The Energy Infrastructure Newsletter • Winter 2019

Click HERE to download a printable PDF of this newsletter.

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

The Times Are Changing,

and MLPs Are Changing, Too

In this Q&A with Advisor Access, portfolio manager Yves Siegel, of Neuberger Berman, explores how socially responsible investment practices have affected investment in MLPs, and looks forward to how the sector might fare in 2020.

Advisor Access: What factors are contributing to MLP market weakness?

Yves Siegel: The simple answer is that broadly, energy has been out of favor with investors over the last several years. This coincides with the rise in popularity of ESG (environmental, social, and governance) investing. The extreme narrative depicts oil and natural gas as harmful to the environment and holds that investment in oil and natural gas companies should be shunned. Further, as the push to renewables gains steam, eventually oil and natural gas will become obsolete, or so the argument goes.

Investors have also taken a more discerning look at the returns on investment generated by energy companies. They have discovered that returns on capital employed are inadequate for the risk inherent in the business, primarily in the case of upstream, or exploration and production companies. MLPs have generated returns above their cost of capital but noticeably less than promised in some cases. These disappointments have often been caused by cost overruns owing to delays in receiving permits and/or issuing expensive equity to fund projects.

In hindsight, the 2015 oil price collapse has had a devastating impact on MLPs. The collapse could not have come at a worse time, as MLPs were in the midst of a super-infrastructure build cycle. As the shale revolution spurred unprecedented growth in oil and natural gas production, MLPs took the lead in building the requisite infrastructure. Traditionally, MLPs financed capital projects with 50% equity and 50% debt. However, the precipitous drop in oil prices also caused a dramatic fall in the equity price of MLPs, and consequently their ability to raise public equity to finance their projects. Unfortunately, in too many instances, MLPs cut their distributions to free up cash flow so they could fund projects and deleverage their balance sheets. The MLP business model broke and investors lost confidence in the sustainability of distributions.

AA: How have MLPs responded to this new environment?

YS: MLPs have moved to a self-equity funding model; they are no longer relying on the public equities market to support their capital projects. They are retaining cash flow to reinvest in their businesses. Consequently, some companies cut their distributions, others restructured and eliminated incentive distributions that were paid to the general partner (GP), and still others just slowed the rate of distribution growth. In addition, companies have reduced their capital expenditures. This is partly a function of the maturation of the shale boom and partly the result of companies being more deliberate in their budgeting and raising hurdle rates for capital projects.

AA: Several MLPs have converted to C Corps. Do you expect more to follow?

YS: Funds flowing into the MLP sector have been anemic at best. Some MLPs have either converted to a C Corp or checked the box to be taxed as a C Corp to attract new investor dollars. Many institutional investors cannot own MLPs due to the issuance of K-1s and the generation of unrelated business taxable income (UBTI). The conversion eliminates these obstacles. The jury is still out on whether this will be a successful strategy.

There are still benefits to the MLP structure. It is a tax-advantaged way to distribute cash to owners with the avoidance of double taxation. There is also the possibility that corporate taxes could be raised with a new administration, and that the tax advantage of MLPs could become even more pronounced. We think most companies will take a wait and see approach until after the 2020 presidential election before making a decision.

AA: Has ESG impacted MLPs?

YS: Environmental, social, and governance criteria is increasingly being used by investors in their investment decisions. The midstream companies are taking ESG very seriously and adding substantial resources to this endeavor. Carbon and methane emissions are declining. Companies are more active than ever in their communities, and we believe corporate governance is improving, with many companies restructuring. The elimination of IDRs (incentive distribution rights) and merging the GP security and MLP security into one removes potential conflicts of interest between the general partner and limited partners, in our view.

