FEATURED COMPANY

Enterprise Products Partners

Enterprise Products Partners L.P.: 26 Consecutive Years of Distribution Growth

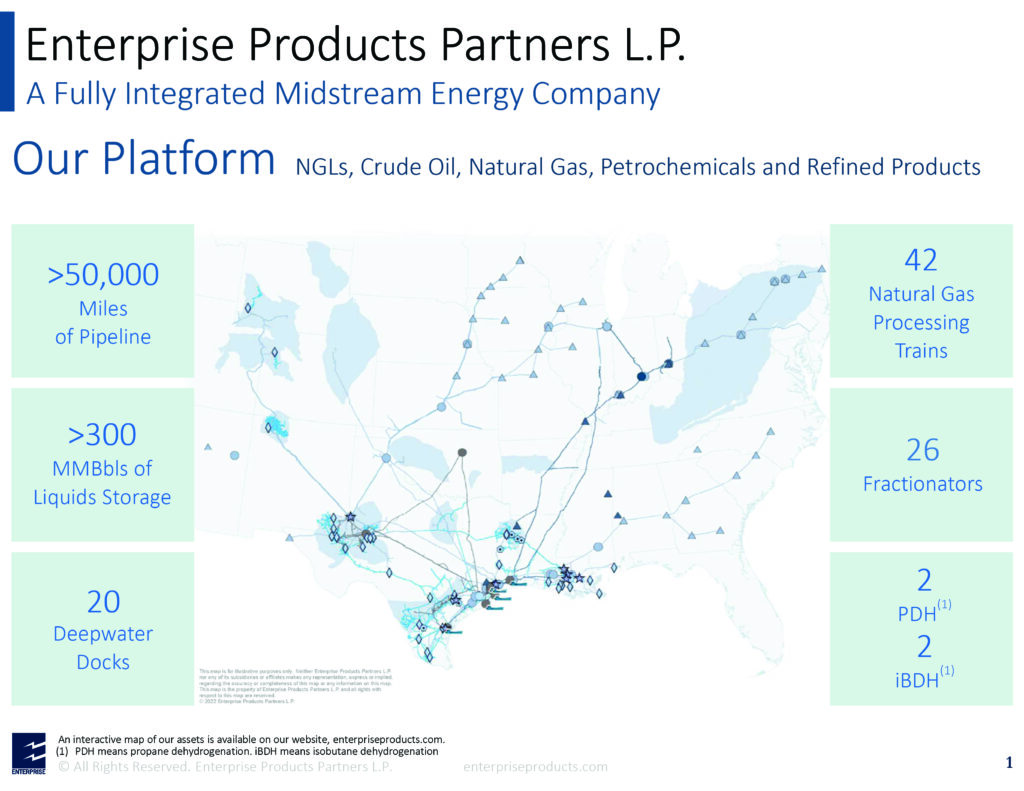

Enterprise Products Partners L.P. (NYSE: EPD) is one of the largest publicly traded partnerships and a leading North American provider of midstream energy services to producers and consumers of natural gas, natural gas liquids, crude oil, refined products and petrochemicals. It has featured 26 years of consecutive distribution increases, every year since its IPO in 1998. For more information, visit www.enterpriseproducts.com.

Click HERE to view the Enterprise Products Partners Investor Presentation.

Advisor Access spoke with Jim Teague, Enterprise Products Partners’ co-CEO, about the company’s business environment and outlook, the challenges of the last decade, plans for future growth and the company’s financial strength.

Advisor Access: Would you introduce Enterprise Products Partners to our readers?

Jim Teague: Enterprise Products Partners L.P. (NYSE: EPD) is one of the largest publicly traded partnerships and a leading provider of midstream energy infrastructure services. Our roots date back to 1968 when Dan Duncan and two partners formed Enterprise Products Company, a wholesale marketer of natural gas liquids. Since our IPO in 1998, Enterprise has delivered over two decades of strategic growth, responsible operations, and attractive returns to unitholders.

