The Energy Infrastructure Newsletter • Fall 2021

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

Midstream Equities Are Well Positioned in the Post-COVID Energy Market

Advisor Access spoke with Brian Watson, Senior Portfolio Manager of Invesco SteelPath Funds.

Advisor Access: In recent quarters, the energy sector has been leading most other sectors. Have midstream equities participated in this investor interest as well?

Brian Watson: Yes, midstream energy infrastructure’s total return, as measured by the Alerian MLP Index, for the year through August 31, was 35%, which outpaces the S&P 500 Index’s 21%. Of course, the energy sectors really began to rally in the fourth quarter of 2020, with investors positioning for economies reopening. For the fourth quarter of 2020, the Alerian MLP Index reflected a total return of 32%. So, thankfully, the sector has been heading in the right direction for a bit.

AA: Where have these equity gains left valuation metrics? Any fear that trading multiples have gotten ahead of themselves?

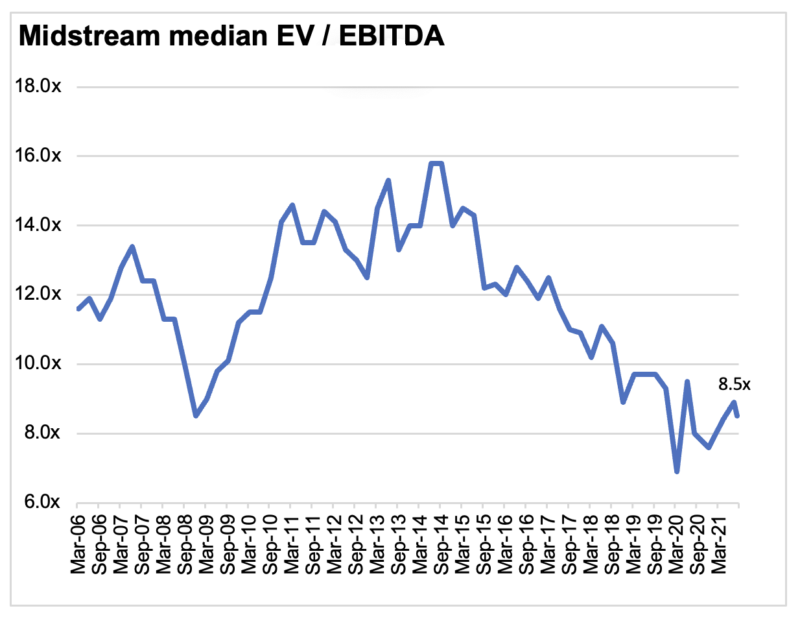

BW: We don’t believe so. Despite the positive performance over the last several quarters, the Alerian MLP Index total return is still slightly down, negative 4%, from the end of 2019 because the first half of last year was impacted by COVID-related volatility. On an enterprise value to EBITDA basis, the sector is trading at a significant discount to the long-term average. On an equity yield basis, midstream appears very attractive compared to other yielding equities. The Alerian MLP Index indicative yield as of August 31, 2021, was 8%, compared to 1.3% for the S&P 500, 3.1% for REITS, and 3.2% for utilities.

Source: Wells Fargo as of August 2021.

AA: Obviously, measures to contain the spread of COVID hit energy demand dramatically in 2020. We all remember front month crude closing at negative $37 per barrel last April. Looking back, how did midstream operators hold up over that period, and has the sector largely recovered at this point?

BW: The headwinds faced by the energy industry last year were unprecedented. Global demand for fuels practically collapsed, which has never happened. The resultant crude oil price collapse was the sharpest in history, and U.S. producers shut-in an unprecedented volume of production.

The impact to midstream earnings was primarily on the volume side. For example, lower gasoline and jet fuel demand caused lower demand to move those products through pipelines and terminals. Well shut-ins meant less volume moving through related midstream assets. So, while certain midstream operators certainly experienced an impact, overall, I think earnings held up much better than original market fears.

For context, first quarter 2020 earnings before interest, taxes, depreciation, and amortization (EBITDA) for public midstream sector participants totaled approximately $16.9 billion, which was prior to significant COVID-19 related disruptions. Second quarter 2020 EBITDA, the quarter most impacted, totaled approximately $15.1 billion, representing an 11% sequential decline. While this impact was sharp compared to a normal environment, given the magnitude of the economic and commodity market disruptions that transpired, I believe the sector’s operating performance was more resilient than some feared.[1]

For context, first quarter 2020 earnings before interest, taxes, depreciation, and amortization (EBITDA) for public midstream sector participants totaled approximately $16.9 billion, which was prior to significant COVID-19 related disruptions. Second quarter 2020 EBITDA, the quarter most impacted, totaled approximately $15.1 billion, representing an 11% sequential decline. While this impact was sharp compared to a normal environment, given the magnitude of the economic and commodity market disruptions that transpired, I believe the sector’s operating performance was more resilient than some feared.[1]

Regardless, sector performance has largely recovered at this point. For the second quarter of 2021, the most recent reporting period, the same cohort of industry participants produced EBITDA of approximately $16.6 billion, down just 2% from the pre-COVID levels seen in the first quarter of 2020.

