FEATURED COMPANY

Healthpeak Properties, Inc. (NYSE: DOC): A Leading Healthcare-Focused REIT

Healthpeak Properties, Inc. (NYSE: DOC) is a fully integrated real estate investment trust (REIT) and S&P 500 company. Healthpeak owns, operates, and develops high-quality real estate focused on healthcare discovery and delivery. The company owns a national portfolio composed of 700 properties totaling nearly 50 million square feet.

Click to view the Healthpeak Properties Company Overview.

Click to view the Healthpeak Properties Investor Presentation.

Advisor Access spoke with Scott Brinker, President and CEO of Healthpeak Properties.

Advisor Access: Would you provide an overview of Healthpeak and explain its niche position among REITs?

Scott Brinker: Healthpeak Properties is a leading healthcare-focused REIT with a nearly 50 million square foot portfolio spanning outpatient medical, life sciences, and senior housing. Our properties sit at the intersection of real estate and healthcare innovation—an essential and growing sector fueled by demographic tailwinds and rising demand for better health outcomes.

- In our life science properties, our biopharma tenants are developing life-changing therapeutics, diagnostics, and devices.

- These breakthroughs from the lab move into our outpatient medical buildings, where our health system and physician tenants deliver efficient care in convenient locations near patients’ homes.

- As healthcare needs evolve, our senior housing communities offer tailored living environments that enhance quality of life.

This strategic integration enables us to provide mission-critical infrastructure at every stage of the care journey, from healthcare discovery to care delivery to senior housing.

Importantly, healthcare real estate operates differently than traditional real estate sectors. Leasing outcomes aren’t driven solely by quality of the location; they’re closely tied to the success of the healthcare services being provided. That’s why our deep knowledge of healthcare operations, regulations, and tenant needs is essential for driving long-term value. We understand how to create environments that help lab professionals innovate, medical providers deliver care, and senior residents thrive, which in turn strengthens tenant relationships and portfolio performance.

With strong demographic tailwinds and high barriers to entry, our high-quality, diversified portfolio is built to deliver consistent dividends and long-term value for our shareholders.

AA: In 2024, Healthpeak completed a merger with Physicians Realty Trust. What are some of the benefits of this merger?

SB: The merger was driven by a simple question: Are we stronger together than alone? A year later, the answer is a resounding yes.

