FEATURED COMPANY

LTC Properties (NYSE: LTC): 235 Consecutive Monthly Dividend Payments and Poised for Growth

Founded in 1992, LTC Properties, Inc. (NYSE: LTC) is a self-administered real estate investment trust (REIT) investing in seniors housing and healthcare properties. LTC’s portfolio encompasses Skilled Nursing Facilities, Assisted Living Communities, Independent Living Communities, Memory Care Communities, and combinations thereof. The company’s main objective is to build and grow a diversified portfolio that creates and sustains shareholder value while providing stockholders current distribution income. To meet this objective, the company seeks properties operated by regional operators, ideally offering upside and portfolio diversification.

Click to view the LTC Properties Investor Presentation.

Advisor Access spoke with Wendy Simpson, Chairman and CEO of LTC Properties.

Advisor Access: For readers unfamiliar with LTC Properties, would you share an overview of the REIT?

Wendy Simpson: LTC has been a trusted investor in needs-based seniors housing and care for more than 30 years. Over that time, we’ve developed deep expertise, allowing us to successfully navigate various real estate cycles and adapt to changing market conditions.

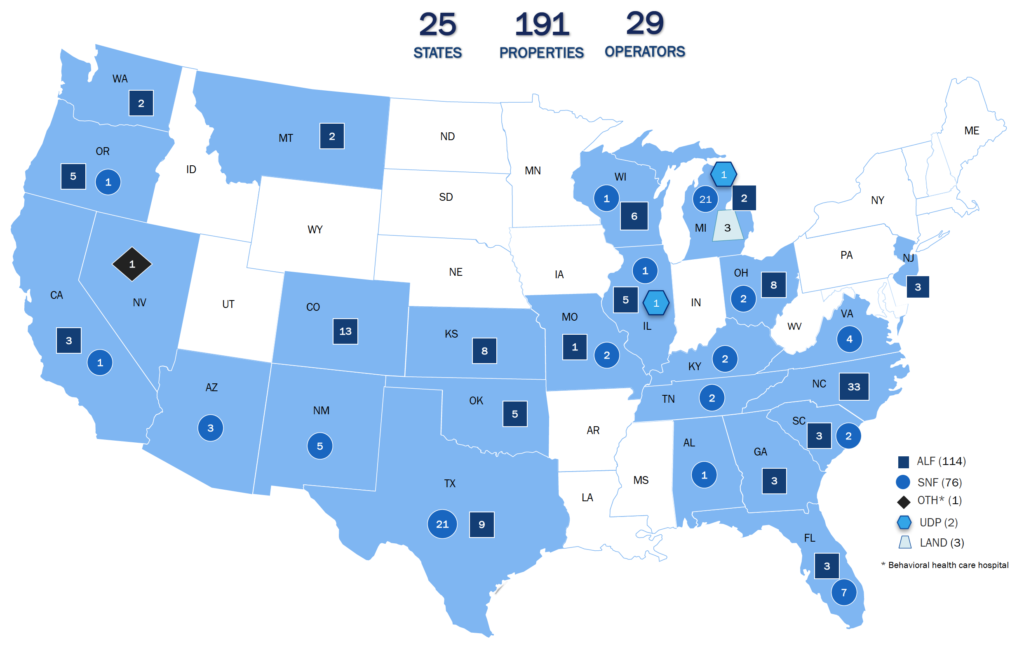

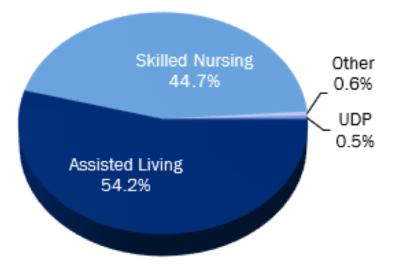

Our portfolio is diverse, with investments in 191 properties across 25 states, working with 29 operating partners. Based on gross real estate investments, approximately half of our portfolio is in private-pay seniors housing, with the other half in skilled nursing.

LTC is recognized throughout the industry for providing flexible investment options that create value for our operators, our stakeholders, and LTC itself. We offer a range of financing solutions tailored to regional, growth-oriented operators, including triple-net leases and structured finance solutions such as preferred equity, and mezzanine lending.

AA: What drove your improved performance for the third quarter?

