The Energy Infrastructure Newsletter • Summer 2023

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

This Is the Golden Age of Midstream

By Sean Maher, Partner, Third Gear Investment Management

In 2021, we entered the “Golden Age” of Midstream. This period is defined by economic prosperity (cash flow) and duration due to high barriers to entry and the importance of an asset’s ongoing operations.

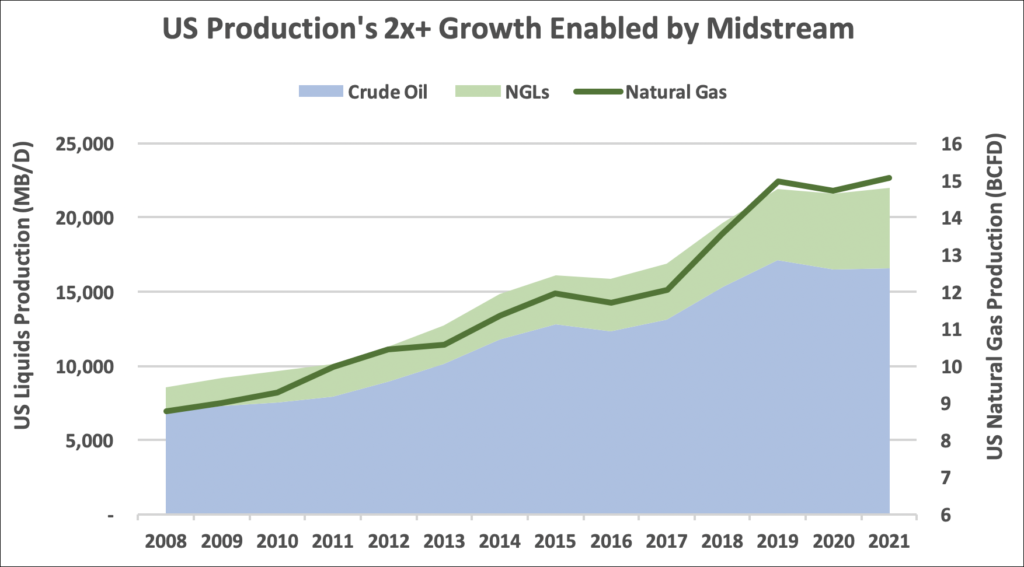

While the Permian Basin has been around for over 100 years, its resurgence is a mere 10+ years old. Production growth boomed in the Bakken, Marcellus, and Utica shales in 2010, and the Eagle Ford and Haynesville shales became more prominent in 2007. This production growth was possible due to the billions of dollars of capital invested by midstream companies to connect the resource to the end market. Before 2010, while there was significant infrastructure, the shale boom required massive investments in new pipelines, storage terminals, processing plants, and export docks; midstream was the horse the upstream industry had to ride to market; midstream companies did not disappoint – they built the assets and enabled production growth. Midstream companies spent over $500 billion in the 15 years up to 2021 to allow this, which increased their asset footprint and cash flow.

Exhibit 1

Source: BP Statistical Review of World Energy (2022)