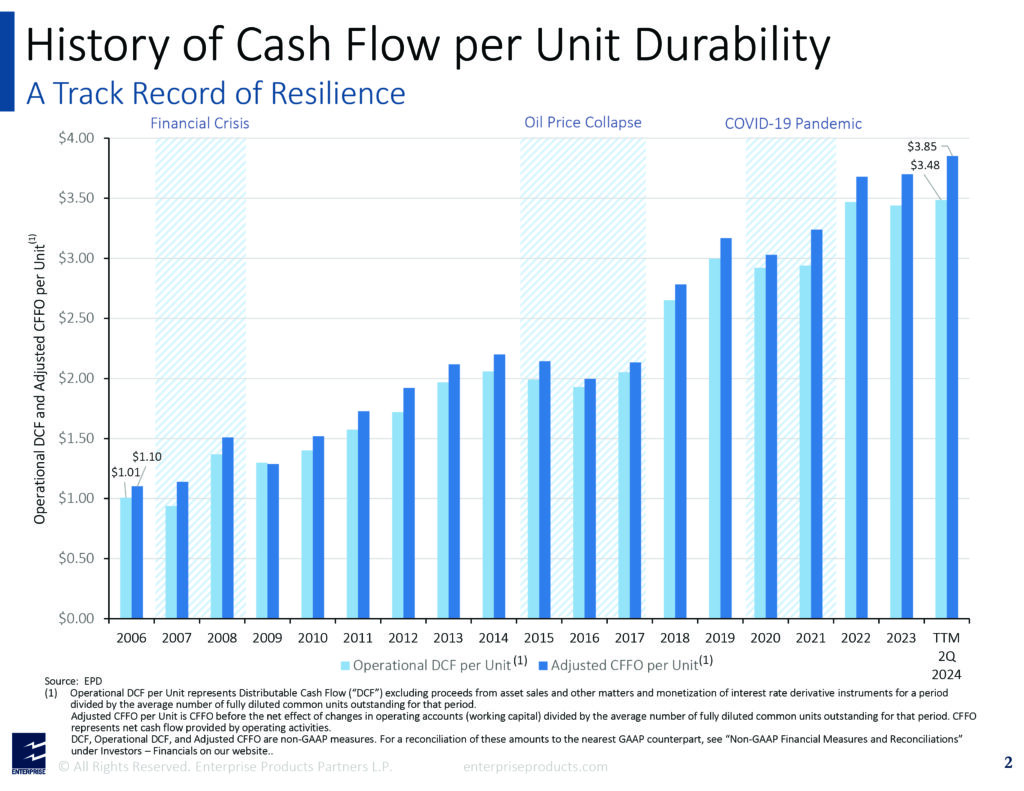

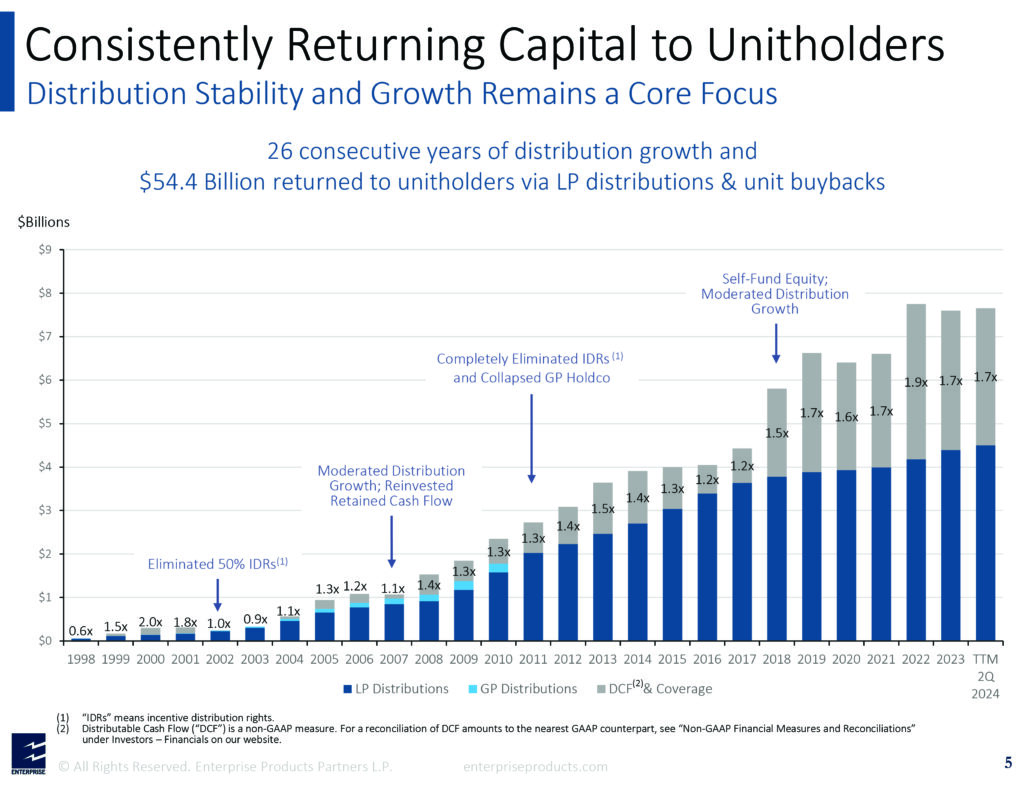

With an A-rated balance sheet, 26 consecutive years of distribution growth, and over 7% yield, Enterprise stands apart as a consistent and compelling investment throughout economic and business cycles.

AA: What are midstream energy services and how do characterize your business model?

JT: We operate energy infrastructure – pipelines, terminals, and processing assets – that provide critical, must-run energy services. We handle natural gas, natural gas liquids (NGLs), crude oil, refined products and primary petrochemicals – collecting fees for services at multiple touchpoints along our fully integrated value chain. Our predominantly fee-based business model provides a high-degree of stability in cash flows, while our integration supports a track record of resilience across energy and broader market cycles.

In terms of scale, in the second quarter of 2024, we reported 12.6 million barrels per day (bpd) of equivalent pipeline transportation volumes and 2.2 million bpd of marine terminal volumes.

