The REIT Newsletter for Advisors • Winter 2021

Closing the Commercial Real Estate Exposure Gap

By John D. Worth, Nareit Executive Vice President, Research & Investor Outreach

Today, 83% of financial advisors invest their clients in REITs and the most frequently referenced attribute they cite is “portfolio diversification.” These advisors have tapped into a strategy used by a majority of institutional investors: allocate a meaningful share of an investment portfolio to commercial real estate.

REITs provide investors with a means of gaining commercial real estate exposure and are present in most major stock indexes. However, to fully achieve the benefits of commercial real estate in a well-diversified portfolio, investors need to hold REITs in excess of their market weight in most stock market indexes.

For decades, institutional investors have been investing in the real estate asset class, recognizing the important role it plays within investment portfolios to help build adiversified portfolio and manage risk. The attributes commercial real estate bring to a portfolio are well documented:

- Exposure to the distinct real estate economic cycle, which differs from the macro cycle for most other equities and bonds due to real estate supply inelasticity; this reduces the correlation of investment returns from real estate with the returns from other assets

- Competitive, long-term investment returns that potentially provide high and growing income from rents plus moderate capital appreciation over time

- Potential inflation hedging attributes due in part to the fact many leases are tied to inflation and that real asset values tend to increase in response to rising replacement costs

Real estate is a critical part of the U.S. economy. In fact, the commercial real estate industry owns structures that house nearly all economic activity. Not surprising, in addition to stocks, bonds, and cash, commercial real estate is a core asset class and accounts for a meaningful share of the overall investable universe available to investors. As Chart 1 shows, commercial real estate is the third largest asset class in the U.S. market basket—representing 14% of the investable universe.

However, most individual investors are underallocated to commercial real estate. Chart 2 compares the real estate exposure in common large-, mid- and small-cap equity strategies with the 14% commercial real estate share of the investable universe in the U.S. As the chart shows, investors using standard equity strategies are underallocated to commercial real estate relative to what it represents as a share of the investable universe. By definition, this underallocation results in a portfolio with higher risk and lower returns.

Studies have shown that adding REITs to a basic portfolio consisting of stocks, bonds, and cash provides meaningful diversification benefits. This diversification is derived in part from the fact that REITs provide stable and reliable dividends to investors. Over long holding periods, REIT dividend yields have been consistently higher than the dividend yield of S&P 500 constituents. As I’ll discuss below, research from Morningstar and others formalizes this concept and suggests that this underallocation leads to lower long-term returns for a given level of risk.

What accounts for this commercial real estate exposure gap? Nareit estimates that just 10% of all commercial real estate and 20% of the higher quality investment grade commercial real estate is owned by the REIT industry. Most commercial real estate is owned through private or non-listed investment strategies compared with other sectors of the economy. This is in sharp contrast to most sectors of the stock market where nearly all major constituents are publicly traded. For this reason, investors need to hold REITs in excess of index market-cap weights in order to obtain meaningful exposure to the commercial real estate asset class.

Over the past few decades, assets have become increasingly correlated. This increasing co-movement between asset classes—especially equity—has challenged advisors to identify investments to better diversify their clients’ portfolios. As noted, the ability of REITs to provide access to meaningful diversification opportunities is increasing recognized by advisors. Chart 3 below compares the correlations of several widely used equity strategies with the total stock market over the last 20-plus years. As the chart shows, REIT have a much lower correlation than any of the alternatives, including small cap, value, and international strategies.

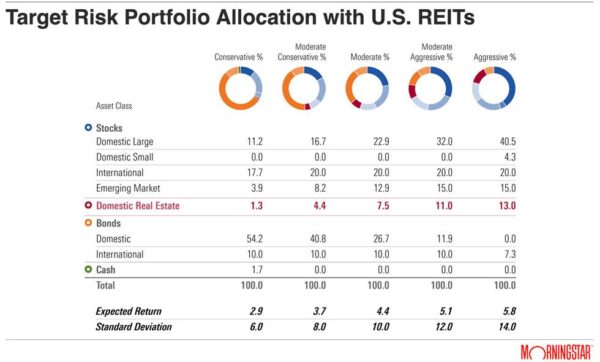

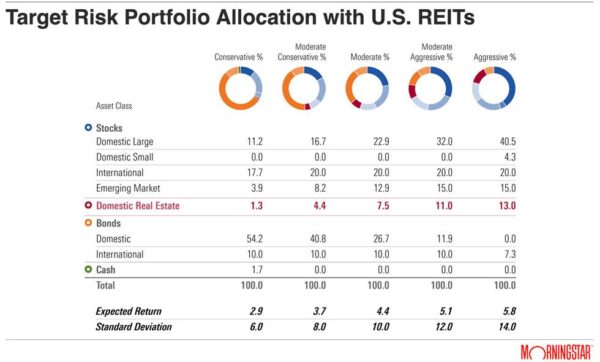

The key role commercial real estate plays is highlighted in a new Morningstar Associates analysis, sponsored by Nareit, that found the optimal portfolio allocation to REITs ranges up to 13%. As illustrated in Chart 4, the Morningstar analysis shows that the inclusion of REITs in a portfolio may increase the return for a given level of risk. The following table depicts five portfolios targeting different levels of risk. For example, a moderate portfolio targeting a 10% standard deviation and 4.4% return allocates 7.5% to REITs, and an aggressive portfolio targeting a 14% standard deviation and 5.8% return is estimated to have a 13% REIT allocation.

Chart 4

In this analysis, Morningstar used Black-Litterman methodology, a mean-optimization methodology well respected by the institutional investment community, and Morningstar Investment Management’s assumptions. The findings of the Morningstar analysis are consistent with the results of other studies conducted by Morningstar, Ibbotson Associates supporting a REIT allocation between 5% and 15%.

Resources including research on determining an appropriate REIT allocation for investors as well as a searchable data base for performance data for REIT mutual funds and ETFs are available at Nareit’s website at

reit.com/quickfacts and at

reit.com/investing/reit-funds.

John D. Worth is executive vice president for research and investor outreach at Nareit. He leads Nareit’s internal and external research efforts and directs Nareit’s investor outreach and education initiatives. Nareit’s research focuses on the role of REITs and real estate in diversified portfolios and commercial real estate market dynamics. The investor outreach program brings Nareit’s research insights to U.S. and global institutional investors. Prior to joining Nareit, Mr. Worth founded the Office of the Chief Economist of the National Credit Union Administration (NCUA) from 2010 and 2015. He led NCUA’s participation on the Financial Stability Oversight Council, the organization composed of the heads of the federal financial regulators and charged with identifying risks to financial stability. Prior to joining NCUA, Mr. Worth spent nearly a decade at the U.S. Treasury where he served as the director of the Office of Microeconomic Analysis and served as acting deputy assistant secretary for microeconomics during 2008. At Treasury, he led a team that oversaw policy development and research on a broad range of issue including entitlements, health care, housing issues, and private pensions. He was a primary author of the Bush Administration proposal that became the Pension Protection Act of 2006. After 2006, Mr. Worth was deeply engaged in housing and financial crisis response, including the development and execution of TARP programs and was one of the primary architects of the homeowner assistance and mortgage modification programs. Mr. Worth has also worked as a consultant for Welch Consulting and the RAND Corporation. He is a graduate of George Washington University and holds a Ph.D. in economics from the University of Southern California.