The REIT Newsletter for Advisors • Fall 2018

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the REIT newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the REIT Newsletter includes valuable information about REITs that you cannot get anywhere else.

Nareit is the worldwide representative voice for real estate investment trusts—REITs—and publicly traded real estate companies with an interest in U.S. real estate and capital markets.

Cohen & Steers is a global investment manager specializing in liquid real assets,

including real estate securities, listed infrastructure, commodities and natural resource equities,

as well as preferred securities and other income solutions.

REITs: Answering the Call for

Defined Contribution Plan Diversification

by Cohen & Steers

Real estate has long been utilized by institutional investors for diversification and inflation protection, with allocations currently averaging around 10%. Yet, when it comes to 401(k)s and other self-directed retirement plans, real estate is almost entirely absent.

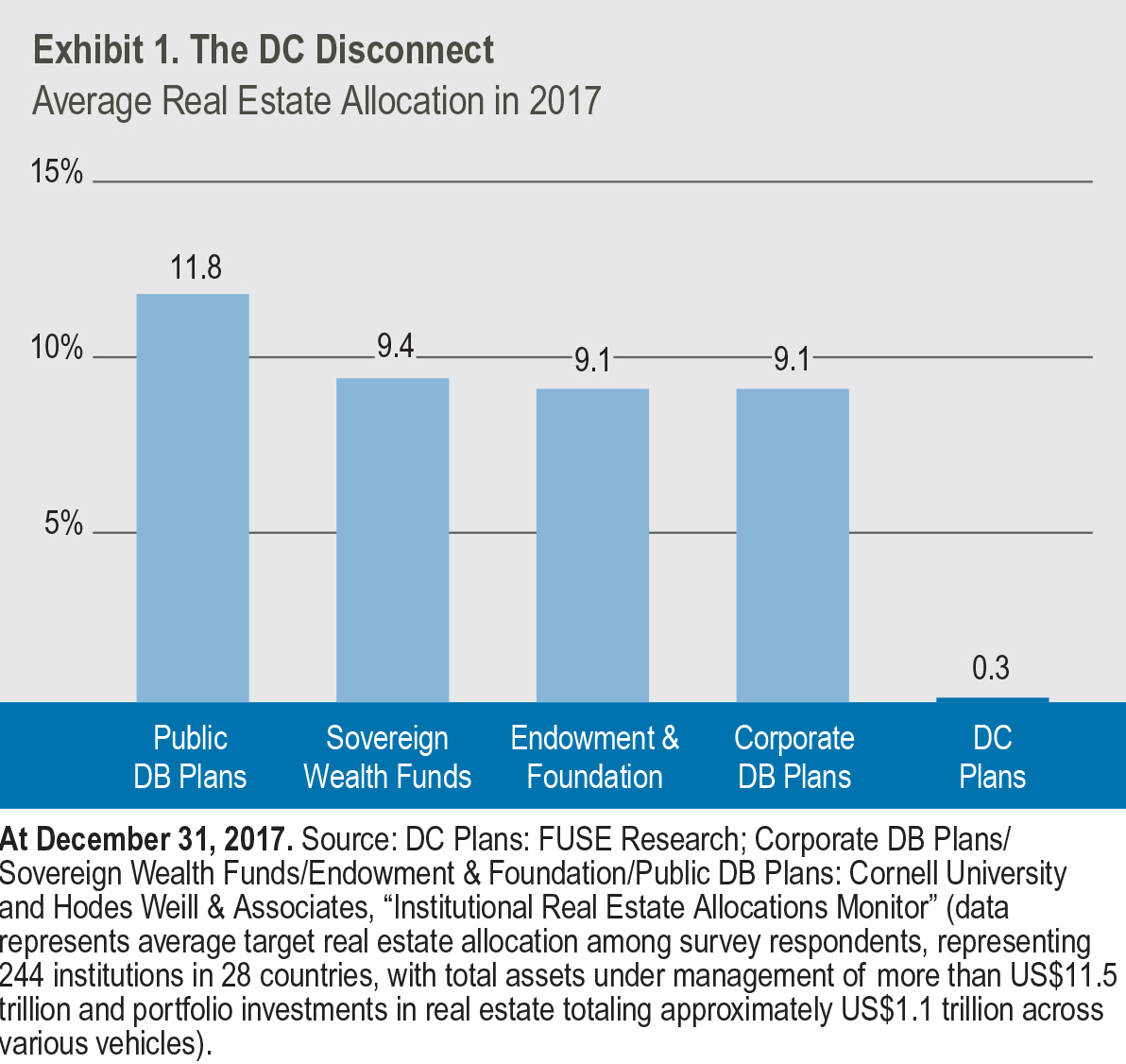

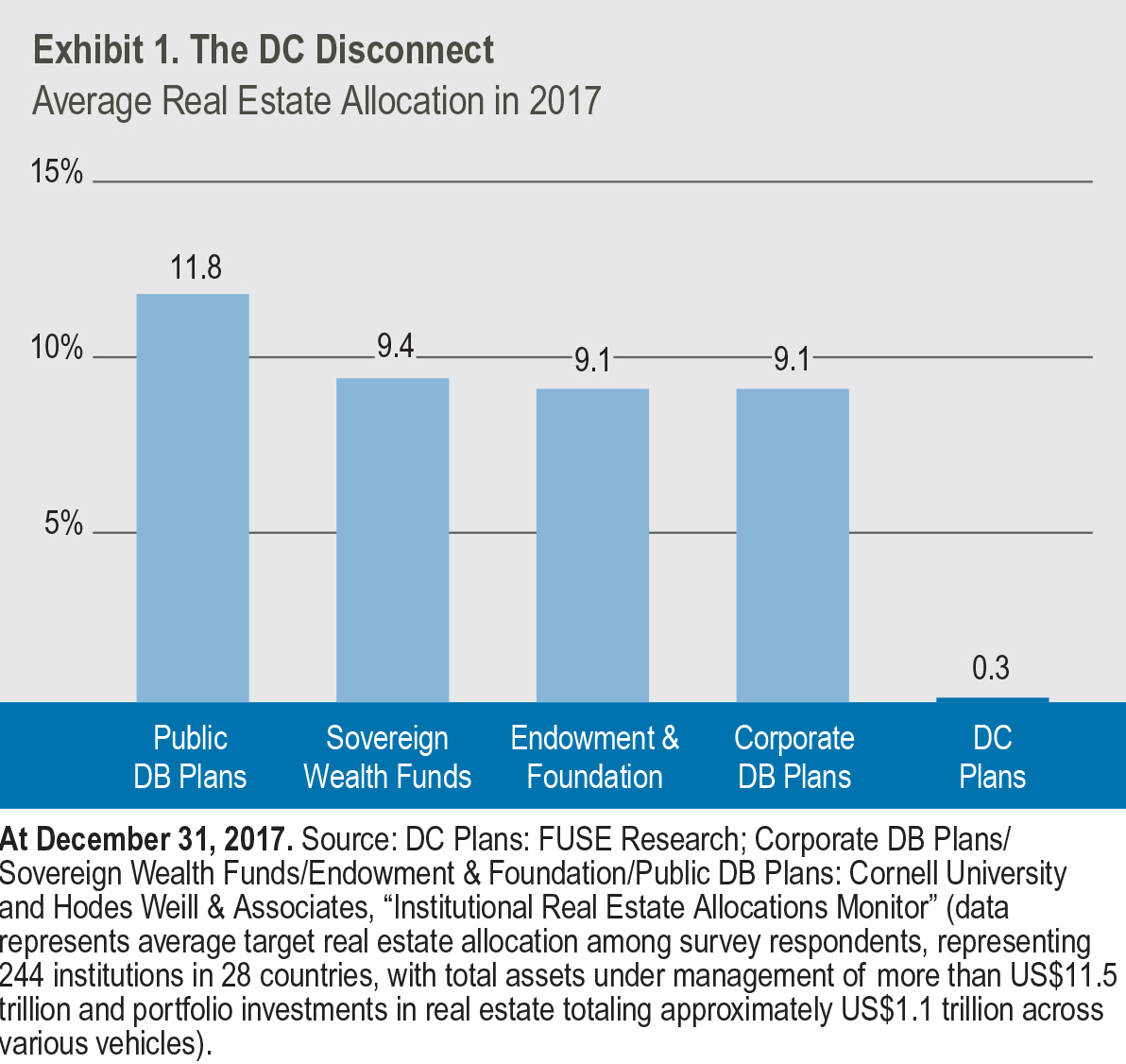

According to the financial data firm Brightscope, only 45% of defined contribution (DC) plans with at least 100 participants offer real estate in their investment menus. Among those that do, allocations have averaged just 2% of plan assets. This is consistent with other data showing that overall real estate allocations across all DC plans are under 1%, well below levels found among institutionally managed defined benefit (DB) plans and other large investors (Exhibit 1).