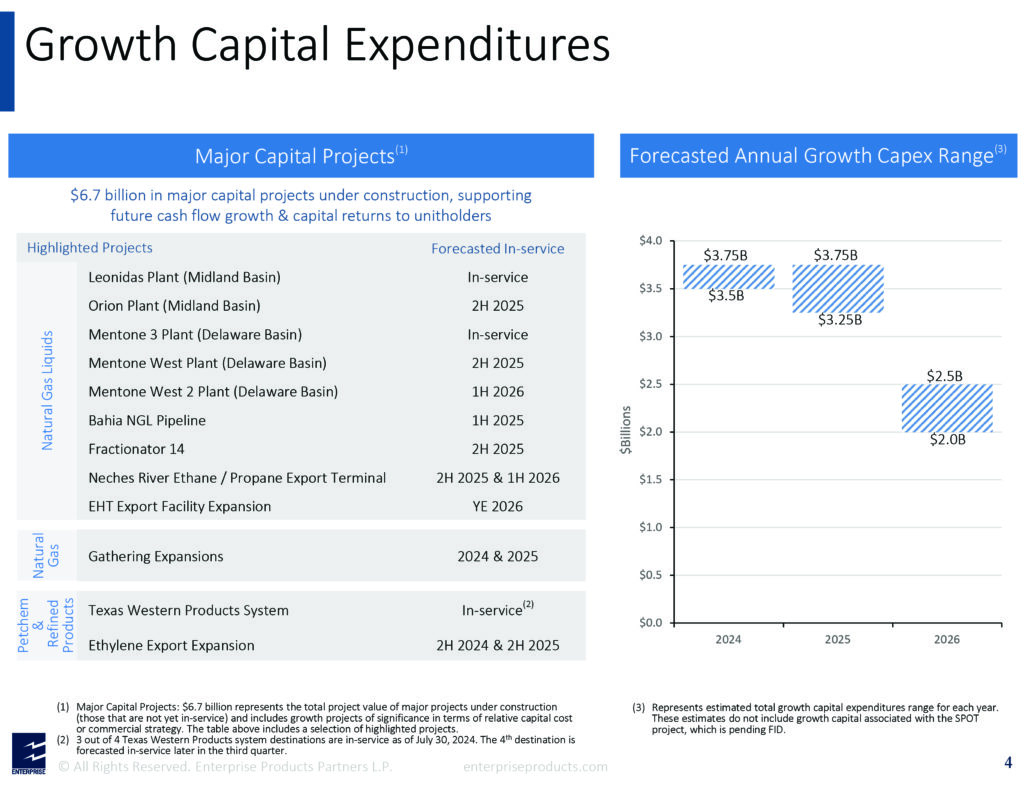

AA: Enterprise has $6.7 billion in major capital projects under construction. What are these projects and how do these support future cash flow growth and capital returns to unitholders?

JT: The majority of our growth capital projects fall under our NGL segment, our largest business segment (over 50% of our gross operating margini), which is fundamental to Enterprise’s integrated system. NGLs include ethane, propane, butane, and natural gasoline that are produced alongside natural gas and crude oil.

We continue to see extremely strong demand for our NGL services, supported in large part by production growth in the prolific Permian Basin and strong global demand for these cleaner-burning fuels. In the second quarter of 2024, we reported record fee-based natural gas processing volumes, record NGL pipeline transportation volumes, record NGL fractionation volumes, and record ethane export volumes.

Our current capital projects list expands and enhances our footprint with:

- Three additional natural gas processing plants in the Permian Basin;

- The 550-mile Bahia pipeline that will transport mixed NGLs from our Permian processing plants to our Mont Belvieu area fractionation and storage complex;

- An additional fractionator (Frac 14) at our Mont Belvieu area complex; and

- An expansion of our NGL export capabilities with an expansion of our Enterprise Hydrocarbons Terminal on the Houston Ship Channel and the addition of a new build export facility located on the Neches River in Orange County, Texas.

These projects exemplify our value chain strategy contributing fee-based revenues across our integrated footprint in support of the continued growth of our partnership and returns of capital to our unitholders.

AA: 2024 marks Enterprise’s 26th consecutive year of distribution increases. How are you able to accomplish this remarkable run?

JT: Our management owns approximately 33% of our limited partner units. In other words, “we eat our own cooking.” We think in decades, not quarters. This long-term mindset has enabled us to build a reliable business with essential services that our customers can count on, execute on projects that generate durable cash flows, and set the industry standard for a strong balance sheet. The resulting resiliency of our partnership has allowed us to increase our distributions for 26 consecutive years, despite challenges posed by macroeconomic events and energy cycles. Since our IPO, we’ve returned $54.4 billion to our unitholders in the form of distributions and buybacks. We’ve taken steps along the way to enhance our footing and today, we have the highest credit rating in the midstream space and the ability to self-fund the equity component of our growth capital projects while maintaining our track record of distribution growth. Simply put, we remain focused on the future.

AA: Many view the U.S. energy market as in transition – how do you think about the future and where do you see opportunities and challenges for Enterprise?