Exhibit 2

Source: Bloomberg

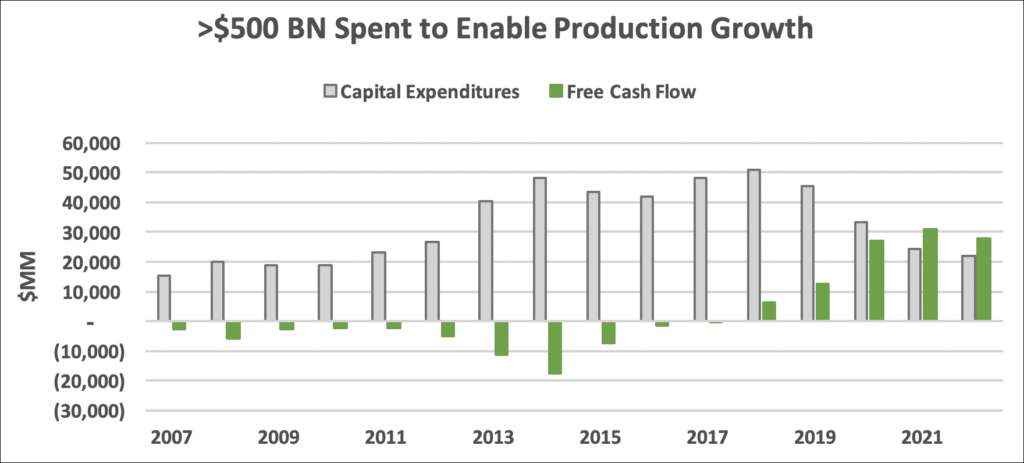

Why is it my contention that we entered the Golden Age of Midstream in 2021? Free cash flow surpassed capital expenditures for the first time. Recognizing this inflection was a critical first step in understanding the value of the investment opportunity in best-in-class midstream. This free cash flow should continue – and is expected to continue – for the foreseeable future. From there, to gain confidence in this paradigm shift, one must embrace three additional albeit crucial points: 1) we know where the resources (hydrocarbons) are, 2) we have the infrastructure to provide egress for those molecules and bring them to market, and 3) management teams will remain disciplined in capital spending.

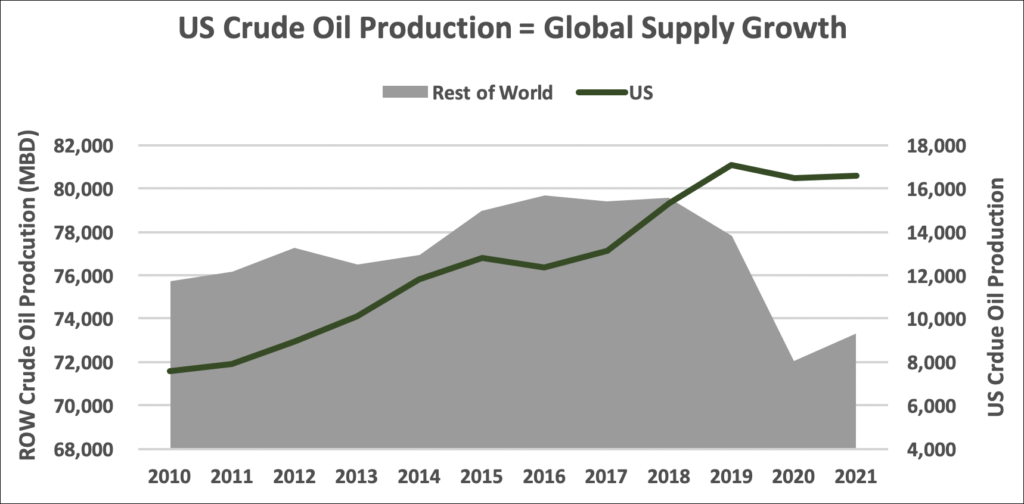

Regarding the first and second points, since the emergence of hydraulic fracturing, we have found extractable hydrocarbon resources all over the continental U.S. This was critical in enabling the production boom from 2010 to 2020. Anecdotally, but speaking to the importance of the U.S. energy industry, is the fact that the U.S. has been the primary source of global supply growth since 2010, as shown in the exhibit below; the importance of U.S. production cannot be overstated. The U.S. upstream market enables global economic growth, and midstream brings those molecules to market.

Exhibit 3

Source: BP Statistical Review of World Energy (2022)

Exhibit 4

Source: Bloomberg

Financially, many midstream companies appear to be in excellent shape as they continue to see stable fee-based cash flows, capacity for economic growth through optimization, and smaller “bolt-on” projects. Suppose one were to assume that U.S. crude oil and hydrocarbon production remained flat over the next decade. In that case, the inflection shown in Exhibit 2, coupled with the strong EBITDA shown in Exhibit 4, should highlight the long-term, cash-cow nature of the investment vehicle.