AA: Do you think midstream operators came away from last year with some new lessons learned? If so, how have they adapted their business practices as a result?

BW: I believe the dramatics of last year just served to hasten change that was already underway. Over the past several years, most midstream companies have begun to maintain much higher coverage ratios than used to be normal. The coverage ratio measures the level of cash flow earned compared to that paid out as distributions. On average, sector coverage ratios have increased from 1.1x in 2016 to approximately 2.0x today.[2]

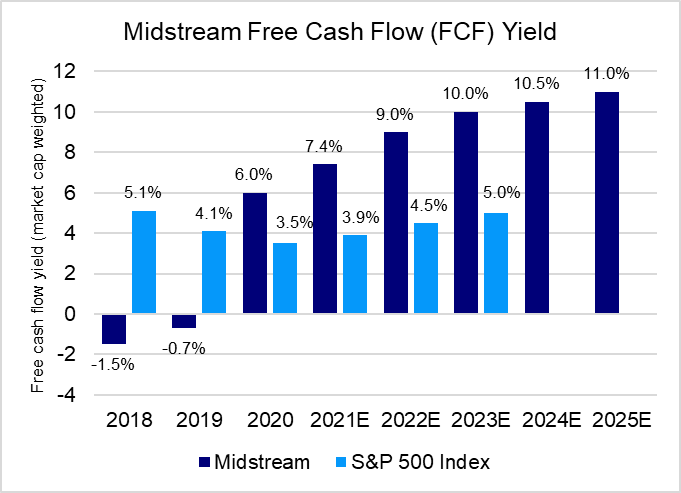

This improvement to the average coverage ratio is dramatic and is very significant. Additionally, we believe the sprawling, decades-long pipeline build-out that was required to serve the emergence of the U.S. shale plays is now largely complete.

So, just as midstream operators are retaining more of their cash flow than ever before, their capital spending requirements are also shrinking. I’ve been involved in midstream investment since the mid-’90s and the sector has never before been positioned to generate this level of free cash flow. It will be interesting to see how management teams deploy the cash generated in the coming years. Thus far, free cash flow has largely been targeted to debt reduction, but as leverage metrics hit desired levels, we believe more substantial share or unit buybacks, as well as distribution growth, is likely.

Source: Wells Fargo as of August 2021.

Therefore, it seems to us that the midstream sector has really just returned to its origins. Prior to the emergence of the shale basins and the massive expansion of midstream assets needed, most operators were low-spend, slow-growth companies paying a reliable and healthy distribution or dividend. We believe that description can fit today as well—except that coverage ratios are substantially better today.

It is also important that U.S. producers (E&Ps), which are midstream asset customers, have been following a similar path of focusing on free cash flow. Last quarter, U.S. E&Ps collectively generated their highest quarterly free cash flow in over a decade.[3] We believe this is good news as it means the average midstream customer is financially healthier than in previous periods.

AA: Governmental and corporate efforts to lower carbon emissions has gained much attention over the past couple of years. How might these efforts impact midstream operators?

BW: Well, it would take hours to address the policy options and the state of alternative energy technology, but it is important to consider these efforts in context. Since the U.S. has emerged as one of the world’s largest energy exporters, we believe the outlook for U.S. midstream volumes, in total, will be driven by global consumption. Further, the outlook for any particular midstream asset is dependent on local conditions, not global aggregates.

When thinking about the macro, however, consider that over the past thirty years, global energy demand has roughly doubled, driven by quality-of-life advances within developing nations. To meet this need, between 1980 to 2018, global crude oil production increased 60%, natural gas production increased 158%, and coal production increased 112% .[4]

Looking forward, developing nations energy demand is likely to continue to expand significantly. For example, over one-third of the earth’s population still lacks access to clean cooking fuel, primarily relying on biomass.[5] While roughly 840 out of every 1,000 U.S. citizens has a vehicle, this ratio falls to 200 per 1,000 in China, and only 41 per 1,000 in India. Consider too that the U.S. population is only 330 million compared to China’s 1.4 billion and India’s 1.37 billion.[6]

While renewables are likely to contribute to developing world energy demand, the cost, logistical, and reliability advantages of traditional fuels remain substantial. Therefore, traditional fuels will likely be an integral contributor to achieving affordable quality-of-life improvements within developing nations. Additionally, even some developing nations are attempting to limit their reliance on coal for power generations, resulting in a more pronounced reliance on natural gas and renewables relative to history.

