The Energy Infrastructure Newsletter • Fall 2024

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

U.S. Infrastructure Has a Strong Future Ahead

Advisor Access spoke with John D. Edwards, CFA, a Senior Portfolio Manager running infrastructure strategy at Capital Ideas.

Advisor Access: Would you discuss the growth in datacenters driven by artificial intelligence (AI) that could drive a 15%–20% increase in power demand by the end of this decade as well as an increase in fossil fuel consumption to supply this rising demand?

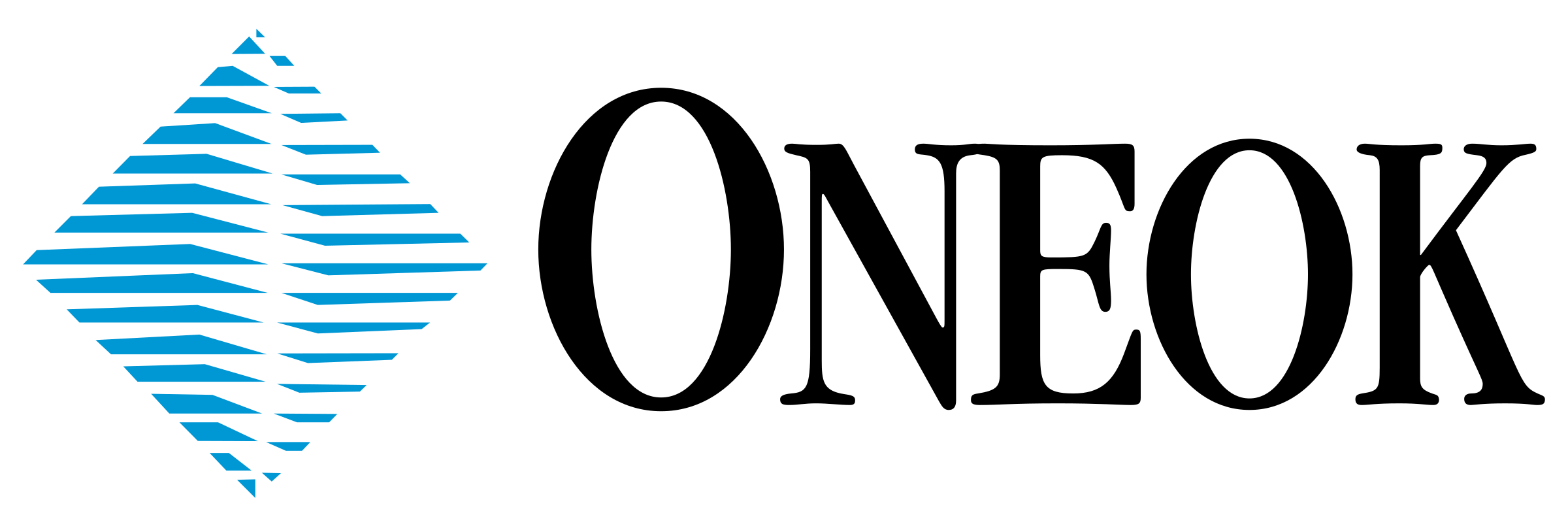

John Edwards: When considering the unprecedented scale of capital investment recently deployed into AI, a significant spike in power demand to support this technological development makes sense. AI-driven searches typically require 30x–100x of the electricity required for traditional search.

AA: How does this increased power demand translate into growth in aggregate electricity demand?

