The MLP Newsletter for Advisors • Spring 2018

Click HERE to download a printable PDF of this newsletter.

As an investment advisor, you have been subscribed to the MLP Newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the MLP Newsletter includes valuable information and expert opinion about MLPs that you cannot get anywhere else.

The Master Limited Partnership Association (MLPA) is a trade association representing the publicly traded limited partnerships (PTPs) that are commonly known as master limited partnerships (MLPs), and those who work with them.

Cushing Asset Management offers multiple MLP and energy infrastructure investment strategies to meet the needs of institutional investors. They have solutions designed for the needs of high net worth individuals and institutional investors, including public and private pension plans, sovereign wealth plans, Taft-Hartley-plans, foundations, endowments and other charitable organizations, insurance companies and family offices. They offer long-only and long-short separately managed accounts and private funds, including investment vehicle options for investors with specific tax and liquidity needs.

Advisor Access spoke with portfolio manager Kevin Gallagher.

The Advisor Access Interview

Advisor Access: As commodity prices continued to improve, MLPs performed poorly in 2017. What do you attribute that to?

Kevin Gallagher: Despite a solid fundamental backdrop, midstream energy infrastructure, including MLPs, was one of the few asset classes to stumble in 2017. Midstream energy companies are energy infrastructure businesses involved in the transportation, storage, and processing of oil and gas. Or, put more simply, midstream companies are the movers of energy, as opposed to upstream companies, which are producers (drillers). Many of these midstream companies structure themselves as MLPs, which are pass-through entities that pay out a significant component of operating earnings to investors in the form of distributions.

The lackluster performance of 2017 was driven by several factors, including weak investor sentiment, fluctuating energy prices, contagion from some company-specific headlines, and concerns regarding the impact from the tax reform bill. It appears that many of these clouds have lifted, as evidenced by the strong start for midstream energy, thus far, in 2018. We see more tailwinds for MLPs and midstream energy stocks going forward.

AA: On the subject of tax reform, what was the impact of broad tax reform and the recent Federal Energy Regulatory Commission (FERC) ruling?

KG: One overhang for MLPs in 2017 was tax reform and the concern that MLPs would be stripped of their tax-advantaged status. MLPs maintained their tax-advantaged status over C corporations, primarily due to the 20% pass-through deduction that was included in the new tax reform bill. In addition, tax reform is a positive for energy infrastructure companies structured as C corps. While these companies are generally not cash taxpayers, it extends their ability to be non- or extremely low-cash taxpayers going forward.

More recently, at its open commission meeting on March 15, 2018, FERC broke with nearly two decades of policy by revising its approach toward the recovery of income taxes for regulated pipelines operating under “cost of service”-based tariff rates owned by MLPs. Put simply, the FERC ruled that MLPs can no longer include an income tax allowance (typically referred to as an “ITA”) in their rate-base calculation for determining pipeline tariffs under a cost-of-service mechanism. All else equal, this ruling will result in lower maximum rates that select pipelines can charge shippers. The greatest impact will be felt directly by FERC-regulated pipelines (typically natural gas) operating under cost-of-service rate mechanisms owned by MLPs, although impacts will vary depending on a multitude of factors.

A critical point to emphasize is that the majority of midstream and related assets are not impacted by this ruling. Unregulated and competitive-based midstream businesses, including crude oil, natural gas, and natural gas liquid (NGL) gathering systems, natural gas processing facilities, intrastate pipelines, fractionators, storage/logistics terminals, trucking/rail terminals, export facilities, marine services, wholesale fuels distribution (including propane), etc. are not impacted whatsoever by this ruling.

Second, and with respect to interstate regulated pipelines, this ruling only applies to tariffs operating under a cost-of-service methodology. In other words, it does not apply to competitive market-based rates (where the operator can charge “what the market will bear”), nor will it apply to negotiated or settled rates (an agreed-upon tariff between a shipper and operator).

Third, the ruling will be less applicable to regulated cost-of-service pipelines currently underearning their allowable return on equity (ROE). This is probably most applicable to Boardwalk Pipeline Partners, LP (NYSE: BWP).

Last, regulated cost-of-service pipelines held by C corps will be less impacted, but will need to reduce their assumed tax rate from 35% to 21% to be partially offset by any other cost increases as noted above.

In relation to the benchmark Alerian MLP Index, companies representing approximately 63% of the current index weight made public statements of “no material impact.” Based on our analysis and third-party sources, we believe an additional 23% of the current index weight will face little to no impact given their operation of nonregulated assets and other factors, bringing the total of expected limited impact to approximately 86% of the index (see Exhibit A). For companies with assets subject to the ruling’s impact, including the 14% with the most exposure, we expect the overall financial impact to weighted average index-level distributable cash flows to be less than 5%, based on current levels. Accordingly, we believe the market’s violent reaction and broad-based sector price decline was largely unwarranted.

AA: After what has been a tough period for MLPs, how do you see this and other factors impacting the outlook for the asset class?

KG: As we have suggested, the FERC ruling does not apply to the vast majority of the midstream sector, and we even expect manageable cash-flow impacts for those companies that are affected.

