The REIT Newsletter for Advisors • Summer 2017

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the REIT newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the REIT Newsletter includes valuable information about REITs that you cannot get anywhere else.

The National Association of Real Estate Investment Trusts (NAREIT®) is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets.

The Summer 2017 issue features an article by Brad Case, PhD, CFA, CAIA, senior vice president of research and industry information for NAREIT.

Your Home Is Not a Retirement Plan

by Brad Case, PhD, CFA, CAIA

by Brad Case, PhD, CFA, CAIA

Most investment advisors understand that a diversified portfolio must include meaningful exposure to each of the four fundamental asset classes: cash for liquidity, equities, bonds, and real estate. Each has diversification benefits. But have you and your clients had a conversation about how to structure the real estate component of their investment portfolio?

Too many investors still think their home fits the bill. It doesn’t (nor does a vacation property). If their home constitutes their only holding of this critical asset class, then you may need to help them understand how to add the investment returns of real estate for long-term wealth building, and for the protection of portfolio diversification.

What distinguishes the three fundamental asset classes other than cash—equities, bonds, and real estate—is that their investment returns are driven by fundamentally different market cycles:

- Returns in the equity asset class—meaning most exchange-traded stocks, along with non-traded (private) equity—respond to the business cycle, which is also called the stock-market cycle or the inventory cycle. Returns increase when macroeconomic demand conditions improve during expansions, and decline when demand softens during recessions. The duration of the business cycle varies quite a bit, but averages something like four to eight years.

- Returns in the fixed-income asset class—that is, bonds—respond to the interest rate cycle: returns increase when interest rates decline, and decline when interest rates increase. Of course, interest rates are related to macroeconomic conditions too, so the duration of the interest rate cycle is roughly similar to the duration of the business cycle.

- Returns in the real estate asset class respond to the real estate market cycle, which is very different from the business cycle or the interest rate cycle, with an average duration (first observed in 1933 by the great real estate market researcher Homer Hoyt) of about 18 years. The last complete real estate cycle lasted 17½ years, from Q3 1989 to Q1 2007, and the one before that lasted 17 years, from Q3 1972 to Q3 1989. We’re now just 10½ years into the current cycle.

Why is the real estate cycle so much longer than the business cycle or the interest rate cycle? The reason is supply responsiveness. Constructing even a relatively small building takes around four years—much of it required for permitting before construction even begins—whereas production for most goods and services can be adjusted in a matter of weeks (or months for big-ticket items). That enormous difference in supply responsiveness means that real estate returns are driven not primarily by macroeconomic demand conditions—that is, what drives the business cycle—but rather by real estate supply conditions.

So what’s wrong with your clients thinking about a home as a real estate holding? Simply this: Your home has value, but it’s not an investment asset.

From their bond portfolios, your clients receive a steady stream of income; they can sell bonds quickly for cash; they can increase or decrease allocations to rebalance or take advantage of market movements; and with an ETF or mutual fund they can get low-cost diversification from thousands of individual bonds. From their stock portfolios, your clients will receive long-term appreciation; they can sell stocks quickly for cash; they can increase or decrease allocations to rebalance or take advantage of market movements; and with an ETF or mutual fund they can get low-cost diversification from thousands of individual equities.

None of that is true of their home. From their home they will receive neither a steady stream of income (except what economists call the “imputed income” of actually living in it) nor significant long-term capital appreciation (Nobel prize-winning economist Robert Shiller estimates that real house price appreciation has averaged just 0.4% per year for the past 125 years). They will not be able to sell their home quickly for cash—instead they will lose about 6% in commissions and wait months for a sale to close. They will not be able to rebalance their real estate exposure: What do they propose to do? Sell half their daughter’s bedroom? (And if their solution is to cash-out by borrowing against it, remind them of the damage that millions of households suffered just a decade ago by using their houses as an ATM.)