JT: We think globally. Energy security, reliability and affordability continue to be the preeminent themes in energy markets, not only domestically but also internationally. We believe “energy transition” is a misnomer. It is really “energy addition.” We believe an “all of the above” approach will be required to meet the evolving and growing energy needs of our world. This means not only the expansion of renewables but also more hydrocarbons. The shale revolution provided the United States with an abundant resource that fortifies our domestic energy security and allows the U.S. to play a critical role in the elimination of energy poverty globally. At Enterprise, we are proud to play a role in our nation’s and our world’s energy story and, as evidenced by our $6.7 billion of major capital projects under construction, we continue to see opportunities to expand and enhance our network of energy infrastructure.

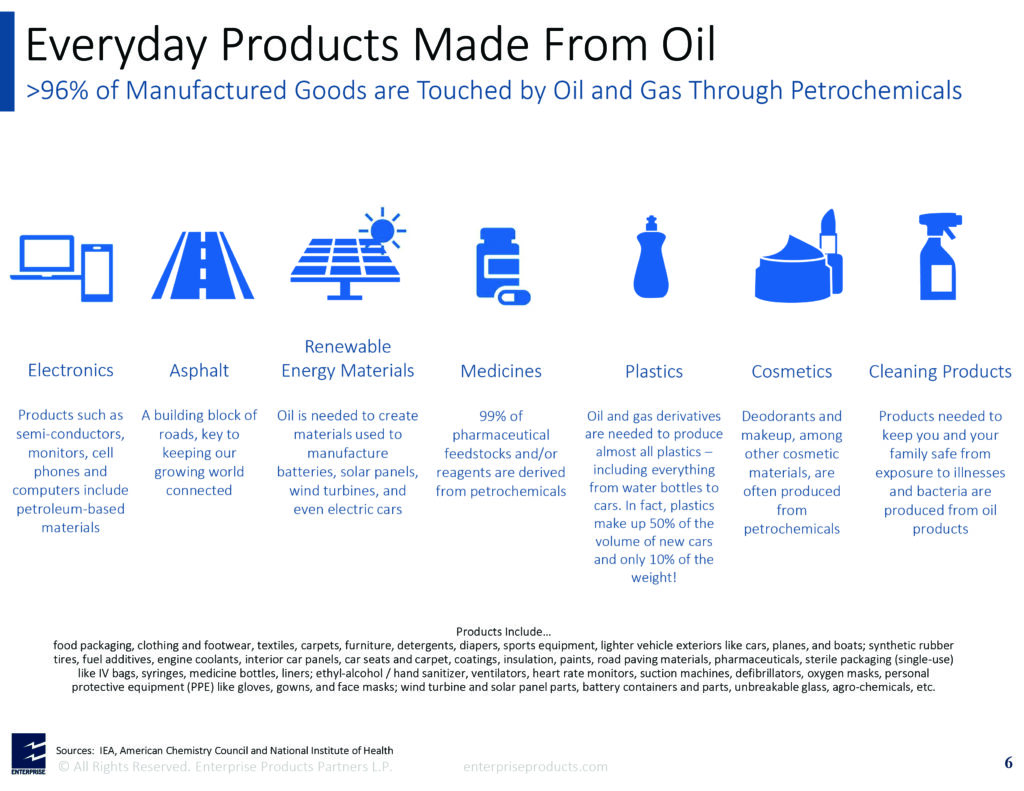

In terms of challenges, energy is widely misunderstood. The average consumer isn’t aware of the breadth of infrastructure that enables them to turn on their lights every morning, or the extent to which petrochemical products are essential to modern life. We believe that reality contributes to the difficulties our industry faces in the permitting and construction of critical energy infrastructure. We support industry efforts aimed at educating our nation’s leaders on energy markets and the positive role that U.S. energy infrastructure plays in supporting access to affordable energy and, in turn, improving health and well-being around the world.

AA: Any final takeaways for our readers on Enterprise Products Partners L.P. (NYSE: EPD)?