We believe REITs are well suited as a diversifier in DC plans for several reasons. First, they have a long track record compared to most alternatives, with data going back many decades providing extensive evidence of the historical long-term benefits to investors.

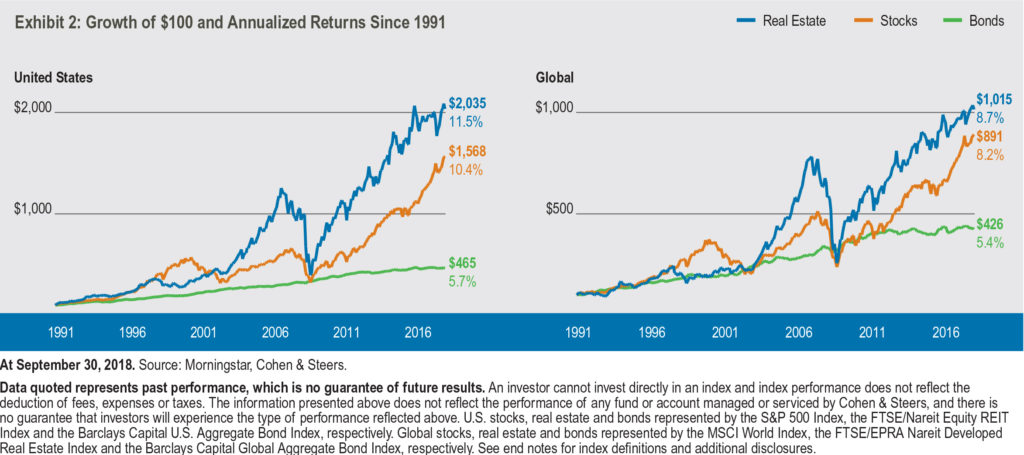

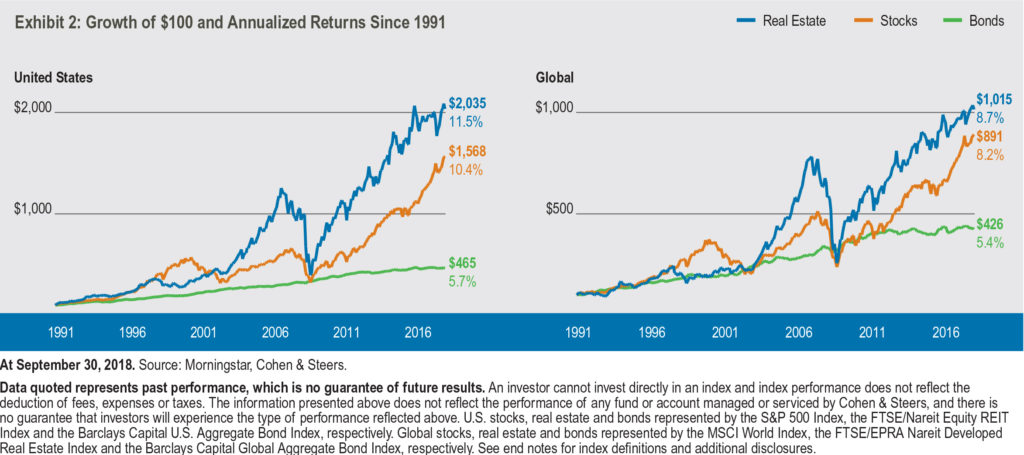

Since the beginning of the modern REIT era in 1991, U.S. REITs have returned 11.5% per year, compared with 10.4% for the S&P 500 and 5.7% for U.S. bonds (Exhibit 2). Compounded over the years, REITs provide a 30% performance advantage over the broad stock market. The story is similar for global indexes, with REITs and other real estate securities outperforming stocks and bonds over the same time period. Whether focused on the U.S. or global markets, real estate has consistently been among the better performing asset classes, demonstrating the potential of real estate to enhance long-term returns.