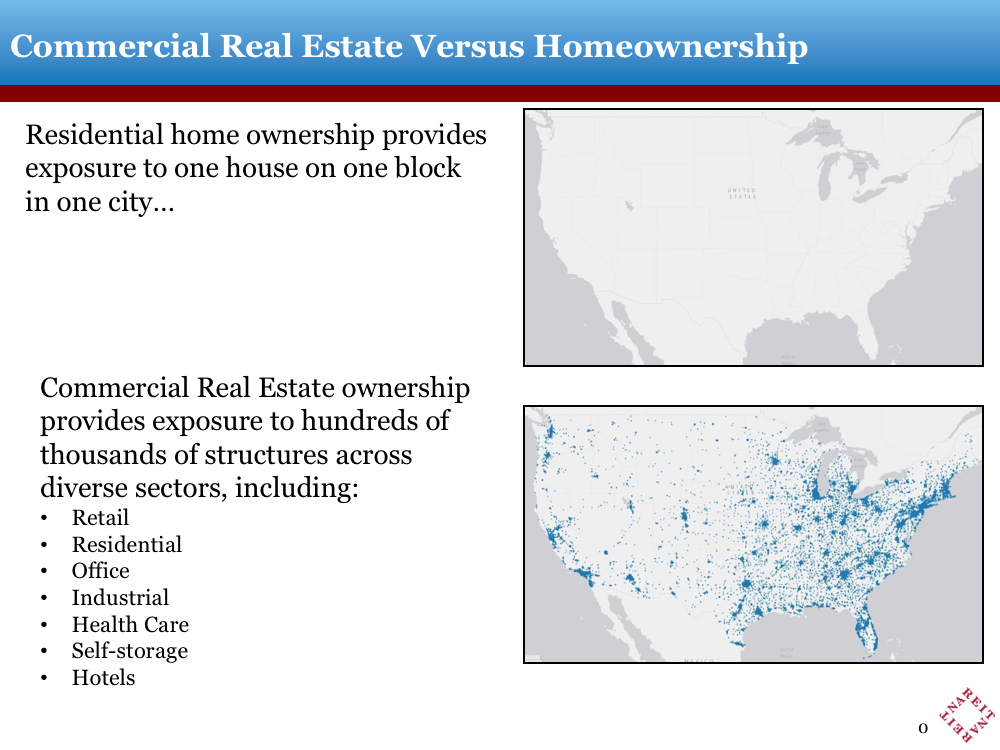

Perhaps worst of all, no matter how great their house’s “curb appeal,” their exposure provides no diversification benefits because it is still limited to just one residential structure . . . on one block . . . of one street . . . in one neighborhood . . . in one town or city . . . in one state . . . in one region of our country. Help your clients stick to the simple rule: Choose your house because that’s where you want to live. Don’t use your home for any other purpose.

Instead, your clients should get the diversification benefits of real estate investment by holding stock in equity REITs (real estate investment trusts). Equity REITs are professionally managed portfolios of properties whose returns are driven by the real estate market cycle, providing the all-important asset class diversification of one of the four fundamental asset classes.

Stock exchange-listed equity REITs have provided strong, steady current income and strong, long-term capital appreciation, with total returns averaging 11.2% over the past 25 years (compared to just 9.6% for the S&P 500), divided almost equally between the two forms of wealth creation. Going back as far as data allow, total returns from exchange-traded equity REITs have averaged 11.9% per year since the beginning of 1972, compared to just 10.5% for the S&P 500.

Some $7 billion of listed REIT holdings change hands each day, so your clients can convert even a house-sized holding into cash on a moment’s notice at a minimal transaction cost. And, of course, they can always rebalance their exposure or adjust holdings to take advantage of current market conditions—including today’s larger-than-normal dividend yield spreads, historically a sign of stronger-than-usual returns going forward.

Best of all, even a single listed REIT typically owns dozens, if not hundreds, of individual properties. With an ETF or mutual fund, your clients get exposure to a portfolio of more than 50,000 professionally managed assets, of every property type, located in literally every city of every state in every region of the country, with significant exposure to real estate markets outside the U.S. as well—and that doesn’t even count some 94,000 single-family rental homes, 79,000 cell phone transmission towers, and timber acreage across the nation.

Many Americans who thought that owning a house would bring them financial security found financial ruin instead. In contrast, real estate investment through listed REITs has proven to be an important and successful part of the portfolios of millions of Americans, with competitive long-term price appreciation, steady income, easy conversion to cash, and easy reallocations for tactical or rebalancing moves.

Best of all, listed REITs have given investors the benefits of diversification into the real estate asset class and the real estate market cycle, dampening the portfolio swings that they would have felt from exposure only to the shorter business cycles and interest rate cycles. REITs have proven their worth as the investment form of real estate.

Brad Case, PhD, CFA, CAIA, is senior vice president of research and industry information for the National Association of Real Estate Investment Trusts (NAREIT). Dr. Case has researched residential and commercial real estate markets, domestically and globally, for more than 25 years. His research encompasses investment return characteristics including returns, volatilities, and correlations with other assets; measuring appreciation in property values; inflation protection; use of DCC-GARCH and Markov regime switching models to measure and predict investment characteristics; the length of the real estate market cycle; and the role of the investment horizon. He has a particular interest in the relationship between listed and unlisted real estate markets. He holds patents as the coinventor of the FTSE NAREIT PureProperty® index methodology and the backward-forward trading contract. Dr. Case holds degrees from Williams College and the University of California at Berkeley, and earned his PhD in Economics at Yale University, where he worked with Robert Shiller and William Goetzmann.