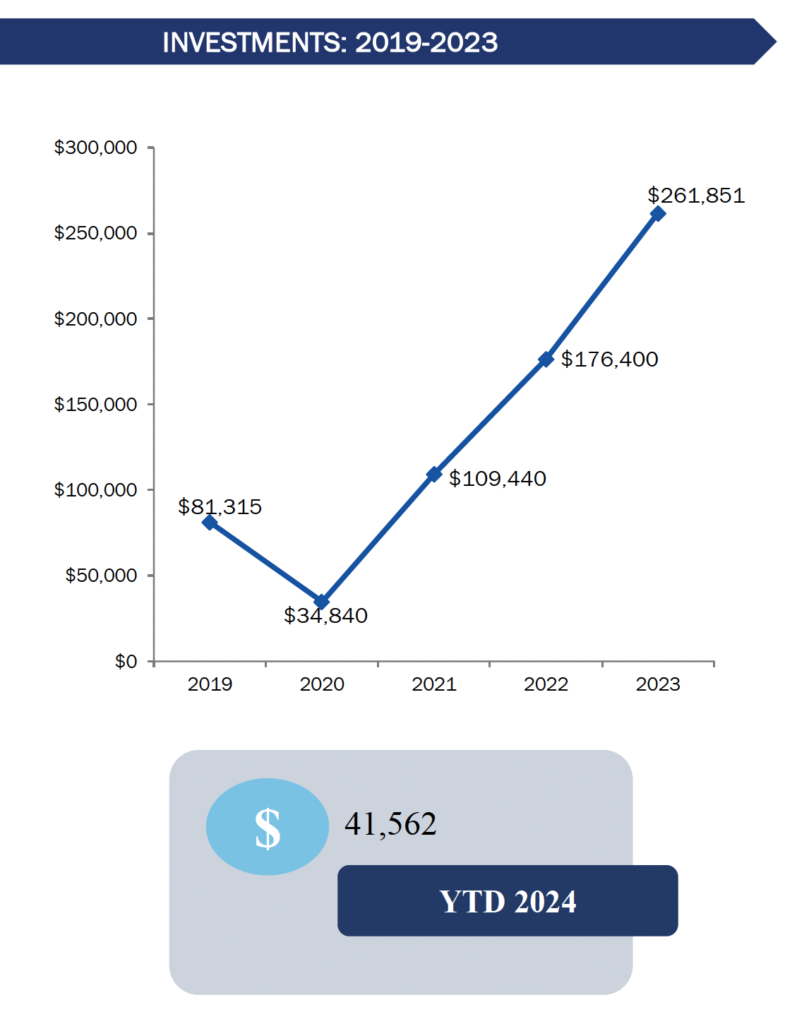

WS: We have been working diligently to streamline our portfolio, which is a key part of our broader strategy to strengthen our business for the long-term. At the same time, we’ve focused on de-levering our balance sheet and expanding access to capital, positioning us for sustainable growth and greater financial flexibility moving forward.

Our growth for the third quarter was driven by several factors: revenue from former operators related to past portfolio transitions, lower interest expense due to our successful de-leveraging efforts, rent increases, and higher income from new investments in unconsolidated joint ventures. We are optimistic about the remainder of this year and into 2025.

AA: What is LTC’s current growth strategy?

WS: Thanks to our efforts to strengthen our balance sheet, we are in a strong position to focus on growth.

In the third quarter, we originated a $26.1 million mortgage loan for the construction of a seniors housing community in Illinois. This aligns with our strategy of building a pipeline of accretive transactions that deliver value for LTC and our stakeholders.

Looking ahead, we see a significant opportunity in utilizing a RIDEA structure, which allows REITs to participate in the net operating income of properties managed by third-party operators. With the support of our Board, we are evaluating the infrastructure needed to implement this structure and anticipate starting with the cooperative conversion of selected triple-net leases in our seniors housing portfolio. This initial phase represents an estimated, existing gross investment of $150 million to $200 million, which could be converted by the second quarter of 2025.

AA: LTC was able to maintain payment of monthly dividends throughout the pandemic when most healthcare REITs cut theirs. In fact, the company has a record of 235 consecutive monthly dividend payments. What sets LTC apart that makes this possible?

WS: We are extremely proud of our record of 235 consecutive monthly dividend payments, which reflects LTC’s disciplined approach to balance sheet management. Our philosophy of maintaining low leverage and a conservative FAD payout ratio has been instrumental in preserving our ability to provide consistent dividends, even during challenging periods like the pandemic, when many of our peers were cutting theirs.