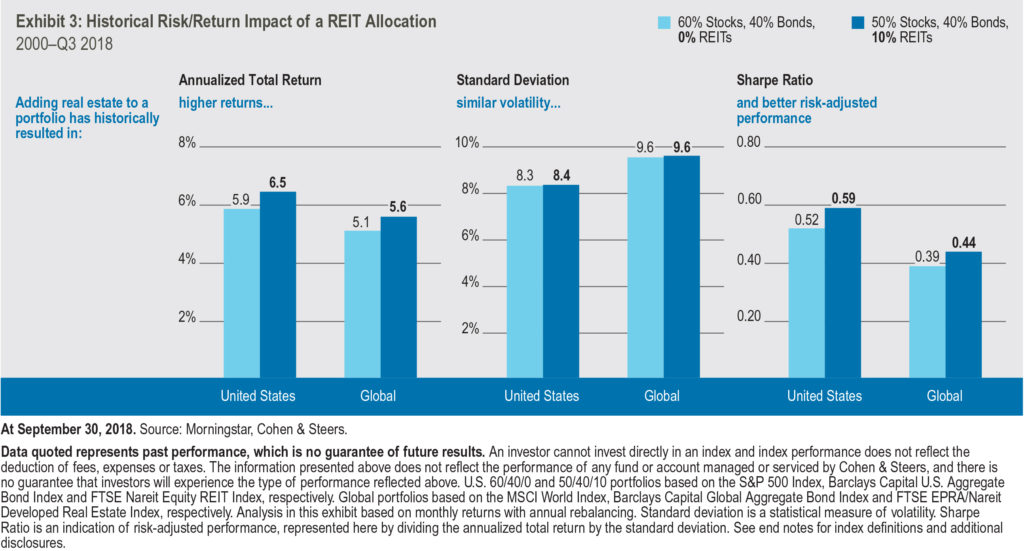

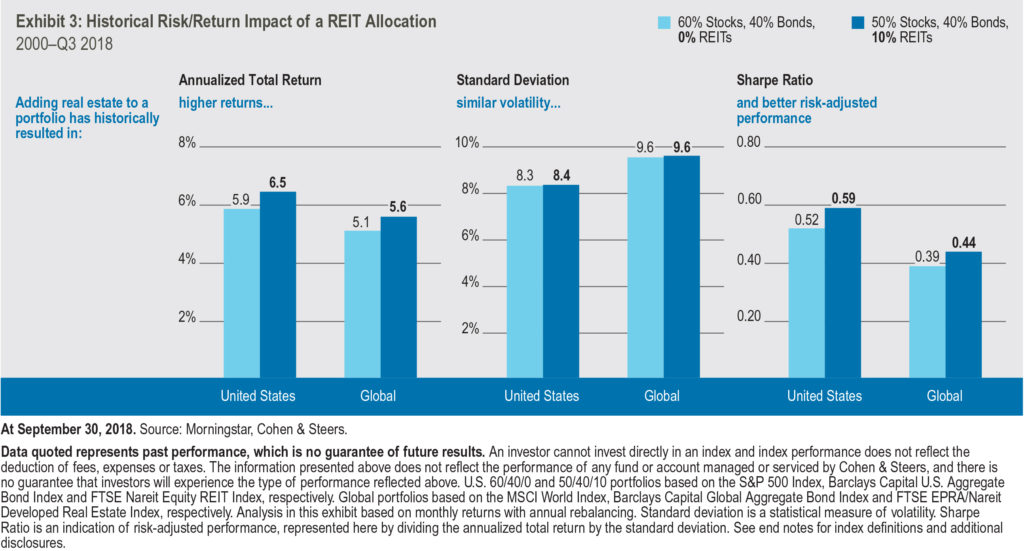

Some investors may feel the benefit of REITs’ strong return potential is offset by increased volatility—but this ignores several key points. REITs typically account for a relatively small portion of an overall portfolio, with allocations typically ranging from 5–10%. REITs tend to perform differently than other stocks, so they can help reduce overall portfolio volatility. Real estate is also a long-term allocation, which should keep short-term volatility in perspective. As shown in Exhibit 3, using data since 2000, shifting 10% of a stock and bond portfolio to REITs has historically led to higher total returns, similar volatility and better risk-adjusted performance.

REITs have also historically offered much needed diversification potential to DC plans, helping enhance portfolio efficiency over full cycles. Further, as an investment in hard assets, REITs have inherent inflation-hedging qualities that can help investors defend against the rising cost of living. REITs are also distinct from many other alternatives in that they trade on public stock exchanges, matching the daily liquidity and pricing needs of most DC plans.