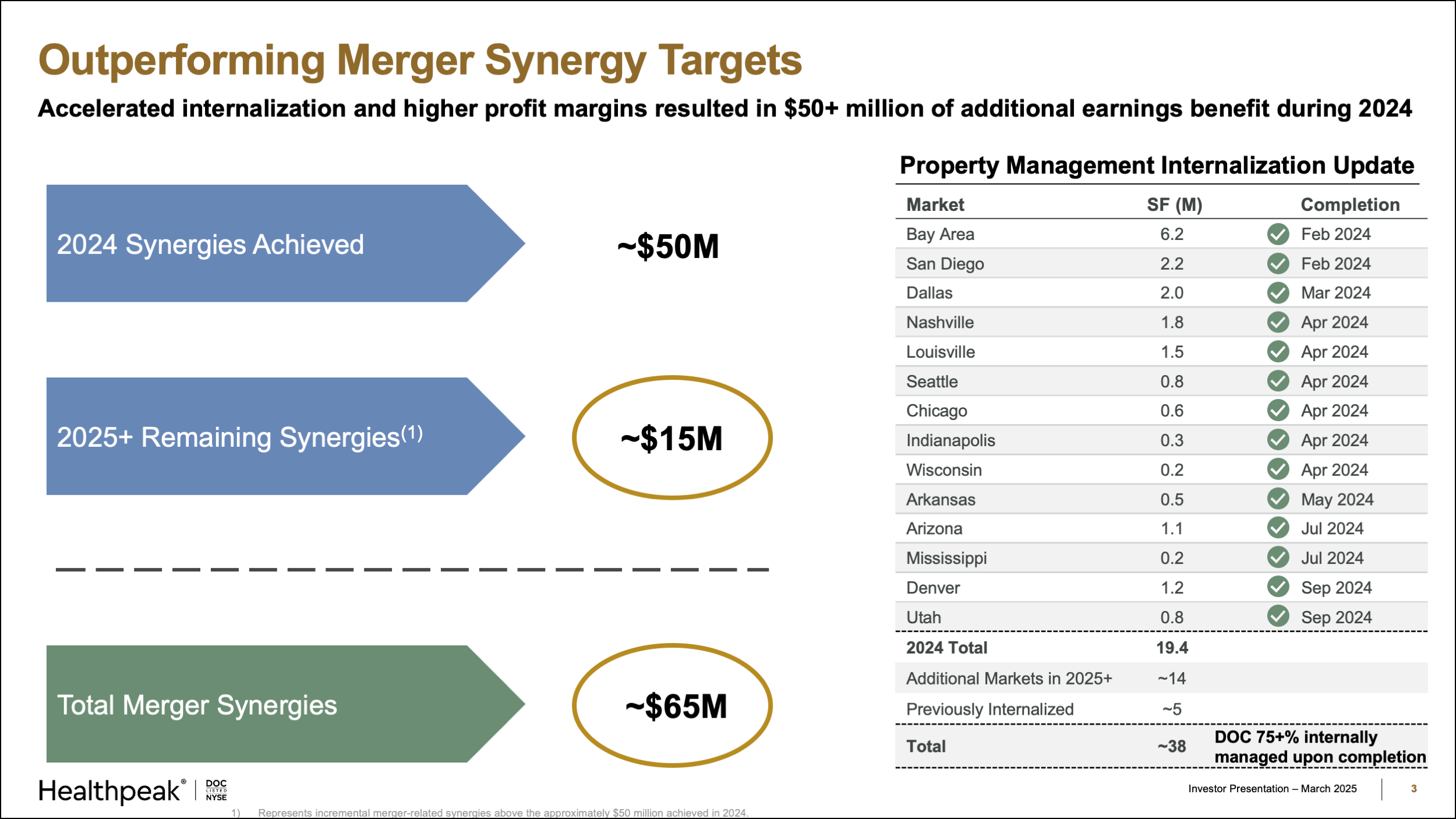

Financially, the merger has been a huge success. We exceeded our first-year synergy targets by more than 25%, and now expect total synergies north of $65 million.

Strategically, we’ve brought Healthpeak closer to our assets and tenants, which allows us to make smarter leasing and capital allocation decisions. During 2024, we leveraged Physician Realty’s experience and best practices to internalize property management across nearly 20 million square feet, with an additional 14 million square feet planned in 2025 and beyond.

Our property managers are embedded in local markets interacting directly with tenants and eliminating the duplication required under third-party property management. The positive feedback from the property managers on the ground and our tenants further validates the strategic decision to internalize.

AA: Healthpeak recently announced a dividend increase at a time when many REITs face headwinds in an environment of higher interest rates and changing market conditions. What sets Healthpeak apart that makes this possible?

SB: Our capital allocation decisions have put our portfolio, balance sheet, and liquidity in an enviable position.

In 2024, we merged with Physicians Realty Trust, which increased our allocation to the stable and attractive outpatient medical business to just over 50% while generating earnings accretion, improving our balance sheet and creating the best platform in the outpatient sector.

Additionally, we’ve sold $1.3 billion of stabilized assets at a 6.4% cap rate and used the proceeds to fully fund our development pipeline, buy back almost $300 million of stock at an implied 8% cap rate, and bring leverage down to low-5 times net debt to EBITDA. We also reduced floating rate debt from 20% to almost zero.