JT: We believe our A-rated balance sheet, 26-year track record of distribution growth, and over 7% yield collectively offer a unique investment opportunity not only in the energy space but also the broader market. Our critical energy infrastructure assets and financial profile are built for the long run, and with a management team that is highly aligned with our limited partners, we remain focused on execution, reliability, and the long-term health of the partnership.

AA: Thank you for your insights, Jim.

[i] Gross Operating Margin (GOM) is a non-GAAP measure. For a reconciliation of GOM to the nearest GAAP counterpart, see “Non-GAAP Financial Measures and Reconciliations” under Investors – Financials on our website www.enterpriseproducts.com.

Jim Teague is Director and Co-Chief Executive Officer of Enterprise Products Partners. Mr. Teague has served as Co-Chief Executive Officer since January 2020 and has been a director of Enterprise Products Partners General Partner (GP) since November 2010. He also serves as Co-Chairman of the Capital Projects Committee. Mr. Teague previously served as Chief Executive Officer of Enterprise GP from January 2016 to January 2020, Chief Operating Officer of Enterprise GP from November 2010 to December 2015, and Executive Vice President of Enterprise GP from November 2010 until February 2013. He served as Executive Vice President of EPGP from November 1999 to November 2010 and additionally as a director from July 2008 to November 2010 and as Chief Operating Officer from September 2010 to November 2010. In addition, he served as EPGP’s Chief Commercial Officer from July 2008 until September 2010. He served as Executive Vice President and Chief Commercial Officer of Duncan Energy Partners GP from July 2008 to September 2011. He previously served as a director of Duncan Energy Partners GP from July 2008 to May 2010 and as a director of Holdings GP from October 2009 to May 2010. Mr. Teague joined Enterprise in connection with its purchase of certain midstream energy assets from affiliates of Shell Oil Company in 1999. From 1998 to 1999, he served as President of Tejas Natural Gas Liquids, LLC, then an affiliate of Shell. From 1997 to 1998, he was President of Marketing and Trading for MAPCO, Inc. Mr. Teague also serves on the board of Solaris Oilfield Infrastructure, Inc.

This presentation contains forward-looking statements based on the beliefs of the company, as well as assumptions made by, and information currently available to our management team (including information published by third parties). When used in this presentation, words such as “anticipate,” “project,” “expect,” “plan,” “seek,” “goal,” “estimate,” “forecast,” “intend,” “could,” “should,” “would,” “will,” “believe,” “may,” “scheduled,” “pending,” “potential” and similar expressions and statements regarding our plans and objectives for future operations, are intended to identify forward-looking statements.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct. You should not put undue reliance on any forward-looking statements, which speak only as of their dates. Forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those expected, including insufficient cash from operations, adverse market conditions, governmental regulations, the possibility that tax or other costs or difficulties related thereto will be greater than expected, the impact of competition and other risk factors discussed in our latest filings with the Securities and Exchange Commission.

All forward-looking statements attributable to Enterprise or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained herein, in such filings and in our future periodic reports filed with the Securities and Exchange Commission. Except as required by law, we do not intend to update or revise our forward-looking statements, whether as a result of new information, future events or otherwise.

Disclosures

Investors and others should note that Enterprise Products Partners L.P. posts important financial information, including non-GAAP reconciliations, using the investor relations section of the Enterprise Products Partners website, www.enterpriseproducts.com, and Securities and Exchange Commission filings.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements that can be identified by the use of words such as “expect,” “intend,” “potential.” Forward-looking statements are predictions based on current expectations and assumptions regarding future events and are not guarantees or assurances of any outcomes, results, performance or achievements. You are cautioned not to place undue reliance upon these statements. These forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Enterprise Products Partners’ actual results may vary materially from those discussed in the forward-looking statements as a result of factors and uncertainties disclosed in Enterprise Products Partners’ reports filed with the Securities and Exchange Commission, which should be reviewed together with these forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. Enterprise Products Partners has paid Advisor Access a fee to distribute this email. Enterprise Products Partners had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.