The Energy Infrastructure Newsletter • Fall 2022

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

U.S. LNG Capacity Expected to

More than Double by End of Decade

Advisor Access spoke with Chase Mulvehill, Senior Oilfield Services, Midstream and MLP Analyst, BofA Securities

Advisor Access: U.S. liquefied natural gas (LNG) exports collapsed during the COVID-19 pandemic but has demonstrated a strong recovery, especially post the Russia-Ukraine conflict. Walk us through the pandemic to where we are now.

Chase Mulvehill: As a result of the global economic lockdown, international LNG/natural gas demand fell significantly during COVID, which caused U.S. LNG exports to fall from 9 billion cubic feet/day (Bcf/d) before COVID to around 3 Bcf/d during the depths of lockdowns. Also during COVID, Japan/Korea Market (JKM) prices, which are a global marker for LNG prices, fell from $6/million British thermal units (MMbtu) to sub $2/MMbtu. At $2/MMbtu, the JKM price failed to cover freight costs, and as such, U.S. LNG remained stranded in the U.S.

However, U.S. LNG exports experienced a V shaped recovery, with exports rebounding quickly and actually reaching record highs of 11 Bcf/d later in 2020. And U.S. LNG exports remained at these levels for most of 2021. But in 2022, U.S. LNG export volumes stepped up again as 2.3 Bcf/d of incremental capacity came online, taking nameplate capacity to almost 14 Bcf/d.

Also, earlier this year, global LNG was supercharged by Europe trying to reduce its dependence on Russian gas post the Russia-Ukraine conflict, where Europe is looking to replace up to 16 Bcf/d of Russian natural gas over the coming months and years. This also affected Asian buyers, who are eager to restock inventories before the winter season, as Asia and Europe compete for spot LNG at unsustainable prices $55–65/MMbtu. Europe lacks the infrastructure to consistently use LPG as a heating source in the winter, and developing countries in Asia are looking to move away from dirtier heat sources like kerosene.

Currently, all U.S. LNG facilities, with the exception of Freeport LNG, are running at nameplate capacity or above. If a plant can temporarily run above nameplate capacity, it can capture the spread between Henry Hub and JKM/Title Transfer Facility (TTF) prices of >$55/thousand cubic feet (Mcf). So, ~13% of U.S. natural gas or 11 Bcf/d is currently being exported as LNG. Note that Freeport LNG experienced an unplanned outage in June, and when restored, it will add 2 Bcf/d of nameplate capacity. The Calcasieu Pass facility added capacity of 1.5 Bcf/d in 2Q22, mostly offsetting the Freeport outage in early June.

AA: What is your outlook for incremental U.S. LNG capacity longer term?

CM: By the end of this decade, we expect U.S. LNG nameplate capacity [nameplate capacity is what a facility expects to produce in the long term with average maintenance and weather] to more than double from current levels of almost 14 Bcf/d (103 million tonnes per annum [Mtpa]) to about 29 Bcf/d (223 Mtpa). This includes 2.4 Mtpa of Golden Pass set to start up in 2024/25, 2.4 Mtpa of projects sanctioned so far this year and 9.8 Mtpa of risked projects that we expect to be sanctioned over the next couple of years. So this represents about 15 Bcf/d of incremental feedgas demand that must be supplied by U.S. shale over the next 5–6 years. To put this in context, current U.S. natural gas production sits at 118 Bcf/d today. Thus, this surge in U.S. LNG exports would require a 13% increase in U.S. natural gas production—and that is before considering any domestic demand increase in natural gas from the power and/or industrial sectors.

AA: I can see that between the capacity under construction and recently sanctioned projects, U.S. LNG capacity can grow to almost 20 Bcf/d. But what are you seeing today that gives you confidence in additional projects being sanctioned over the coming quarters?

CM: During COVID in ’20, as global natural gas demand fell, many believed that natural gas could be bypassed altogether as a transition fuel by hydrogen, solar, battery storage and wind. But now with the world in the middle of a major energy crisis, the case for natural gas as not only a transition fuel, but as a destination fuel, is growing. First, the carbon intensity of natural gas is 40% less than coal. The European Union notes that natural gas is considered “green” if it replaces coal-fired generation. Second, the U.S produces natural gas with lower emissions on a full cycle basis than other countries, as it is sourced primarily from shale. That said, the natural gas industry is also working together to reduce carbon emissions through measurement programs certifying “Responsibly Sourced Natural Gas” from the wellhead and emissions trading programs. This is all helping drive strong demand for global LNG even well into the future. To this point, we are seeing significant offtake agreements being signed. For example, we count 51.5 Mtpa of signed offtake agreements for U.S. LNG project so far in 2022. This is what gives us confidence in more U.S. LNG projects being sanctioned over the coming quarters.

AA: How will this significant increase in U.S. LNG exports impact the midstream industry longer term?

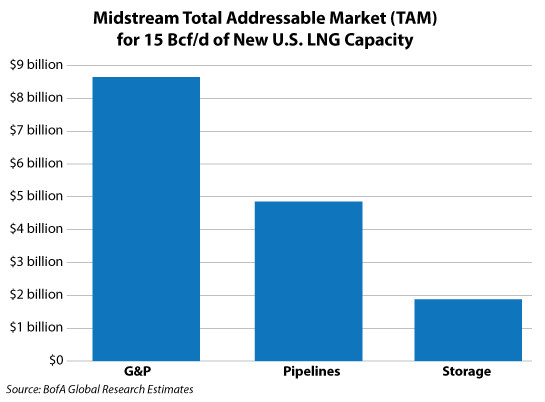

CM: For the overall midstream industry, we have quantified the TAM (Total Addressable Market) for about 15 Bcf/d of new LNG. This includes the full value chain of midstream opportunities from the wellhead to water, which means it includes midstream revenues associated with Gathering and Processing (G&P), long-haul pipelines and storage. Also, we expect the Permian supplies 50% of incremental U.S. LNG feedgas, Haynesville 35%, and the Marcellus 15%. We conclude there is a $16 billion opportunity for 15 Bcf/d of LNG for the midstream sector with G&P driving $9 billion, long-haul pipes $5 billion, and storage and lateral pipelines $2 billion of value. Permian associated gas will need to make its way to the Gulf Coast through intra-state pipelines, while the Haynesville will build north-to-south pipes to move gas to the Louisiana LNG corridor. We expect, over time, Marcellus and Utica gas will again find its way down to the Gulf Coast over the next decade.

AA: Thanks, Chase, for your insights.

Chase Mulvehill joined BofA Securities in June 2018 as the Senior Oilfield Services analyst on the energy team. His regular research publications include his most popular Oilfield Services Chart of the Week, while his macro-focused thematic approach to covering the sector is unique amongst his competitors. He was ranked Runner-up in the 2020 Institutional Investor All-America Research Poll for the Oilfield Services & Equipment sector. Prior to joining the firm, Mulvehill spent four years on the sell-side, covering Oilfield Services at Wolfe Research and SunTrust Robinson Humphrey, and six years on the buy-side as an analyst covering oilfield services and other energy sectors at Millennium and Carlson Capital. And before his time on the buy-side, Mulvehill worked as an oilfield services associate at Jefferies. Prior to joining Wall Street, he worked as an aeronautical engineer at Lockheed Martin. He earned his MBA from Southern Methodist University and a Bachelor’s degree from Auburn University where he studied Aerospace Engineering. Mulvehill is based in Houston, Texas.

Printed by permission. Copyright © 2022 Bank of America Corporation.