Unfortunately there is a negative stigma attached to oil and gas companies, including midstream infrastructure companies such as MLPs. Clearly fossil fuels generate carbon emissions that are deemed harmful to the environment. But no magic wand can be waved today that can eliminate hydrocarbons from our ecosphere and allow us to maintain our standard of living. Renewables, such as wind and solar, are an intermittent source of energy. The wind doesn’t always blow and the sun doesn’t always shine. We need other sources of energy as a backup. Natural gas is filling that void, and is part of the solution to the holy grail of neutral carbon emissions. According to the Energy Information Administration (EIA), between 2005 and 2017, the CO2 emissions reduction attributable to natural gas replacing coal and oil-based generation resources was greater than the reductions attributable to renewables and other non-carbon generation sources combined.*

AA: What are investors missing, if anything?

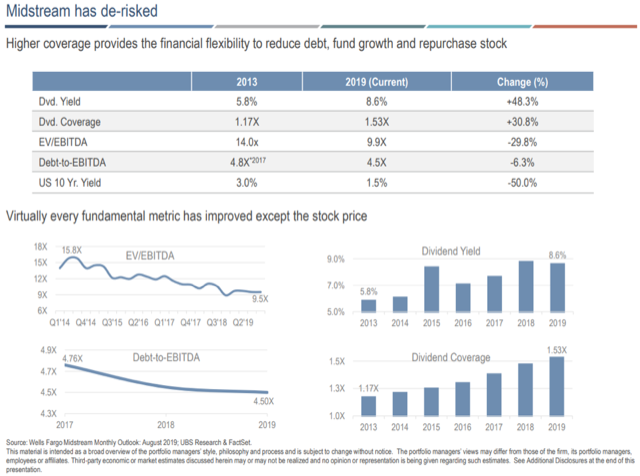

YS: Investors have not yet recognized that the midstream sector has transitioned to a lower risk financial model and better corporate governance. Balance sheets have improved, dividend coverage ratios are stronger (about 1.5x on average, versus 1.0–1.05x several years ago), and companies are no longer relying on issuing equity to finance growth. In the next couple of years, we believe companies will generate true free cash flow that will enable them to fund growth capital expenditures, pay distributions, and buy back stock without accessing the capital markets for debt or equity. Despite better financial metrics, in our view stock valuations are very compelling relative to historic averages and yield alternatives. The Alerian MLP Index is yielding about 10% as of this writing, more than 600 basis points above the ten-year Treasury.

AA: What is your outlook for MLPs for 2020?

YS: MLPs should be viewed as midstream companies that happen to be structured as partnerships. Taken one step further, these infrastructure companies happen to process, store and transport energy. We believe 2020 could be a snapback year for these companies as investors recognize the durability and stability of the underlying businesses. The winners are likely to be the large, well-capitalized companies integrated across the energy value chain and diversified geographically and by commodities. As the U.S. continues to grow as a major exporter, those companies that can reach both domestic and global markets will have competitive advantages over peers.

Earnings and cash flow growth will likely moderate beyond 2020 as growth capital expenditures fall to a more sustainable level. However, in our opinion, free cash flow will grow. This will be the metric that investors will hone in on and will lift stocks higher. We believe there is potential for valuation multiples to expand, albeit not back to the levels reached in the 2014 peak. Just a modest boost in multiples coupled with high dividend yields could lead to a very attractive value proposition.

The biggest risk, in our view, is political. Delays in permitting, especially in the Northeast, have been costly. If the rhetoric against fossil fuels ramps higher during the presidential election, it could create a headwind for the energy sector. However, we suspect logic will prevail over the longer term. Our energy industry is vital to the U.S. economy. It creates jobs, lowers our trade deficit and improves our quality of life.

* “Transition to a Lower-Carbon Economy.” The INGAA Foundation; May 2019.

Yves Siegel is a portfolio manager for the Rachlin Group within Neuberger Berman’s Private Asset Management division. Prior to joining the firm in 2012, he was a managing director and senior equity analyst at Credit Suisse. Before that, he was a senior portfolio manager at a New York hedge fund focused on MLPs, and was also a managing director and senior analyst with Wachovia Securities, where he worked for ten years. Mr. Siegel also had successful sellside engagements in senior analyst positions with Smith Barney and Lehman Brothers. He has appeared on CNBC and in front of several energy and MLP-related regulatory and industry panels. Mr. Siegel received both a BA and MBA from New York University, and has been awarded the Chartered Financial Analyst designation.