The Energy Infrastructure Newsletter • Spring 2025

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

The Growing Impact of the Global LNG Sector

Advisor Access spoke with Michael Openlander, a managing director in the global energy investment banking group at Moelis.

Advisor Access: The global liquified natural gas (“LNG”) sector continues to grow in market size and importance. How does this sector work and what key market dynamics underpin these trends?

Michael Openlander: The LNG sector is an established, yet growing facet of the broader global energy market that exists to connect the world’s largest LNG exporting countries led by the U.S., Qatar and Australia primarily via marine shipping to the world’s largest structurally short LNG import markets in East Asia (China, Japan, South Korea), Europe, India and the rest of Asia in additional other smaller regional demand markets.

The growing size and importance of the global LNG sector is being driven by continued global energy demand growth, an increased focus on energy security, natural gas and LNG’s relatively lower emission profile compared to other traditional forms of energy including coal and oil, and natural gas and LNG’s high reliability for baseload power generation supply compared to intermittent forms of energy supply from the renewable energy sector.

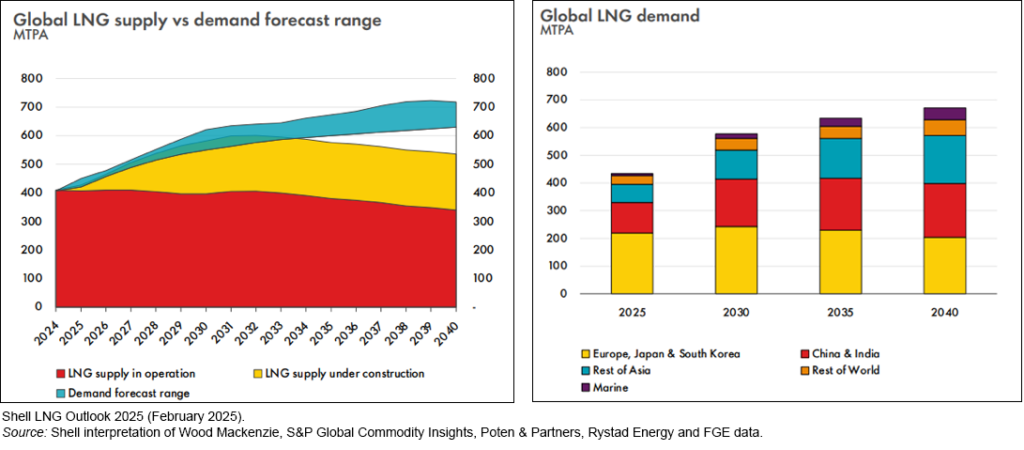

AA: How large is the global LNG market and how much is it expected to grow by 2040?

MO: The global LNG supply in operation currently is approximately 400 million tons per annum (MTPA) with another approximately 200 MTPA of LNG supply under construction.

Over the next 15 years, global LNG demand is expected to grow another 200 MTPA with South and South East Asia driving much of the incremental LNG demand.

AA: Why is the U.S. playing an increasingly prominent role in adding incremental LNG supply to the global market?

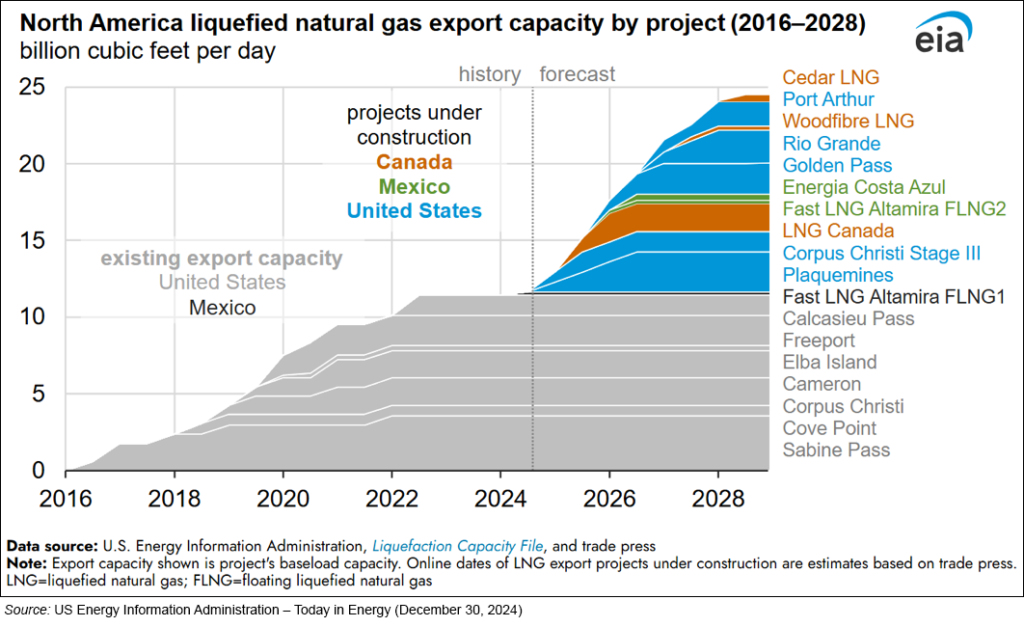

MO: U.S. natural gas production has grown significantly over the last 15 years because of the U.S. shale revolution. This has resulted in excess U.S. natural gas supply and low prices relative to key international demand markets, providing the economic incentive for the U.S. to steadily increase its LNG export levels. As a result, the U.S. is expected to close to double its LNG export capacity from projects under construction which represents the majority of the North American LNG export market.

