FEATURED COMPANY

NNN REIT, Inc. (NYSE: NNN):

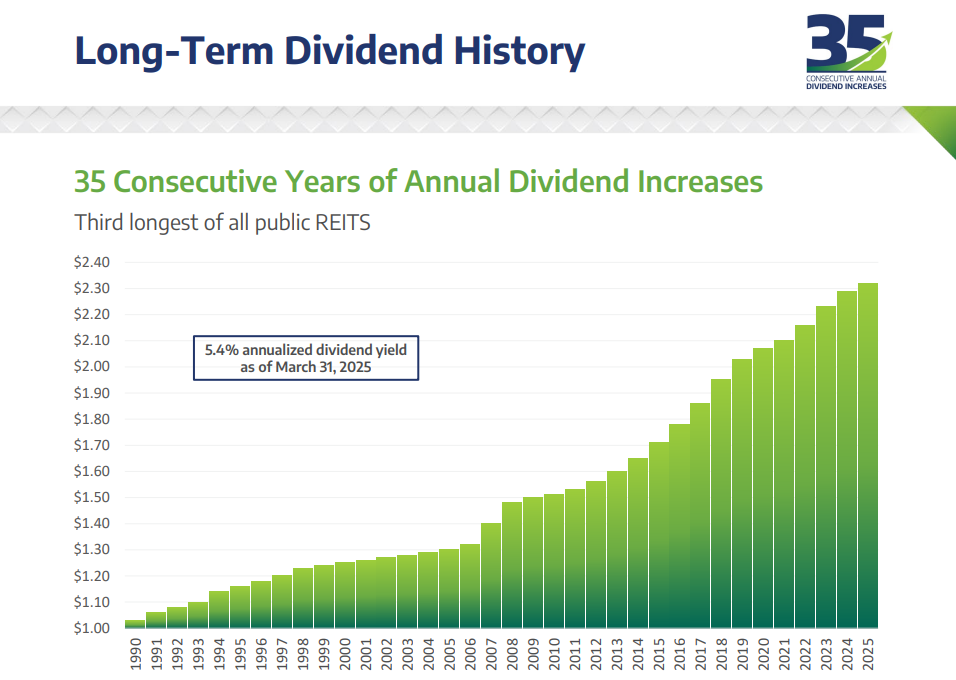

35 Years of Annual Dividend Increases

NNN REIT, Inc. (NYSE: NNN), a real estate investment trust, invests primarily in high-quality retail properties subject to long-term leases. The company owns 3,641 properties in 50 states with a gross leasable area of more than 36 million square feet.

President and CEO Steve Horn talks to Advisor Access about the company’s strategy that has led to 35 successive years of dividend growth.

Click to view the NNN REIT Fact Sheet.

Click to view the NNN REIT Investor Presentation.

Click to view the NNN REIT Annual Report

Advisor Access: For readers unfamiliar with NNN REIT, would you share an overview of the REIT and explain your niche in the sector?

Steve Horn: NNN REIT, Inc. is traded on the New York Stock Exchange under the ticker symbol “NNN.” We own a robust portfolio of 3,641 triple-net-leased properties in 50 states with more than 36 million square feet of gross leasable area and a 25-year average occupancy rate of 98.2 percent. Owning our properties on a triple-net-lease basis puts the property-level operating expenses in the hands of our tenants and allows more of our rental revenue to go straight to our bottom line. Since the 1990s, we have generated consistent stockholder returns supported by strong dividend yields and 35 consecutive annual dividend increases. Our shareholders have enjoyed a 30-year average annual total return of 11.1%. We are known as a disciplined and deliberate team with a consistent, strong track record of sustainable performance.

AA: NNN announced Q1 2025 results on May 1. What are some of the highlights?

