The MLP Newsletter for Advisors • Spring 2017

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the MLP Newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the MLP Newsletter includes valuable information and expert opinion about MLPs that you cannot get anywhere else.

The Master Limited Partnership Association (MLPA) is a trade association representing the publicly traded limited partnerships (PTPs) that are commonly known as master limited partnerships (MLPs), and those who work with them.

ClearBridge Investments is a leading global equity manager committed to delivering long-term results through active management. They have followed this approach for more than 50 years and continue to offer investment solutions that emphasize differentiated stock selection to move their clients forward. Advisor Access spoke with Chris Eades, Managing Director and Portfolio Manager at ClearBridge.

Assessing Energy MLPs

One Year from the Bottom

The Advisor Access Interview

Advisor Access: Can you provide an overview of the current energy MLP landscape?

Chris Eades: It has been a volatile ride for MLP investors over the past couple of years. But despite the volatility in oil prices and in MLP stock prices, most MLP business models held up as expected during the cyclical downturn (and now recovery) in oil prices. Most of the assets owned by MLPs do not generate cash based on the price of oil or the price of natural gas, but rather on the volume of oil and natural gas that flows through energy infrastructure assets. So, while oil and natural gas prices have been exceedingly volatile over the past couple of years, MLP cash flows have remained resilient and, in fact, grew in 2015 and 2016 despite oil prices falling from more than $100 per barrel to $26 per barrel in February last year.

Chris Eades: It has been a volatile ride for MLP investors over the past couple of years. But despite the volatility in oil prices and in MLP stock prices, most MLP business models held up as expected during the cyclical downturn (and now recovery) in oil prices. Most of the assets owned by MLPs do not generate cash based on the price of oil or the price of natural gas, but rather on the volume of oil and natural gas that flows through energy infrastructure assets. So, while oil and natural gas prices have been exceedingly volatile over the past couple of years, MLP cash flows have remained resilient and, in fact, grew in 2015 and 2016 despite oil prices falling from more than $100 per barrel to $26 per barrel in February last year.

Despite resilient cash flows, MLP stocks did trade off by more than 55% from their August 2014 high to their February 2016 low, as measured by the Alerian MLP Index. Essentially, MLP stocks traded for a period of time as if their cash flows were dependent on the price of oil and natural gas—like an oil and gas production company. In fairness, the severity of the downturn in MLP stocks was worse than we envisioned going into the cyclical downturn for oil and natural gas prices. But, while stocks can disconnect from their underlying cash flow fundamentals over the short term, we knew that ultimately stocks would discount cash flow fundamentals. This took a while to occur, but the rebound we have seen since February 2016 reflects the market more rationally valuing the cash flow capabilities of these MLP companies and their assets.

So far in 2017, MLP stocks have gotten off to a solid start, with the Alerian MLP Index up roughly 5% in January compared to the S&P 500’s 2% gain, a 1% return from utilities, and a flat performance for real estate investment trusts (REITs). Utilities and REITs have been compared to MLPs as income-oriented investments. The performance of MLP stocks in the early part of 2017 reflects renewed investor confidence that oil and natural gas prices have bottomed out and are poised for further recovery.

AA: What is your outlook for MLPs in 2017?

CE: MLP distribution growth in 2017 will likely accelerate somewhat relative to the 3% distribution growth seen in 2016. And after a modest decline in 2016, we expect U.S. oil and natural gas production to increase to recent peaks in the second half of 2017, driving the need for incremental infrastructure to process, transport and store increasing production. This, in turn, will likely lead to accelerating cash flow growth, and subsequently, accelerating distribution growth for the MLP companies we invest in. In addition, MLP balance sheets are fairly healthy, and with ready access to both the debt and equity capital markets, we believe MLPs are well positioned to finance growth projects in their current backlogs.

Though MLP stocks have staged an impressive rebound off their February 2016 lows, valuations for MLP stocks remain below levels typical for the sector. Following the extreme lows of a year ago, we continue to expect MLP valuations will return to historical average levels. This continued normalization of stock valuations, combined with what could be accelerating growth, leaves us positive on MLP stocks looking out over the balance of 2017 and into 2018.

AA: What will be the effect of the OPEC production cuts on oil prices? How quickly is U.S. production likely to pick up?