Beyond the U.S. LNG projects currently under construction, there are many more U.S. LNG projects under development with the potential to materially increase U.S. LNG capacity beyond the capacity currently in operation and under construction.

AA: The U.S. has a significant amount of LNG export projects under development but not yet funded and under construction. How has the regulatory environment changed under the Trump administration and how is that impacting further development of the U.S. LNG export market?

MO: The Trump administration has prioritized removing regulatory hurdles and granting key permits and authorizations to allow for continued development of U.S. LNG export projects. As an example, the Trump administration passed a series of executive orders in January 2025 that returned the U.S. Department of Energy to regular order related to consideration of pending applications to export U.S. LNG to countries without a free trade agreement (“FTA”) with the U.S. in accordance with the Natural Gas Act. This was an important action because the U.S. exports the majority of its LNG to non-FTA countries. These authorizations are critical for the commercialization and financing of new U.S. LNG export projects.

AA: How is the continued build out of the U.S. LNG sector being financed and what key sub-sectors of the energy value chain are driving the development?

MO: U.S. LNG projects are being developed by both large investment grade energy companies as well as private, entrepreneurial developers.

The large cap companies are dominated by global energy majors, integrated utilities and diversified midstream companies. Most of the LNG projects developed by these companies are financed on balance sheet through existing cash flow and established access to both the public and private capital markets.

The private developers are in many cases pure play LNG developers with less certain access to capital. If a private developer is successful in commercializing an LNG project, they typically will fund the project through a combination of private equity, infrastructure funds and project bank debt. If the private developers are successful in achieving commercial operations, there are examples of continued LNG project development and increased access to the capital markets including via an initial public offering.

AA: You mentioned the importance of the global LNG sector on energy security, CO2 emissions reduction potential and baseload power generation. What are some examples of these dynamics in the market?

MO: The Russia/Ukraine conflict brought energy security to the forefront for Europe. Heavy European reliance on Russian natural gas supply was structurally impacted as the conflict started and continues today. Global LNG supply has been a large part of the energy security solution for Europe as they decreased their exposure to Russian natural gas.

Coal-to-natural gas switching for power generation has allowed the U.S. to materially reduce its CO2 emissions over the last 15 years. Replicating this dynamic on a global scale using global LNG supply into developing economies in Asia, which are still highly reliant on coal fired power generation, has the potential to be one of the largest CO2 emissions reduction solutions globally in the coming decades.

With the AI / datacenter growth boom well underway, power generation and baseload energy supply constraints are expected to be limiting factors without large scale investment in incremental baseload energy supply. Natural gas and LNG’s relatively lower emission profile to coal and higher reliability than renewable energy, position it to be a major piece of the AI / datacenter power supply solution in the coming years.

AA: Any parting comments for our readers?

MO: As global energy demand continues to grow, the global LNG sector is poised to continue to play a major role in the global energy supply mix for decades to come given its unique attributes balancing reliability, global availability, emissions reduction potential and scale relative to other forms of energy supply. These dynamics are driving strategic decisions across the LNG value chain, and we’re seeing them shape how companies approach investment, development , and financing.

AA: Thank you for your insights, Michael.

Michael Openlander is a Houston based managing director in the global energy investment banking group at Moelis, a leading global investment bank. He advises clients in the energy infrastructure sector including the LNG, downstream, midstream and sustainability sub-sectors. Michael has over 20 years of investment banking, corporate finance and accounting experience and has advised on a wide variety of strategic advisory, M&A, capital markets and restructuring transactions in the U.S. and globally. Michael previously worked in the global energy & power investment banking group at Bank of America Merrill Lynch. Earlier in his career, he held positions of increasing responsibility at Baird, Marsico Capital Management and PwC. Michael earned a B.S. in finance and a B.S. in accounting from the University of Missouri–St. Louis and an M.B.A. from the Mendoza College of Business at the University of Notre Dame

This material is intended solely for informational purposes and has been prepared based on publicly available information and third party sources identified herein. Statements of facts and opinions expressed by Michael Openlander are those of Mr. Openlander and do not represent the opinion or recommendation of Moelis & Company LLC or its affiliates (“Moelis”). This material is not intended to provide the basis for any decision on any transaction and is not a recommendation or an offer to sell or a solicitation to purchase any security, option, commodity, future, loan or currency. Moelis assumes no responsibility for independently verifying the information and disclaims any liability in connection with this material and makes no representation or warranty as to the accuracy, completeness or reasonableness of the information herein. Moelis provides mergers and acquisitions, restructuring and other advisory services to clients and its affiliates manage private investment partnerships. Its personnel may make statements or provide advice that is contrary to information contained in this material.

DISCLOSURES

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements. This information may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. The author had final approval of the content and is wholly responsible for the validity of the statements and opinions.

The EIC Newsletter for Advisors is solely distributed by Advisor Access. The Advisor Access full disclaimer is to be read and fully understood before using our site. By viewing our website, you are agreeing to our full disclaimer which can be read at: www.advisor-access.com/disclaimer.

The EIC is a registered trademark of the Energy Infrastructure Council and information provided by the EIC in this newsletter or on the website may not be used without the written consent of the EIC. Contact the EIC directly for said permission: lori@eic.energy.

Newsletter Sponsors have paid Advisor Access a fee to include their corporate logos in this newsletter and as such their logos are to be considered advertising. Sponsor logos are the trademarks and property of the individual companies.

ABOUT ADVISOR ACCESS

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision.