The Energy Infrastructure Newsletter • Spring 2023

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

The Case for Energy Infrastructure

Advisor Access spoke with Jim Baker, Managing Partner,

Kayne Anderson Capital Advisors, L.P.

Advisor Access: It has been a very eventful few years for the energy sector, hasn’t it? How would you summarize what has occurred?

Jim Baker: Yes, “eventful” is a very succinct way to describe what has transpired. The last three years brought about an unprecedented series of events for the global economy and, in turn, the energy sector. Clearly the pandemic had a huge impact, but that is only part of the story—a growing push for decarbonization (often referred to as “the energy transition”) and the need for reliable and affordable sources of energy (often referred to as “energy security”) have also had a profound influence on the energy markets. The war in Ukraine and the resulting energy crisis in Europe have ensured that events in the energy industry are frequently front page news in the financial press.

This is an obvious statement but worth mentioning nonetheless—the energy industry is a vital component of the global economy. When things are functioning as expected, energy is not something many people spend much time thinking about—it is often taken for granted that energy will be readily available and affordable. When things are not functioning as expected, the ripple effects are huge and people’s day-to-day lives are meaningfully impacted on a real-time basis. That’s when people start to pay attention to the sector. There is little doubt that the energy sector is in the midst of a multi-decade transition, and change is the only constant we can expect for the foreseeable future. This will create challenges but will also create opportunities.

Often overlooked in this conversation, however, are discussions about (1) the progress the energy sector has made over the last few years repairing balance sheets, enhancing corporate governance, and implementing shareholder friendly policies, (2) the expected tight global supply/demand balance for energy-related commodities once economies fully recover from the COVID pandemic, and (3) the important role energy investments can play in investors’ portfolios.

AA: Kayne Anderson specializes in the energy infrastructure industry, correct? Why are you attracted to this asset class and why should investors want exposure to energy infrastructure in their portfolios?

JB: Yes, we have specialized in energy infrastructure investments for over two decades at Kayne Anderson. We view the sector as an extremely attractive, long-term investment opportunity. In particular, we are bullish on North American energy infrastructure companies. Why do we feel this way? North America—principally because of its shale reserves—is increasingly a critical supplier of hydrocarbons to the rest of the world. Stated more bluntly: the United States plays a vital role in ensuring our allies have access to affordable and reliable supplies of hydrocarbons (for example, LNG [liquefied natural gas] exports to Europe). The energy infrastructure sector’s vast network of assets is the critical link in connecting this supply with domestic and international markets. The story is similar when you consider the energy transition. Energy infrastructure companies are already very active helping facilitate the transition to lower carbon and renewable fuels. This will be the case for the next couple of decades and, in our opinion, is a growth opportunity the market is not ascribing much value to.

JB: Yes, we have specialized in energy infrastructure investments for over two decades at Kayne Anderson. We view the sector as an extremely attractive, long-term investment opportunity. In particular, we are bullish on North American energy infrastructure companies. Why do we feel this way? North America—principally because of its shale reserves—is increasingly a critical supplier of hydrocarbons to the rest of the world. Stated more bluntly: the United States plays a vital role in ensuring our allies have access to affordable and reliable supplies of hydrocarbons (for example, LNG [liquefied natural gas] exports to Europe). The energy infrastructure sector’s vast network of assets is the critical link in connecting this supply with domestic and international markets. The story is similar when you consider the energy transition. Energy infrastructure companies are already very active helping facilitate the transition to lower carbon and renewable fuels. This will be the case for the next couple of decades and, in our opinion, is a growth opportunity the market is not ascribing much value to.

The large, high-quality energy infrastructure companies that develop and operate these “mission critical” assets provide investors exposure to many of the same themes driving the broad energy sector with lower volatility, higher dividend yields, and less direct commodity price exposure. This is not to suggest other sectors within the energy industry are bad investments—quite the contrary, we are bullish on most energy subsectors right now. But in our opinion, energy infrastructure is a lower risk way to get exposure to the energy sector’s positive macro themes.

Building on that last comment, let’s dig a little deeper and focus on the attributes of these companies. These are businesses that operate assets with high barriers to entry and have long-term contracts underpinning their operations. The net result is businesses with strong “competitive moats,” stable cash flows, and significant levels of free cash flow. That is a pretty nice combination, in our opinion.

AA: How does the uncertain economic backdrop impact your view of the financial prospects for the energy infrastructure sector?