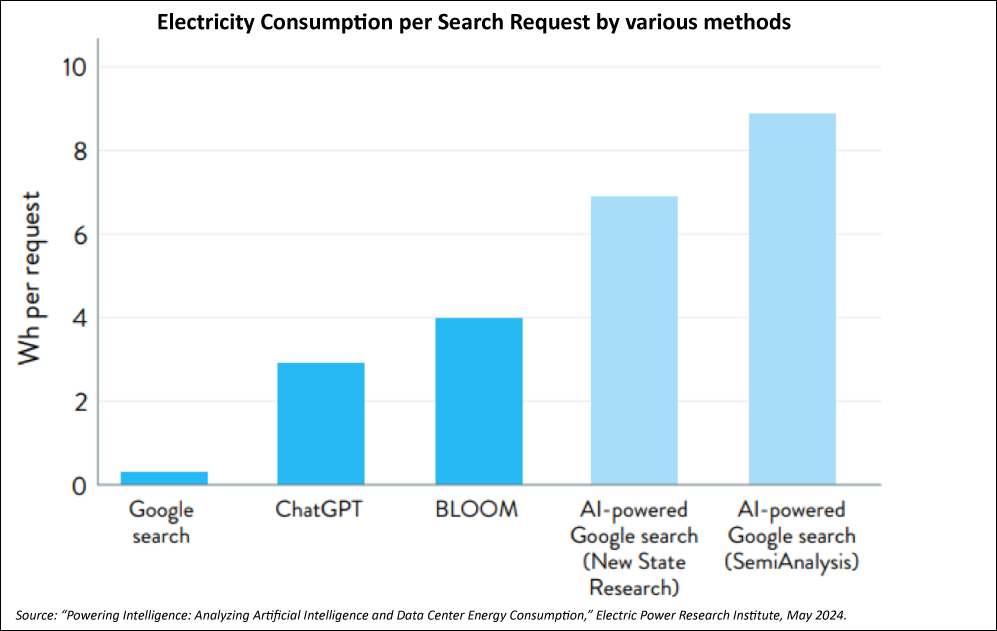

JE: All indications are that the rate of growth is likely to accelerate given the recent explosion in AI. In an August 2024 EEI podcast, Jensen Huang, CEO of Nvidia, explained how in just a decade computing power has scaled up by an astonishing 1,000,000x. As computing power has become significantly more efficient at scale, the demand for power is rising and will continue to rise further as AI can be harnessed because of the large increase in productivity.

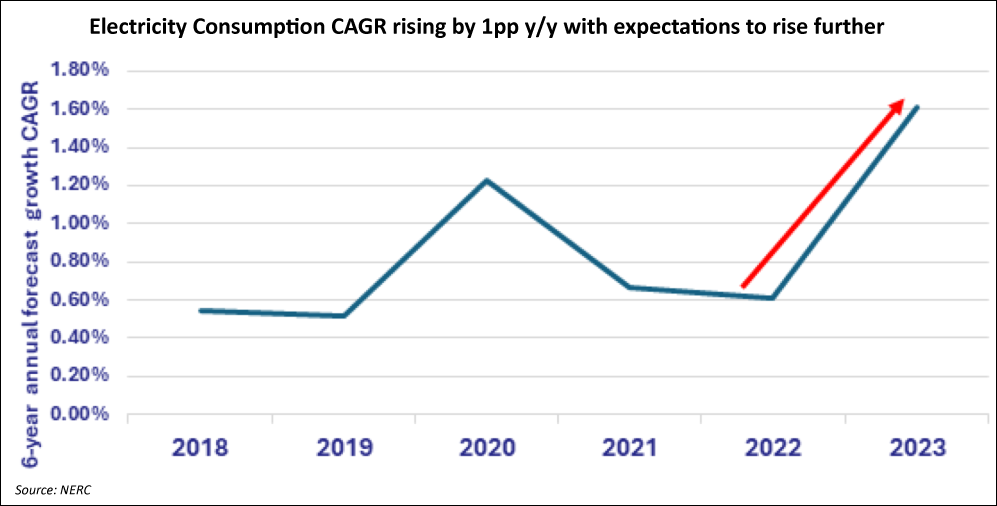

According to the Electric Power Research Institute (EPRI), the demand for electricity from datacenters alone is expected to total anywhere from ~200 terawatt hours/year (TWh/year) to ~400 TWh/year from a base of ~4,000 TWh/year by 2030. The question then becomes how much infrastructure is required to support and sustain that kind of growth in electricity consumption.

AA: How does this growth in electricity demand translate into capital costs and spending in the utility industry?

JE: Even a measured uptick in electricity demand is likely to drive a significant increase in capital investment required to support this. Assuming the latest figures of ~4,000 TWh of electricity consumption and current U.S. peak demand of 814 megawatts (MW), a 1.6% annual growth in peak demand would require 80,000 MW of new generating capacity by the end of the decade. A natural gas combined cycle (CC) electric generation facility, which is typically among the least expensive to build, costs from $1.2 billion to $2 billion for 1000 MW of capacity. As a result, the electric generation facilities alone would cost anywhere from $80 billion to $160 billion to the end of the decade, assuming no inflation in the costs of engineering, procurement, and construction.