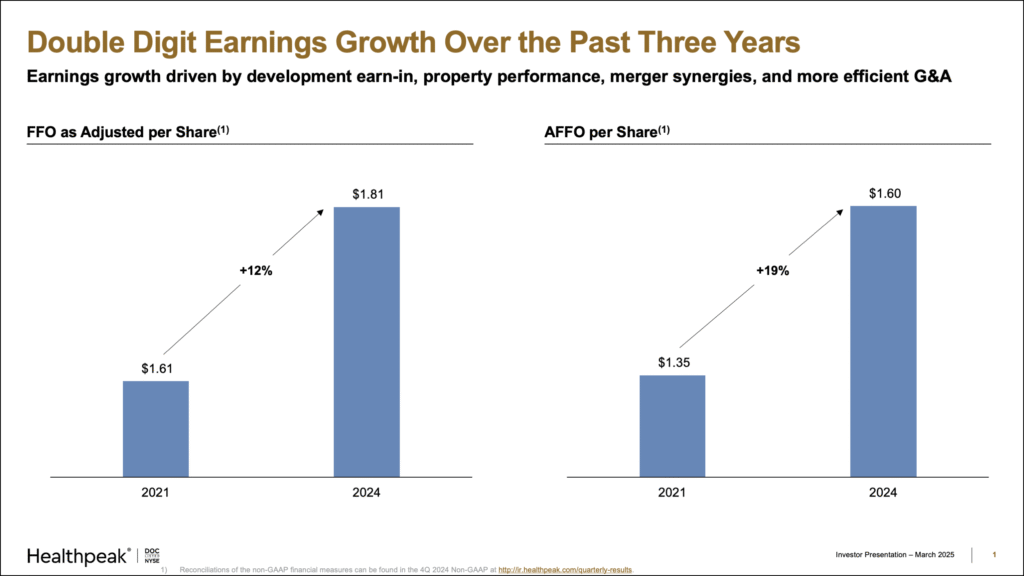

From 2021 to 2024, Healthpeak grew AFFO [adjusted funds from operations] per share by 19%. This growth was driven by the strength of our underlying portfolio, earn-in from completed developments, and synergies from our successful merger. As a result of our financial performance, limited unfunded development, and conservative balance sheet with very little floating rate debt, we were able to increase our dividend while still maintaining a safe and conservative payout ratio that provides approximately $300 million of annual free cash flow we can reinvest into our business.

While we see significant upside in our stock, a consistent and growing dividend remains a key component of Healthpeak’s total return strategy. In addition to our recent dividend increase, we transitioned to monthly dividend payments, offering shareholders more frequent and predictable income.

AA: How is Healthpeak positioned for long-term growth and value creation?

SB: We’re aligned with powerful, long-term healthcare trends:

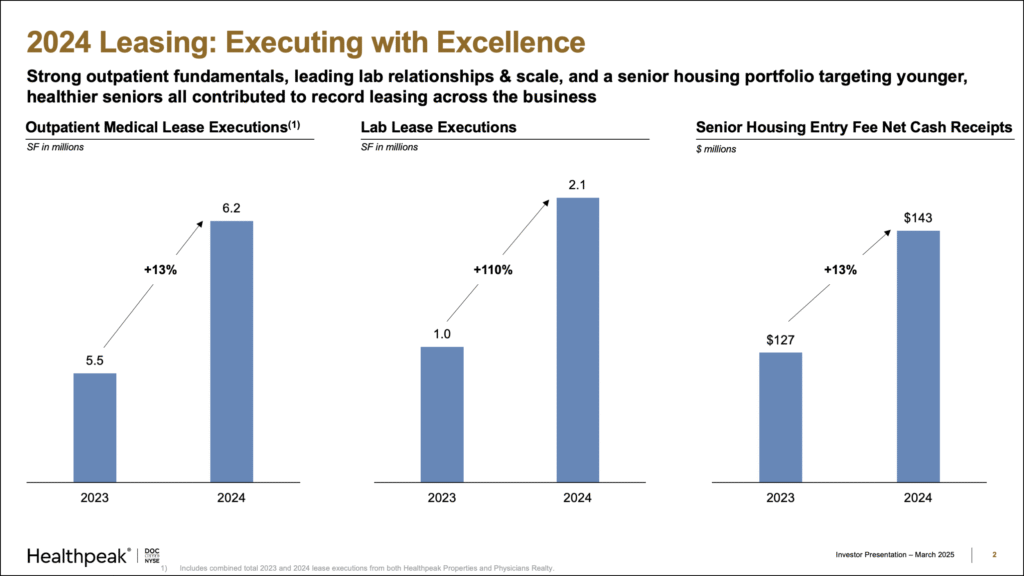

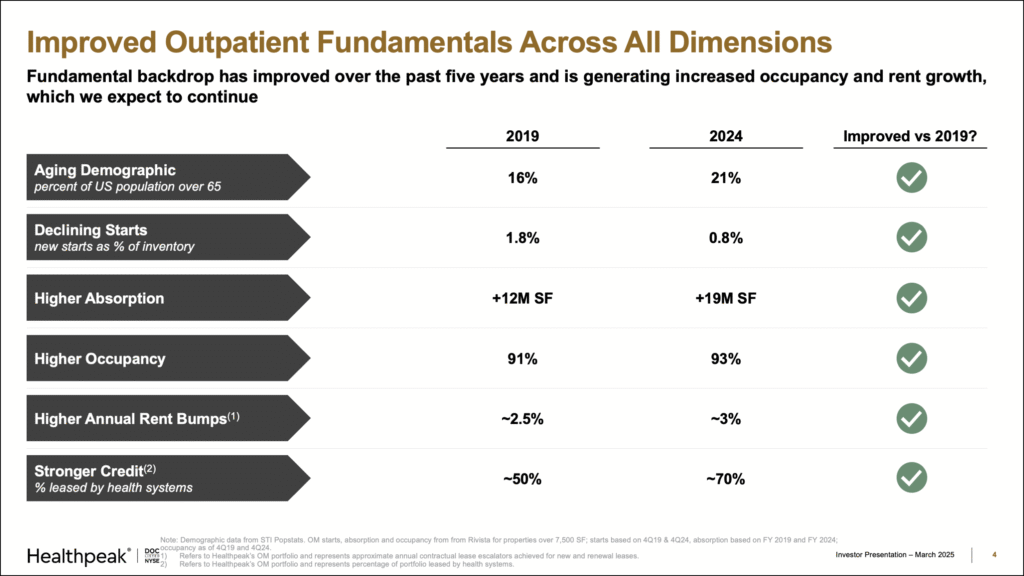

- Outpatient Care Growth: The shift to outpatient care is accelerating. Health systems are moving services out of hospitals and into our outpatient medical buildings to help lower costs, improve access, and meet consumer preferences. With limited competition from new supply, and growing demand for modern outpatient medical space, the fundamentals for our business have never been stronger and it’s translating into higher occupancy and rent growth.

Additionally, our capabilities and health system relationships continue to generate proprietary new development opportunities. While construction costs remain elevated, our health system partners are prioritizing outpatient growth to capture market share. Our pipeline of highly pre-leased, accretive development projects now exceeds $300 million.