JB: While we pride ourselves on being patient investors focused on long-term returns, the market backdrop at any particular time (either positive or negative) will impact our outlook as well as our risk tolerance. To state the obvious—the economic outlook is uncertain and financial markets are very unsettled. Quite a bit is unfolding on a real-time basis; right now feels like a time to be risk averse. All that said, the business fundamentals driving our long-term return expectations for the energy infrastructure sector are not overly influenced by many of these near-term headwinds. Cash flow for energy infrastructure companies is resilient—look no further to their operating and financial performance during the pandemic as a good example of this point. As mentioned above, a large portion of these companies’ revenues are generated from long-term contracts that are often linked to inflation. Further, these companies have strong balance sheets, ample liquidity, and are generating meaningful levels of free cash flow. Finally, these companies pay attractive quarterly dividends to investors. No sector (or company) can be completely insulated from fluctuations in the economy or volatility in the financial markets, but the attributes of the energy infrastructure sector give us confidence the industry is well positioned to “weather the storm” better than most sectors.

AA: How do you reconcile the contrasting trends of decarbonization and energy security?

JB: In our opinion, the quest for energy security does not conflict with the energy transition. We believe that responsibly produced, low-carbon intensity hydrocarbons will be part of the global mix for decades to come, complementing growing renewable energy sources and providing raw materials necessary to manufacture consumer and medical products that are fundamental to daily life in modern society. We believe energy security and energy transition are multi-decade mega trends for the energy infrastructure industry and we have positioned our portfolios to capitalize on these trends.

AA: Despite two strong years of stock price performance, midstream company valuations generally remain below pre-COVID levels. What is the market missing?

JB: There is no doubt that midstream companies remain in the “penalty box” in the minds of many investors following poor stock price performance in 2020 as well as weak performance for most of the 2015 to 2019 timeframe. We get it, but it is time to “turn the page” on this narrative. There has been a seismic shift in the way energy infrastructure companies are managing their businesses. Midstream—in its themes, corporate structure, and even its jargon—is fundamentally different today than even five years ago. Balance sheets are very strong, companies are financially disciplined, and the sector is generating record amounts of free cash flow.

Midstream companies are collectively expected to generate >$40 billion of free cash flow in 2023, supporting equity values via increasing dividends and share buybacks. Free cash flow is expected to continue to grow for the foreseeable future. We do not believe the market is giving the sector full credit for this yet and it is one of the primary reasons we are so bullish on the outlook for midstream stocks.

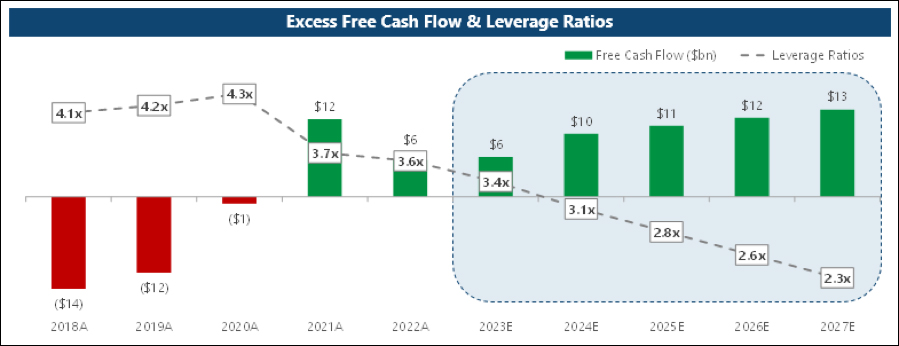

As illustrated in the chart below, midstream companies will quickly achieve “floor” leverage levels (if they haven’t already done so). When this happens, we think companies are much more likely to use their “excess” free cash flow to increase quarterly dividends or for stock buyback programs. While new projects and opportunistic mergers and acquisitions will certainly be part of the mix for certain companies, we believe the midstream sector will remain disciplined in these areas.

Midstream Sector Generating Meaningful “Excess Free Cash Flow”

Source: Kayne Anderson estimates. Note: Companies include EPD, ET, KMI, MMP, MPLX, OKE, TRGP, WES and WMB. “Excess free cash flow” reflects free cash flow after the payment of dividends to shareholders. For the purposes of the leverage metrics in the projected periods (i.e., 2023 and beyond), all excess free cash flow is being used for debt paydown.

The aggregate equity market capitalization for the nine midstream companies in this graphic is ~$275 billion. Excess free cash flow will quickly approach 4–5% of that market cap on an annual basis—that is a very powerful metric in our opinion.

AA: Any closing thoughts for our readers?

JB: We appreciate their time and appreciate their willingness to consider an investment in the energy infrastructure sector. We have a variety of different investment products to satisfy an investor’s specific needs. We would welcome the opportunity to answer any questions, delve into these topics in more detail and discuss the ways we can help satisfy their needs. Please feel free to contact us at cef@kaynecapital.com or (877) 657-3863.