The REIT Newsletter for Advisors • Summer 2019

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the REIT newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the REIT Newsletter includes valuable information about REITs that you cannot get anywhere else.

Nareit is the worldwide representative voice for real estate investment trusts—REITs—and publicly traded real estate companies with an interest in U.S. real estate and capital markets.

The Case for Global Real Estate

by Rick Romano, CFA, Global Head and Chief Investment Officer, Global Real Estate Securities, PGIM Real Estate

by Rick Romano, CFA, Global Head and Chief Investment Officer, Global Real Estate Securities, PGIM Real Estate

At PGIM Real Estate, we see two main drivers for the global real estate market for the remainder of 2019 and beyond.

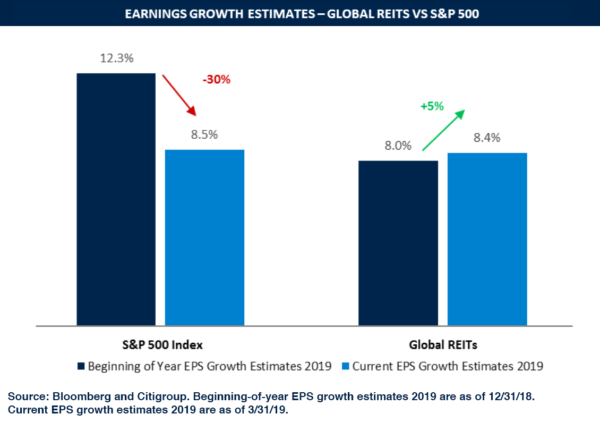

The first major driver is the positive current market backdrop. Valuations are supported by rising earnings growth expectations, with rent growth driven by strong supply/demand fundamentals. In fact, the earnings growth of global REITs has been revised higher by 5% since the beginning of 2019; this is a sharp contrast to the broader S&P 500, which has witnessed a 30% drop in growth expectations.

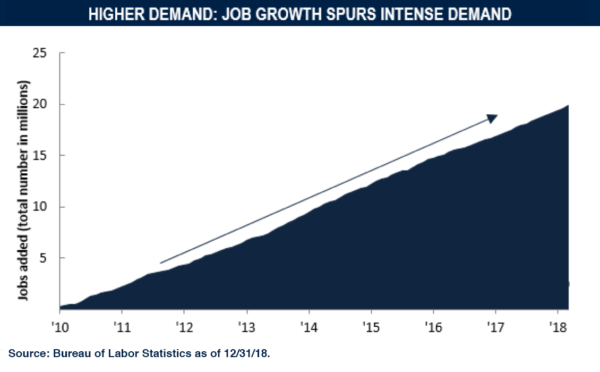

New supply is below the long-term historical average as a result of increased commodity costs during the 2000s and the credit crisis, which crimped funding for developers. Despite growing fears about a slowdown in economic growth, demand growth remains steady. The aggregate commercial real estate occupancy level is approximately 95%—a near record and also above the fifteen-year historical average of 93.6%.

The current environment also presents opportunities for both privatizations and public real estate consolidation, with many REITs currently trading at discounts to private value. Currently, $326 billion in private real estate funds needs to be deployed. This dry powder can be used either to buy private real estate assets or privatize public real estate securities. Both are supportive of real estate valuations.

In terms of merger and acquisition (M&A), 2018 was a record-setting year. With many REITs currently trading at discounts to private value, REITs trading at a stronger capitalization are able to take advantage of this trend by acquiring undervalued property, which provides an immediate earnings boost.