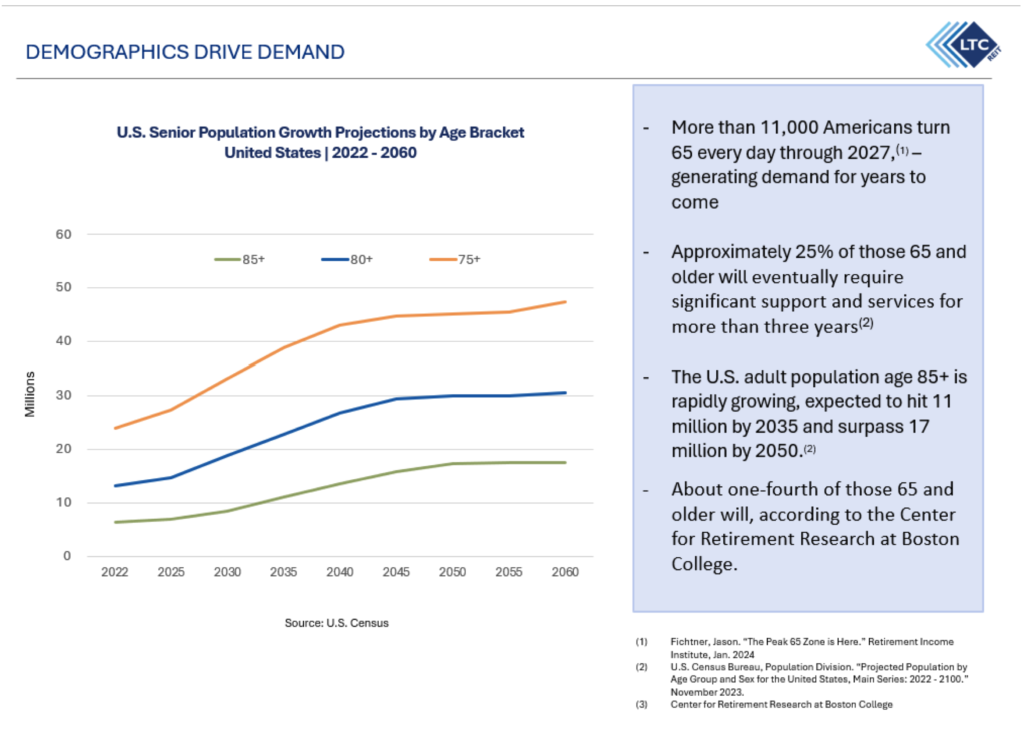

With a current yield of nearly 6%, our dividend provides a strong return for all investors, particularly retirees on fixed incomes. Looking ahead, the aging U.S. population—expected to grow to nearly a quarter of the population by 2060—underscores the importance of our sector and provides a solid foundation for continued growth in our business.

AA: Can you talk about the latest trends in the seniors housing industry?

WS: The seniors housing industry has seen a resurgence over the last several years. Occupancy rates have improved consistently, with the third quarter of 2024 marking the 13th consecutive quarter of increases. Construction starts remain low, which supports further occupancy gains.

Demographics continue to work in our favor. The U.S. adult population of those 85 years of age and older is expected to rise to 11 million by 2035 and surpass 17 million by 2050. This trend points to sustained and growing demand for seniors housing and care.

AA: Is there anything else you would like readers to know?

WS: The challenges of the pandemic tested our industry, but I am proud of how we came together to emerge stronger. Seniors housing and care remain a vital part of the U.S. healthcare continuum, particularly as the population continues to age.

At LTC, I’m confident in the progress we’ve made and the opportunities ahead. We have the right strategy, a talented team, and access to capital to continue delivering value to all our stakeholders.

AA: Thank you for your insights.

Wendy Simpson has been LTC’s CEO and President since 2007 and was appointed Chairman of the Board in 2013. She joined the company in 2000 as Vice Chairman and has also served as Treasurer, Chief Financial Officer, and Chief Operating Officer. Prior to joining LTC, Wendy held executive positions in public companies that owned acute care hospitals, LTACHs, psychiatric hospitals and home health services. She began her career in public accounting and has more than 30 years in healthcare-related businesses.

Disclosures

Investors and others should note that LTC Properties, Inc. posts important financial information using the investor relations section of the LTC Properties, Inc. website, https://ir.ltcreit.com/overview/default.aspx, and Securities and Exchange Commission filings.

The information contained in this facsimile message is intended only for the use of the individuals to whom it is addressed and may contain information that is privileged and confidential. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone at (707) 933-8500.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements. This information may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. LTC Properties, Inc. has paid Advisor Access a fee to distribute this email. LTC Properties, Inc. had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.