However, we have more difficulty measuring the lasting impact to sentiment of an already beleaguered sector and fragile investor base. As you have heard from us numerous times, one of the biggest problems recently impacting the space has been the decline in investor sentiment and resultant fund flows, despite a dramatically improved underlying fundamental and operating environment. The FERC ruling (and increased trading volatility and sector weakness as a result of the ruling) will likely only add yet another source of uncertainty and frustration for investors.

Additionally, the timing of this decision was unfortunate, as the sector seemed to be finding its footing and enjoying positive fundamental momentum, with solid Q4/17 results and 2018 guidance. Energy pricing is not the primary driver of midstream energy fundamentals—it is volume growth. Despite this, when energy prices weakened last year, midstream energy companies were dragged down with them.

From a volume perspective, as long as commodity prices provide a stable backdrop—let’s say $45 to $75 for crude oil and $2 to $4 for natural gas—a normally functioning energy supply chain usually follows. With the synchronized global economic expansion, we believe the pricing environment will provide a positive backdrop for midstream energy companies (including MLPs) in 2018.

AA: With that outlook in mind, has performance been more indicative of sentiment or actual fundamentals?

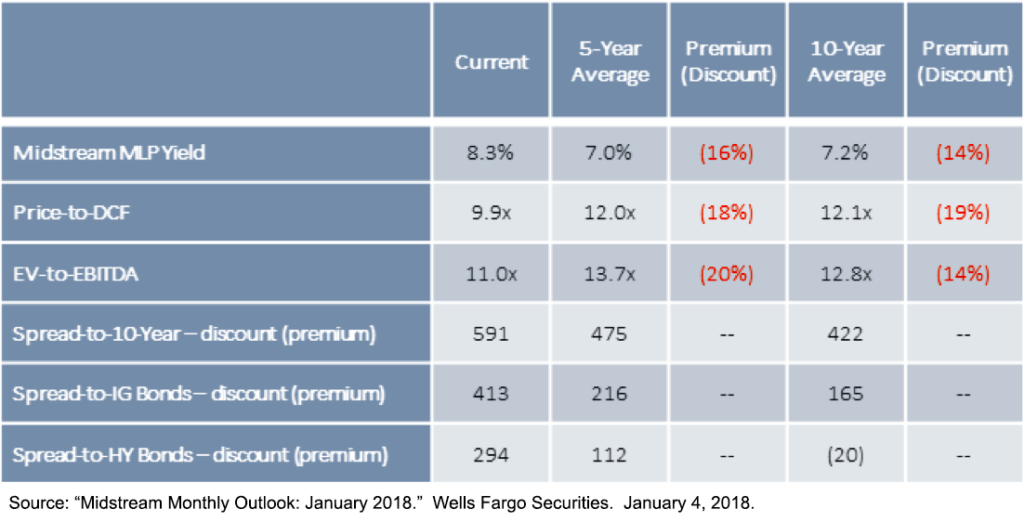

KG: While midstream energy fundamentals were solid last year, investor sentiment was challenged. This extended beyond concerns surrounding tax reform and energy prices. The asset class as a whole was negatively impacted by other issues, including corporate governance issues and distribution cuts by several midstream energy companies. To be sure, investors don’t like these types of headlines and uncertainty. We believe these issues are largely behind us, which should cause investors to once again focus on individual company fundamentals. As Figure 1 below illustrates, valuations are particularly attractive, given the negative sentiment of last year.

In our view, the foundation for midstream energy is rock solid on several fronts. Consider the following:

1) The Unites States has validated that it can be energy independent, and is setting up to be the world’s largest energy exporter.

2) MLPs have validated they can survive a low commodity price environment, as energy technology can make production economical at low price levels.

3) Current metrics validate that volume growth is going to increase across almost all shale basins.

4) There has been validation that demand has picked up—a trend that we believe will continue for the foreseeable future.

Collectively, we believe this will lead to improved investor sentiment for energy infrastructure in general and, more specifically, for energy MLPs. In our view, the stage is setting up nicely for a multiyear—if not longer—run for the energy infrastructure universe. In a market that has stretched valuations and low yields, the attributes for MLPs look compelling. Not only are MLPs’ valuations relatively attractive and fundamentals sound, they also offer growth potential, which historically has provided a cushion in rising interest-rate environments. Furthermore, they offer a compelling income stream for investors.

AA: Thank you, Kevin.

Kevin Gallagher began his career in the energy investment industry in 2000. Before joining Cushing Asset Management, he was a Senior Equity Research Associate at RBC Capital Markets with sector coverage responsibilities spanning Oilfield Services, Exploration and Production (E&P), Alternative Energy, and Master Limited Partnerships (MLP). Mr. Gallagher earned a B.S. in Economics with Financial Applications and an M.B.A. from Southern Methodist University. Additionally, he holds the Chartered Financial Analyst (CFA) designation. Mr. Gallagher joined Swank Capital in 2006, and his roles include research and portfolio management for the firm’s MLP-related funds.