SH: Our strong first quarter results and leadership in the triple-net market, combined with our deep tenant relationships and flexible balance sheet, position us to effectively execute our 2025 business plan and deliver continued per-share growth during the current macroeconomic conditions. Our dividend yield at March 31 was 5.4% and we maintained a dividend payout ratio of 66% of AFFO [adjusted funds from operations]. We invested $232.4 million in 82 properties at a 7.4% initial cash cap rate with a weighted average remaining lease term of 18 years. We also continued to actively manage our portfolio, including selling 10 properties for $15.8 million, producing $3.8 million of gains on sales at a cap rate of 4.9%. We ended the quarter with $1.08 billion of availability on our bank credit line allowing us to take advantage of opportunities as they arise.

AA: NNN has had 35 consecutive years of annual dividend increases, the third longest track record of all REITs. To what do you attribute this remarkable run?

SH: As I said on our recent earnings call, our focus is on Core FFO [funds from operations] per share growth year-over-year, which allows us to reasonably grow the dividend while keeping our payout ratio low. Having a low payout ratio means that we maintain a cushion keeping our dividend safe. When an unexpected disruption impacts the markets, we stay well-positioned to maintain, and hopefully increase, our annual dividend. Avoiding the distraction of getting caught up in an acquisition volume race has allowed us to stay true to our annual dividend increase policy.

AA: Would you explain how your retail net lease strategy generates a reliable income stream, higher occupancy and less volatility?

SH: As mentioned earlier, owning our properties on a triple-net-lease basis puts the property-level operating expenses in the hands of our tenants and allows more of our incoming rental revenue to go straight to our bottom line. Having some level of turnover is typical and allows landlords to refresh/recycle the portfolio. It is not uncommon for tenants to merge, be acquired or move locations in any given year regardless of macroeconomic conditions. Because of our long-term relationships—and ongoing communication—with operators, we have a good sense of whether or not they plan to renew as the lease is approaching its maturity. In cases where we suspect the tenant may not renew, we have plans in place to seek alternative users of the space. Overall, our 25-year average occupancy of 98.2% shows that we’ve done a good job of finding strong locations that are attractive to our current tenants and to alternative users when our tenants decide to leave a location.

AA: In a higher interest rate environment and economic uncertainty, are you making any adjustments?

SH: Our company is now 41 years old so we know how to operate successfully in all types of interest rate or economic environments. Staying true to our long-term, multi-year strategy is the key. We keep a strong, flexible balance sheet, preserve solid relationships with large regional or national operators and continue to be disciplined capital allocators, prioritizing quality over quantity, all while maintaining a light capital market footprint. This allows us to stay the course despite market noise.

AA: Is there anything else you would like our readers to know?

SH: We executed another seamless senior executive succession when our longtime CFO, Kevin Habicht, retired after 32 years and was replaced by Vin Chao, who joins us with a deep and broad background that complements the rest of our senior management team. I am excited about the future of NNN and am pleased to add Vin as another high-quality, versatile team member to help us guide the company as we move forward. I take pride in our company’s ability to have processes in place that allow continued high-level results while simultaneously updating both our portfolio and the makeup of our team.

AA: Thank you for your insights, Steve.

Steve Horn joined NNN in 2003 and has served as President and CEO since April 2022. Previously, Steve served as Executive Vice President and COO following a stint as Chief Acquisition Officer overseeing the acquisition of approximately $5.1 billion of new investment properties. He joined NNN in 2003. He is a member of ICSC and currently serves on the Advisory Board of Governors for Nareit.

Disclosures

Investors and others should note that NNN REIT, Inc. posts important financial information, including non-GAAP reconciliations, using the investor relations section of the NNN REIT website, www.nnnreit.com, and Securities and Exchange Commission filings.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements that can be identified by the use of words such as “expect,” “intend,” “potential.” Forward-looking statements are predictions based on current expectations and assumptions regarding future events and are not guarantees or assurances of any outcomes, results, performance or achievements. You are cautioned not to place undue reliance upon these statements. These forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. NNN REIT’s actual results may vary materially from those discussed in the forward-looking statements as a result of factors and uncertainties disclosed in NNN REIT’s reports filed with the Securities and Exchange Commission, which should be reviewed together with these forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. NNN REIT has paid Advisor Access a fee to distribute this email. NNN REIT had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.