The Energy Infrastructure Newsletter • Spring 2024

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

The Evolving Role of Private Capital

in a Maturing Lower 48

Advisor Access spoke with Gregory Davis, Partner, EIV Capital LLC.

Advisor Access: Traditional and transitional energy are distinct opportunity sets. What is your thinking about them as a private equity investor in today’s market?

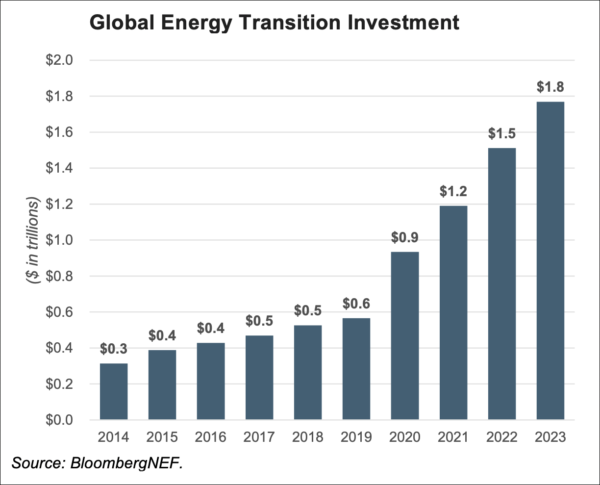

Gregory Davis: Historically, about 75% of our capital has been allocated to traditional energy, primarily midstream infrastructure, and 25% to renewable/transition related investments, with initial investments in the renewables and emissions reduction space in 2010 before the term “energy transition” had been coined. Things are drastically different today. Capital is now flooding into transition – 2023 set a record – and investors appear to be embracing higher degrees of risk in pursuit of decarbonization. We see this as a positive from the perspective of improving long term global emissions; however, capital-on-capital competition is intense and caveat emptor applies. In fact, we see a lot of similarities to the early days of shale when capital inflows supported unprecedented supply growth. That was an enormous positive for consumers and America’s geopolitical calculus, but not necessarily great for investors.

By contrast, traditional energy is experiencing a period of capital scarcity driven in equal parts by ESG mandates and investors who are demanding discipline in the aftermath of lackluster returns from the shale boom. As a firm, we remain convinced of the long-term need for hydrocarbons and believe the lack of capital-on-capital competition presents a compelling opportunity in traditional midstream infrastructure.

Broadly speaking, we do believe traditional midstream offers a more attractive risk/return proposition for investors today. In the nascent energy transition, one’s outcome largely depends on the ability to pick “winners” from a wide range of competing early-stage opportunities. We seek to avoid binary outcomes and will instead focus on the themes we see as critical to the transition regardless of the underlying feedstock/technology – and we are remaining patient while risk-on capital is chasing transition only opportunities.

AA: That’s a helpful backdrop. Focusing in on traditional midstream infrastructure, how have these trends impacted the landscape of investment opportunities?

GD: Leading up to the COVID pandemic, the industry experienced 10-plus years of unbridled supply growth where private equity largely served as greenfield construction capital. Today, supply growth has moderated and absent a few isolated pockets, midstream capacity in the Lower 48 is built-out. In many basins, capacity is over-built.

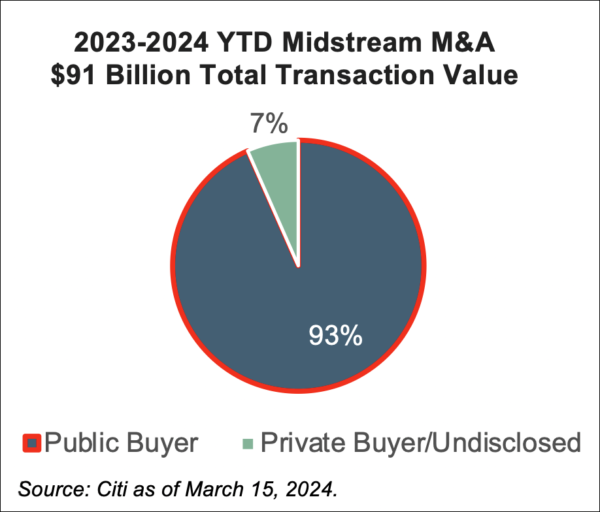

This dynamic, combined with capital scarcity, has triggered a massive wave of consolidation among the large strategics. This makes complete sense in the context of a maturing Lower 48. Companies are seeking scale in order to (1) realize cost synergies, (2) squeeze more value from every molecule they touch and (3) address underlying inventory concerns.

For private equity investors, this translates to an opportunity set that is more heavily weighted toward the acquisition of existing assets. On the one hand, this is great for investors as we are acquiring existing assets that generate a cash yield from day one, thus eliminating the “J-curve” associated with greenfield projects. On the other hand, M&A is a game of low probability. You have to look at a lot of transactions to get a few closed, and there is no consolation prize for finishing in second place.

AA: How do you think of the role of private equity in a maturing Lower 48 now that the industry has pivoted from greenfield to a more M&A-driven opportunity set?

GD: As strategics scale, they often increasingly lose focus on non-core assets. That’s not a criticism. Most simply don’t have enough human and financial resources to go around. This should ultimately drive a corresponding wave of asset realization, which also plays well with public equity investors’ preference for a more focused narrative.

In this scenario, we see a tremendous opportunity for private equity and the entrepreneurs we sponsor. We believe the key to success is identifying challenges and creating a win for all stakeholders. That can take the form of acquiring non-core assets outright or creating partnerships whereby everyone participates in the upside.

At the same time, we believe it is necessary to embrace a longer hold period for our capital. As we shift to investing in mature, cash-yielding assets, it should follow that longer holds will be necessary to generate similar multiples of invested capital (“MOIC”). The idea of generating a 2x+ MOIC within a 3-year hold period is simply not reflective of today’s opportunity set. This is where private equity sponsors, in particular, must adapt. While those days may be gone, we are happy to trade risk for duration when underwriting existing cash flow in a world that we believe is underestimating future hydrocarbon demand.

Moreover, the people factor is not to be underestimated. Many successful individuals have worked themselves out of a job and are now in search of their next challenge. These individuals often happen to be best positioned to know what problems need solving. That’s one of the great things about energy investing. We constantly shift from under-investment to over-investment, followed by consolidation. Equilibrium doesn’t really exist, and the industry has a way of reinventing itself in the wake of consolidation. We don’t expect this period of consolidation to be different.