Finally, REITs are relatively straightforward and transparent, increasing the likelihood that participants will utilize real estate in their portfolios. Most people will interact with dozens of REIT properties in their daily lives, making an abstract investment feel more tangible. For financial advisors with the right educational tools, we believe real estate can be a way to engage investors with tangible assets.

In our view, the low prevalence of real estate in DC plans presents an opportunity for the DC industry. The ultimate goal for DC plans is to give participants the best chance of living a full and rewarding life after retirement— and we believe real estate can play a big role in helping them get there.

Index Definitions

All returns and investment characteristics discussed in this report are based on the indexes below. An investor cannot invest directly in an index and index performance does not reflect the deduction of any fees, expenses or taxes.

Global bonds: Barclays Capital Global Aggregate Bond Index provides a broad-based measure of the global investment grade fixed-rate debt markets. Global real estate/REITs: FTSE EPRA Nareit Developed Real Estate Index (net) is an unmanaged market-capitalization-weighted total-return index, which consists of publicly traded equity REITs and listed property companies from developed markets. Global stocks: MSCI World Index (net) is a free-float-adjusted index that measures performance of large- and mid-capitalization companies representing developed market countries. International stocks: MSCI EAFE Index (net) is an equity index which captures large- and mid-capitalization companies in developed market countries excluding the U.S. and Canada. U.S. bonds: Barclays Capital U.S. Aggregate Bond Index is a broad-market measure of the U.S. dollar-denominated investment-grade fixed-rate taxable bond market, and includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and commercial mortgage-backed securities. U.S. REITs: FTSE Nareit Equity REIT Index contains all tax-qualified REITs, except timber and infrastructure REITs, with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property that also meet minimum size and liquidity criteria. U.S. stocks: The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance.

Data quoted represents past performance, which is no guarantee of future results. The information presented above does not reflect the performance of any fund or account managed or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance reflected above. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no way to predict precisely when such a trend will begin. There is no guarantee that any market forecast made in this commentary will be realized. The views and opinions in the preceding commentary are as of the date of publication and are subject to change without notice.

This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, is not intended to predict or depict performance of any investment and does not constitute a recommendation to buy or sell a security or other investment. This material is not being provided in a fiduciary capacity and is not intended to recommend any investment policy or investment strategy or take into account the specific objectives or circumstances of any investor. We consider the information in this presentation to be accurate, but we do not represent that it is complete or should be relied upon as the sole source of suitability for investment. Please consult with your investment, tax or legal advisor regarding your individual circumstances prior to investing.

Please consider the investment objectives, risks, charges and expenses of any Cohen & Steers fund carefully before investing. A summary prospectus or prospectus containing this and other information may be obtained by visiting cohenandsteers.com or by calling 800 330 7348. Please read the summary prospectus or prospectus carefully before investing.

Risks of Investing in Real Estate Securities. The risks of investing in real estate securities are similar to those associated with direct investments in real estate, including falling property values due to increasing vacancies or declining rents resulting from economic, legal, political or technological developments, lack of liquidity, limited diversification and sensitivity to certain economic factors such as interest rate changes and market recessions. Foreign securities involve special risks, including currency fluctuations, lower liquidity, political and economic uncertainties and differences in accounting standards. Some international securities may represent small- and medium-sized companies, which may be more susceptible to price volatility and less liquidity than larger companies. No representation or warranty is made as to the efficacy of any particular strategy of fund or the actual returns that may be achieved.

This commentary must be accompanied by the most recent Cohen & Steers fund factsheet(s) and summary prospectus if used in connection with the sale of mutual fund shares.

Cohen & Steers Capital Management, Inc. (Cohen & Steers) is a registered investment advisory firm that provides investment management services to corporate retirement, public and union retirement plans, endowments, foundations and mutual funds.

Cohen & Steers U.S. registered open-end funds are distributed by Cohen & Steers Securities, LLC, and are available only to U.S. residents.

Cohen & Steers UK Limited is authorized and regulated by the Financial Conduct Authority (FRN 458459).

Cohen & Steers Japan, LLC, is a registered financial instruments operator (investment advisory and agency business with the Financial Services Agency of Japan and the Kanto Local Finance Bureau No. 2857) and is a member of the Japan Investment Advisers Association.