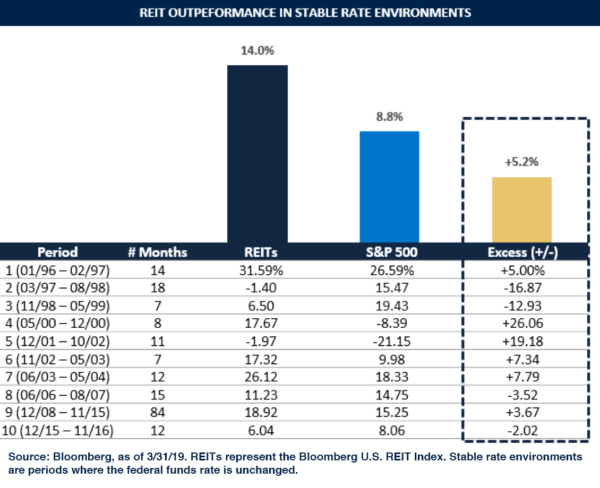

An environment of low growth and stable rates, which is what we have today, has also historically proven positive for REITs. During stable federal funds rate periods, REITs on average returned 13.2%, while the S&P 500 returned 9.8%.

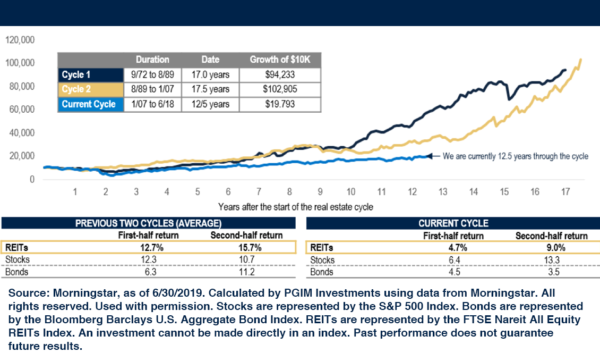

In addition, real estate has delivered solid performance since the current market rally began in March 2009, but it still may be relatively early in the real estate growth cycle. Since 1930, according to Nareit, commercial real estate cycles have lasted approximately eighteen years from peak to peak. The current cycle appears to be following the same pattern as the last two cycles: stabilization followed by strong growth.

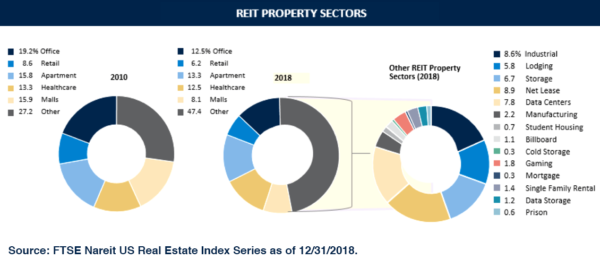

While the market backdrop remains encouraging, the second major driver for the global real estate market moving forward is active management. Historically, the dominant property sectors offering the largest scale and investment opportunity included retail centers, apartments buildings, malls, office buildings, and healthcare. This made up more than 70% of the market in 2010.

Since 2010, the number of REIT stocks across the globe has increased by 17%, from 282 to 338. In the United States alone, the number of US REIT stocks has increased 42%, from 115 to 163, and the number of sectors in the US increased 75%, from 12 to 21. As the real estate sector changes and grows, active managers who are able see growth opportunities and get ahead of the curve can add alpha for investors.

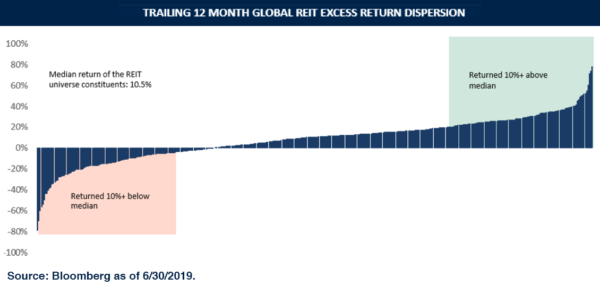

However, not all REITs are created equal, with historical returns revealing a very wide dispersion of returns among global REITs. A little more than 57% of the REIT universe, 238 out of 415 REITs, returned +/-10% from the universe median over the trailing twelve months (ending June 30, 2019). We believe this dispersion creates the need for strong, active managers with specialized insight into the real estate market.