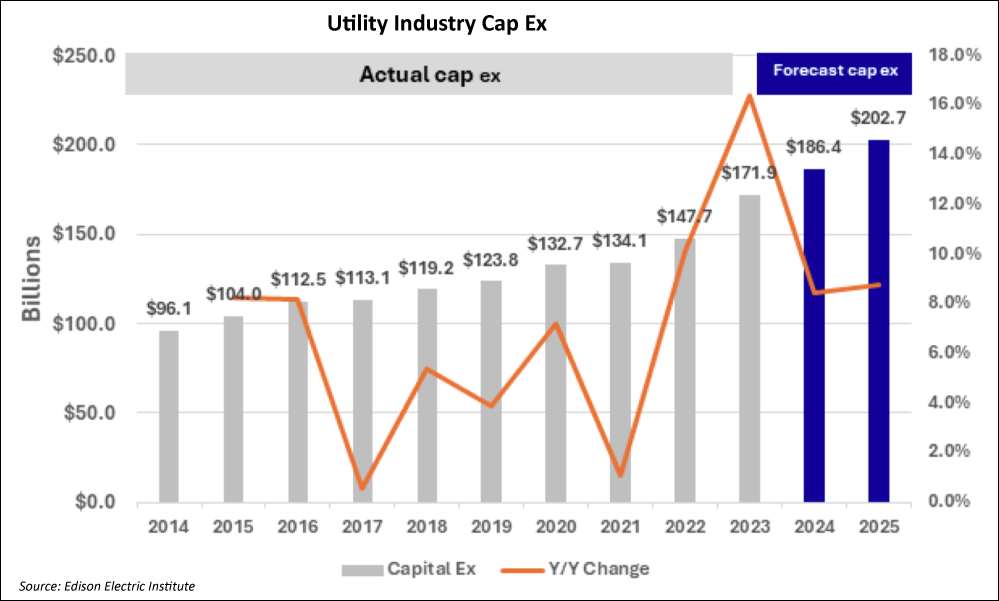

AA: How are we seeing capital expenditures across the electric utility industry?

JE: According to Edison Electric Institute figures, approximately 1/3 of the capital expenditure (cap ex) is for distribution, 1/4 is for generation, 1/5 for transmission, 1/7 for gas-related, and the remaining approximately 6% for regulatory compliance. From 2021–2025, the cap-ex growth rate is expected to be roughly 11% per year. Datacenter cap ex is expected to rise at an even faster clip.

AA: How does this increase in demand from datacenters cut across other sectors of the economy?

JE: The global datacenter market is expected to expand at an annual growth rate of roughly 10–15% over the next several years. Based on past growth patterns and expansion plans, hyperscalers could build several hundred new datacenters by 2030. On September 20, Constellation Energy announced that it signed a 20-year power purchase contract that would support the start of its Crane Clean Energy Center and would restart unit 1 of Three Mile Island to support Microsoft’s goal to help match the power its datacenters use with carbon-free energy.

Another example is that the largest of Oracle’s datacenters are 800 megawatts and Oracle will soon begin construction of datacenters that are more than 1,000 megawatts. The company’s recent comments provide a clear example regarding the robust growth outlook for datacenters and the implications for expansion effects across many sectors of the economy. As Oracle Chairman Larry Ellison explained on Oracle’s recent earnings call:

“Our datacenters are so automated and they’re scalable…we have 162 datacenters now, I expect we will have 1,000 or 2,000 or more datacenters, Oracle Cloud datacenters around the world, and a lot of them will be dedicated to individual banks or telecommunications companies or technology companies or nation states, sovereign clouds, all of this other stuff.”

AA: Can you give us an example of other areas of infrastructure that are likely to experience a step change increase in growth?

JE: The broader U.S. cooling infrastructure market, including not just datacenters but also commercial, residential, and industrial, is estimated to grow roughly 5% per year to reach $26–$33 billion by 2030. The U.S. datacenter cooling market is expected to grow even faster at 6–8%/year over the next six years to reach $5.5–$7.0 billion.

AA: Any closing thoughts?

JE: We believe that the infrastructure space is an exciting opportunity for investors. This includes not just traditional infrastructure such as utilities, the electricity grid, and pipelines, but also technology-related infrastructure as well. Tech-related infrastructure includes the cloud, datacenters, servers, chips, and cooling systems that go into datacenters, the network hardware and software, as well as cybersecurity. The modern economy is now largely driven by technology, data, and related systems as opposed to the “bricks and mortar” infrastructure supporting the older manufacturing-driven economy. It is our view that an investor’s portfolio should reflect this shift in the modern economic landscape, which also includes companies with much higher expected growth compared to traditional infrastructure providers.

AA: Thank you for your insights, John.

John Edwards, CFA is the portfolio manager for the Infrastructure Plus separate account strategy and John Edwards is currently jointly registered with both Principal Street and Capital-Ideas as a portfolio manager of record. Both Principal Street and Capital-Ideas are registered investment firms with the SEC. Prior to joining Capital Ideas, Mr. Edwards joined Principal Street in 2019 as Portfolio Manager for the Infrastructure Plus Strategy, a dedicated infrastructure fund. Previously Mr. Edwards had a wide range of experience in both asset management and in sell-side research including as Partner at ATLAS Infrastructure, a global infrastructure partnership with Global Infrastructure Partners, an independent infrastructure fund management company targeting the energy, transport and water/waste management sectors. Before Atlas, Mr. Edwards was a Director and Senior Analyst at Credit Suisse leading the equity research team covering midstream energy and senior research analyst for the midstream energy industry for Morgan Keegan. While at Credit Suisse, Mr. Edwards was ranked a Top 10 sell-side analyst by Institutional Investor magazine, currently owned by Euromoney Institutional Investor, London, U.K. Mr. Edwards has been widely quoted in the financial media including Barron’s and the Wall Street Journal. In his prior career, Mr. Edwards participated in power plant development across various energy sources including geothermal, wind, and gas-fired generation projects with a wholly owned subsidiary of Edison International. Mr. Edwards is a CFA charter holder from the CFA Institute, holds an MBA from California State University, Fullerton, and a bachelor’s degree in economics from Occidental College.