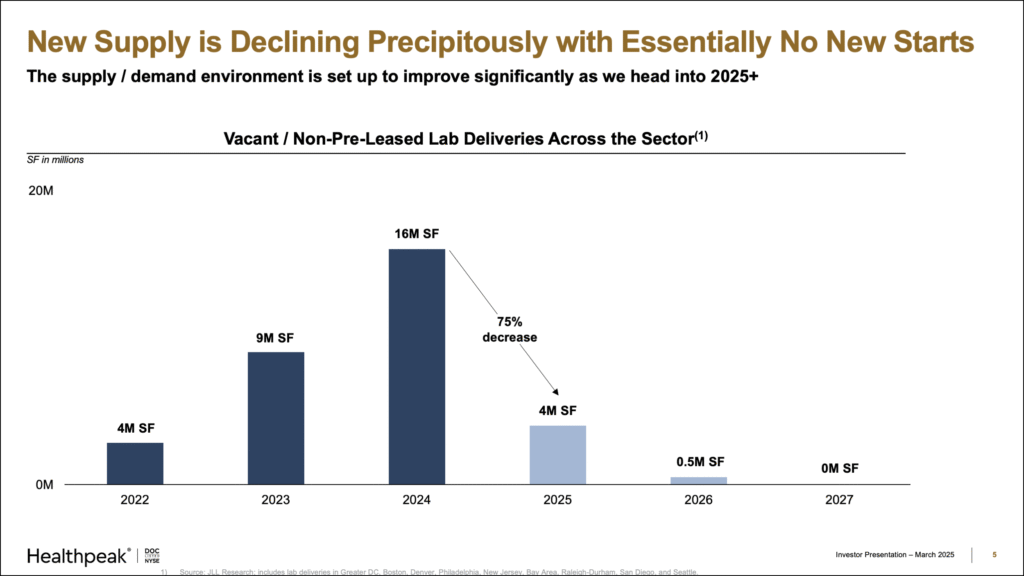

- Life Science Innovation: Few sectors are more critical than biopharma to the United States maintaining leadership on the world stage over the next several decades. R&D spending, drug development, and approvals have been at or near record highs. While the capital markets for life sciences are cyclical, innovation continues to advance.

With no new lab deliveries on the horizon, we expect market fundamentals to improve, and we are actively building an investment pipeline. Healthpeak’s strategy focuses on investments that provide immediate accretion, seniority in the capital stack, and attractive future acquisition rights of buildings in core submarkets. This approach allows Healthpeak to capitalize on current market dislocations while positioning the company for long-term growth.

- Senior Housing Demand: The 80+ population is entering a phase of rapid growth, while new development remains constrained. This imbalance is driving higher occupancy, stronger pricing power, and improving margins for our senior housing communities.

AA: Do you have any final takeaways for our readers on Healthpeak?

SB: At Healthpeak, we focus on delivering mission-critical, irreplaceable healthcare real estate that supports lab professionals innovating, providers delivering care, patients accessing services, and seniors living well.

This purpose-driven approach, combined with disciplined execution, prudent capital allocation, and a strong balance sheet, positions us for sustainable long-term growth and value creation.

For shareholders, this means a high-quality, diversified portfolio, a growing dividend, and the opportunity to invest in an essential real estate sector.

AA: Thank you, Scott, for your insights.

Scott Brinker has been Healthpeak Properties President and Chief Executive Officer, and a member of the Board of Directors, since October 2022. From January 2019 to October 2022, Mr. Brinker served as President and Chief Investment Officer, and from March 2018 to December 2019, he served as Executive Vice President and Chief Investment Officer. Prior to that, he served in various investment and portfolio management-related capacities at Welltower Inc. (NYSE: WELL), a healthcare REIT, from July 2001 to January 2017, most recently as its Executive Vice President and Chief Investment Officer. Mr. Brinker received a Bachelor of Arts from Yale University and earned a master’s degree from the University of Michigan’s Ross School of Business.

Disclosures

Investors and others should note that Healthpeak Properties, Inc. posts important financial information using the investor relations section of the Healthpeak Properties, Inc. website, https://www.healthpeak.com, and Securities and Exchange Commission filings.

The information contained in this facsimile message is intended only for the use of the individuals to whom it is addressed and may contain information that is privileged and confidential. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone at (707) 933-8500.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements. This information may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors, which may further be described in the company’s Securities and Exchange Commission filings. Healthpeak Properties, Inc. has paid Advisor Access a fee to distribute this email. Healthpeak Properties, Inc. had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.