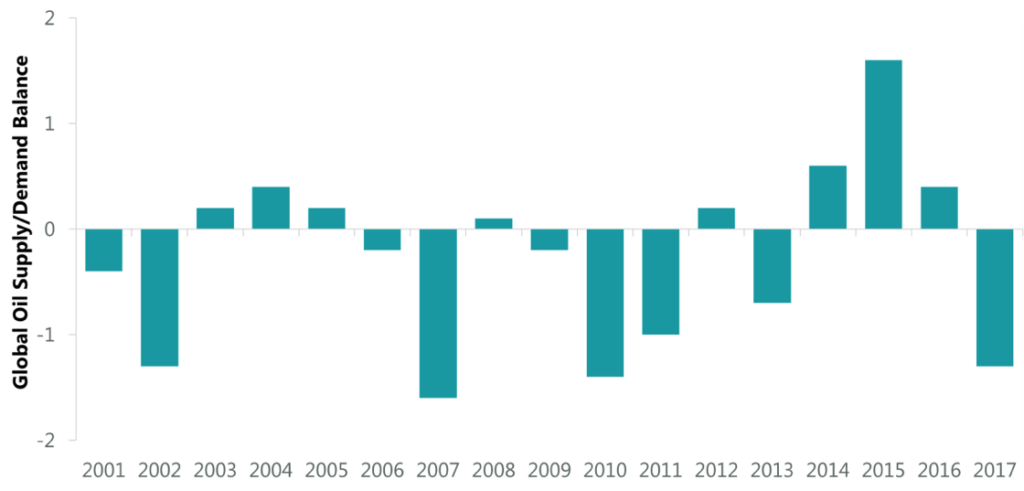

CE: Though MLP cash flows are not driven by the price of oil, we remain constructive on oil prices. Entering 2017, our expectation was that oil demand would begin to exceed available supply, as seen in Exhibit 1. This will likely necessitate inventory drawdowns and stronger oil prices. OPEC’s recent decision to curb output will likely accelerate inventory drawdowns and result in firmer oil prices. Further, we expect U.S. oil drilling activity to increase through 2017, as incremental U.S. oil production will likely be needed to ensure the oil market does not move to an undersupplied position. This increasing U.S. oil and natural gas production will likely drive new growth projects and higher cash flows for MLP companies.

Exhibit 1: Global Oil Supply/Demand Balance (Millions of Barrels per Day)

Source: U.S. Energy Information Administration, ClearBridge Investments.

AA: What potential implications does a Trump presidency have for MLP companies?

CE: A Trump presidency potentially has positive implications for MLP stocks over the next four years:

Delays in permitting new pipeline projects should become less of an issue in the Trump administration compared to the Obama administration. Within days of being inaugurated, President Trump signed executive orders easing the regulatory/permitting burdens on two large pipeline projects: Energy Transfer Partners’ Dakota Access Pipeline and TransCanada’s Keystone XL pipeline. These early executive orders signal an administration seeking to foster development of energy resources in the United States and limit regulatory delays.

Lead times to receive drilling well permits on U.S. federal lands increased during the Obama administration. A Trump presidency should see a more streamlined process for well permits, which could allow for more development of federal lands, leading to increasing production and the need for incremental transportation infrastructure.

Lastly, Trump campaigned on a vision of U.S. energy independence and advocated increased drilling activity as a means to achieve this policy goal. An administration that encourages drilling activity will likely benefit energy MLP companies from the resultant need for transportation infrastructure.

AA: What impacts could rising interest rates have on MLP investments and distributions?

[pullquote]“…a gradual increase in interest rates will not likely be an issue for MLP stocks.”[/pullquote]

CE: There is the risk of rapidly increasing interest rates should Trump follow through with potentially inflationary fiscal spending measures discussed during the election campaign. Faster-than-expected rate hikes could push the dollar even higher and potentially could be a negative for oil prices and the energy sector broadly. However, a gradual increase in interest rates will not likely be an issue for MLP stocks. There have been four periods in the past 10 years where 10-year Treasury yields increased by more than 100 basis points. In all four periods, MLP stocks were up in terms of total return—posting better returns than other income-oriented stocks such as utilities and REITs. It’s also worth noting that the absolute level of interest rates at the peak of those most recent periods of rate increases was much higher than current rates seen in the market. Unlike fixed income securities, MLP stocks seek to increase their income to investors over time, leaving them less likely to trade like bonds or other income-oriented stocks over the interest rate cycle.

AA: Thank you, Chris.