While renewables are likely to contribute to developing world energy demand, the cost, logistical, and reliability advantages of traditional fuels remain substantial. Therefore, traditional fuels will likely be an integral contributor to achieving affordable quality-of-life improvements within developing nations. Additionally, even some developing nations are attempting to limit their reliance on coal for power generations, resulting in a more pronounced reliance on natural gas and renewables relative to history.

For example, coal accounts for 58% of China’s primary energy mix, versus less than 10% for natural gas currently, but China has announced intentions to reduce this dependence. If countries across the globe converted from coal use to natural gas, that alone could reduce up to 1.2 gigatons of CO2 emissions, the equivalent of removing 260 million cars from the road.[7]

As a result, if historical energy demand continues as it has over recent decades, or is even close, significant renewables substitution within developed nations is likely to be materially offset by the energy needs of the developing world population.

AA: You mentioned that individual midstream asset performance isn’t necessarily tied to total oil and gas demand anyway. Can you discuss that disconnect?

BW: Of course. What matters is the volume and margin outlook for a midstream operator’s specific assets. The grand total of oil and gas consumption across the globe doesn’t really enter that equation.

For example, U.S. shale basins have been the only global basins to exhibit meaningful growth over the past decade, and given the paucity of global oil and gas investment over the past five years, this trend is likely to continue. Therefore, even in an environment where global crude oil or natural gas demand is declining, U.S. shale basins may deliver steady or growing production, to the benefit of associated logistics assets and those assets that enable exports.

While aggregate domestic gasoline demand may begin to decline due to the adoption of electric vehicles (EVs) at some point, such adoption is unlikely to happen uniformly across geographies. Diesel demand is likely to be little changed for some time, and no realistic option for jet fuel has emerged. Further, those product pipelines that do experience volume declines may seek rate relief within their regulatory framework to maintain return thresholds regardless.

AA: Are any midstream companies pursuing opportunities related to decarbonization efforts?

BW: Many midstream providers are already, and will continue to benefit, from existing and emerging emission reduction efforts. For example, the use of biofuels is likely to increase, and the transportation, handling, and delivery of biofuels is already a significant business for a number of midstream operators.

Global carbon capture capacity is already set to increase by more than 4x over the next 10 years.[8] This process requires an array of logistical assets that existing midstream providers are well suited to provide.

The use of hydrogen may increase as businesses seek alternatives to hydrocarbons in certain industrial processes that require high heat and for certain transportation needs. Midstream operators would likely be the best positioned, through existing asset footprints and experience, to enable the transportation and handling of hydrogen should these efforts succeed.

We believe, over time, midstream operators will become important providers of services required to enable the use of renewables.

AA: Thank you, Brian.

This article has been prepared solely for informational purposes and is not to be considered as investment advice or an offer or a solicitation for the purchase or sale of any financial instrument, property, or investment. It is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. The information contained herein reflects the views of the author(s) at the time the article was prepared and will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing or changes occurring after the date the article was prepared.

[1] Company filings, Bloomberg L.P., Invesco SteelPath as of 8/31/2021.

[2] Wells Fargo as of 8/31/2021.

[3] Company reports, Bloomberg L.P., and Invesco SteelPath as of 8/31/2021.

[4] EIA 2020.

[5] IEA 2019.

[6 Energy.gov 2017 report

[7] IEA 2019.

[8] US Capital Advisors as of 6/30/2021.

Brian Watson is a Managing Director and Senior Portfolio Manager for the SteelPath team at Invesco. In this role, he is focused on the SteelPath strategies. Mr. Watson joined Invesco when the firm combined with OppenheimerFunds in 2019. At OppenheimerFunds, he was a director of research and portfolio manager for the SteelPath strategies. Prior to that, he was a portfolio manager and led the MLP research effort at Swank Capital LLC in Dallas, Texas. Mr. Watson also covered the MLP and diversified energy sectors for RBC Capital Markets in the firm’s equity research division. Before that, he worked for Prudential Capital Group, helping to analyze, structure, and invest in private debt placements issued primarily by companies involved in the energy industry, including those involved in oilfield services, midstream services, and oil and gas exploration and production. Mr. Watson earned a BBA degree from the University of Texas at Austin and an MBA from the McCombs School of Business at the University of Texas at Austin. He is a Chartered Financial Analyst® (CFA) charterholder.