high inflation, rising interest rates, geopolitical tremors, climate change and energy security concerns. A defensive posture is warranted, in our view, and at Siegel Asset Management (SAM) Partners we favor companies that have strong balance sheets, generate free cash flow and pay attractive and growing dividends.

The energy sector, which has been the best performing sector in the S&P 500 over the past two years, meets these criteria. While the energy sector is not immune, it should hold up relatively well against the macro headwinds mentioned above for the following reasons:

- Dividend support: The S&P 500 energy sector sports an attractive yield of more than 4% (according to Bloomberg), while the yield on the Alerian Midstream Energy Index (AMNA) is approximately 6%. It should also be noted that exploration and production (E&P) companies with variable dividends have yields in the upper single-digits. For reference, SAM’s Infrastructure Income Strategy, a three-pronged portfolio of midstream, utilities and renewable energy companies, provides a yield of nearly 5%.

- Substantial free cash flow: E&P and midstream companies historically have outspent their cash flow from operations and relied on the capital markets, debt and equity to finance their capital expenditures and dividends. That model has been retired. E&P and midstream companies are now reinvesting only about 30–35% of their cash flow with the balance used to reduce debt and return cash to shareholders. The 2023E free cash flow yield for these energy subsectors is very attractive at about 15% and 9%, respectively, according to Evercore ISI and Wells Fargo Securities, LLC. (See box below).

- Oil and natural gas prices are likely to remain elevated. Despite the recent pullback, oil and natural gas prices are likely to remain high due to supply constraints caused by underinvestment in fossil fuels, E&P companies’ focus on returns and not growth and OPEC policy to support crude oil prices.

- Breakeven costs are well below current commodity prices for most basins. Oil and gas prices could fall by ~50% and it would still be profitable for E&P companies to drill and complete most wells.

- Balance sheets are strong: Energy companies have substantially deleveraged and are well positioned to weather a recessionary storm. This alleviates concerns of midstream companies’ counterparty risk that was prevalent during the oil price collapse of 2014–2015.

- Value and dividend paying stocks should continue to outperform growth stocks during a period of rising interest rates.

Free cash flow is defined as cash flow from operations less capital expenditures. It is discretionary cash that can be used to reduce debt and return cash to shareholders. A useful valuation metric that has come into vogue is price-to-free cash flow per share ratio (like price-to-earnings per share ratio). The inverse of price-to-cash flow per share is the free cash flow yield (free cash flow per share divided by price). Conceptually, a company could distribute all its free cash flow to shareholders as dividends.

THE ENERGY SECTOR CANNOT BE IGNORED

Energy has become relevant again and is the top performing sector in the S&P 500 (i.e., S&P 500 Energy year-to-date return of 63.4% vs. S&P 500 of -15.7% as of 11/29/22). Given its outperformance, energy’s weighting in the S&P 500 (i.e., 5.26% as of November 29, 2022) has slowly increased this year (it was just under 4% as of February month-end and 2.67% as of 12/31/21).

Although the weighting is up from about 2% during the pandemic, it is still well below 6.1% at 2017 year-end and the last peak of 12.3% at the end of 2011. If energy stocks continue to outperform, as we foresee, the sector’s weighting will continue to grow. We suspect that both retail and institutional investors will be attracted to energy stocks because of a fear of missing out (FOMO) given the strong returns, while portfolio managers given the higher sector weighting need to pay attention or risk posting poor relative returns.

Russia’s invasion of Ukraine catapulted energy security as a priority for governments around the globe, most notably, Europe. Affordable, available and reliable energy is essential for human welfare, such as for heating homes, power generation and industrial uses. It’s been easy to take for granted by developed nations, but no more. Decarbonization has temporarily been stymied as consumption of coal has soared and oil has displaced cleaner burning natural gas to meet energy needs. However, the commitment to decarbonization has not wavered but will take more time than perhaps appreciated. We agree with those that have referred to the energy transition as “energy addition.” The addition of renewable energy, such as wind and solar, is needed to both support decarbonization and the growth in energy consumption resulting from an expanding global population and economy.

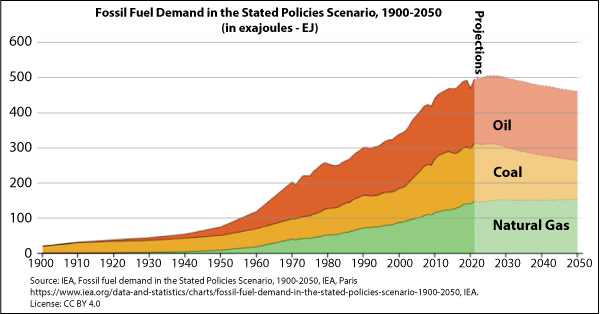

Indeed, in the International Energy Agency’s (IEA) recently published World Energy Outlook, renewable energy grows rapidly for decades to come and gains market share in the energy mix, but fossil fuels will remain vital to fulfill the world’s energy needs and provide for human welfare. For decades, fossil fuel’s market share of energy supplied hovered around 80%. The IEA projects under its Stated Policies Scenario (STEPS) that fossil fuels’ market share will fall below 75% by 2030 and to just above a still meaningful 60% by 2050. Under this scenario based on current government policies and not aspirational targets, oil supply increases through 2030 and plateaus through 2050, while natural gas supply grows modestly through 2050. It should be no surprise that coal supply peaks in 2021 and falls precipitously through 2050.

CONCLUSION

We strongly believe that the energy sector should be a meaningful weighting in equities’ portfolios for value-oriented investors seeking income and modest growth. The future winners in the energy sector will be the best allocators of capital and free cash flow. They will invest in and embrace the energy transition and environmental, social, and governance (ESG) factors. Many of the traditional energy companies sport strong balance sheets, robust cash flow and growing dividends. In addition, many of them are investing in clean technologies and will be critical providers of requisite infrastructure for the clean energy future. We believe growth-oriented investors with a long-term time horizon, ability to cope with near-term volatility and greater risk tolerance should also consider clean energy companies for their equity portfolios.

A Balanced Portfolio Approach

We have strong conviction that traditional energy companies can prosper in the years ahead and invest in a net zero carbon future. We are also believers in the long-term potential of clean energy stocks and have exposure to this megatrend via investments in utilities, companies that provide utility scale renewable power under long-term contracts, and selective exposure to pure-play clean energy stocks. SAM Partners’ objective is to provide investors with above-average income and attractive risk-adjusted returns.