With the resource plays identified and extensive infrastructure added in the form of processing plants, fractionation units, export docks, storage terminals, long-haul and short-haul pipelines for crude oil, natural gas, and natural gas liquids, the last critical piece, in my opinion, based on over 20 years analyzing and covering energy companies, is the capital discipline of management teams. This is easily evidenced by the marked decline in capital expenditures in Exhibit 2, but, notably, it further highlights that if we already have the infrastructure in place, we don’t need more, and the midstream sector will not build on spec – they require contracted cash flows to undertake new investments; my discussions with management teams lead me to believe that the days of hope through acreage dedications are long gone as the producer had no pending liability and the midstream operator bore all the risk.

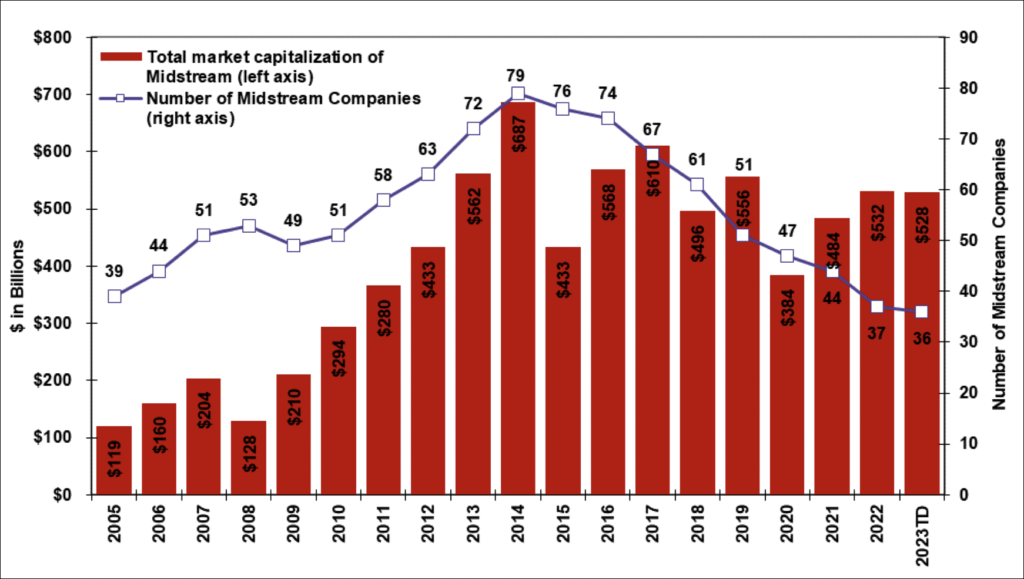

The second point supporting capital discipline is the wave of consolidation we see today. Consolidation is critically important as it improves the economics of each molecule transported, can strengthen balance sheets, and enhance optionality to the producer customers (who are also consolidating). The industry began consolidating in 2014, as shown in the chart below, but in 2021, the sector entered what will likely become the final wave of consolidation. With Enterprise Products’ acquisition of Navitas, Phillips 66’s acquisition of DCP Midstream, Energy Transfer’s purchase of Enable and Lotus, and Targa’s purchase of Lucid, the dominos are falling. Based on my experience, another recently announced transaction will likely accelerate the pending merger and acquisition cycle, and differentiation will be driven by scale, balance sheet strength, optionality, and export capacity.

Exhibit 5

Source: Wells Fargo Equity Research

The reduced capital spending is predominantly driven by 1) pipe already in the ground and limited ability to increase a footprint along a congested Gulf Coast, 2) management discipline due to their equities being rewarded for returning capital to shareholders through higher dividends and unit/share repurchases, and 3) high barriers to entry, which will impede the ability of start-ups to attack incumbents, especially considering the higher cost of capital in the current rate environment.

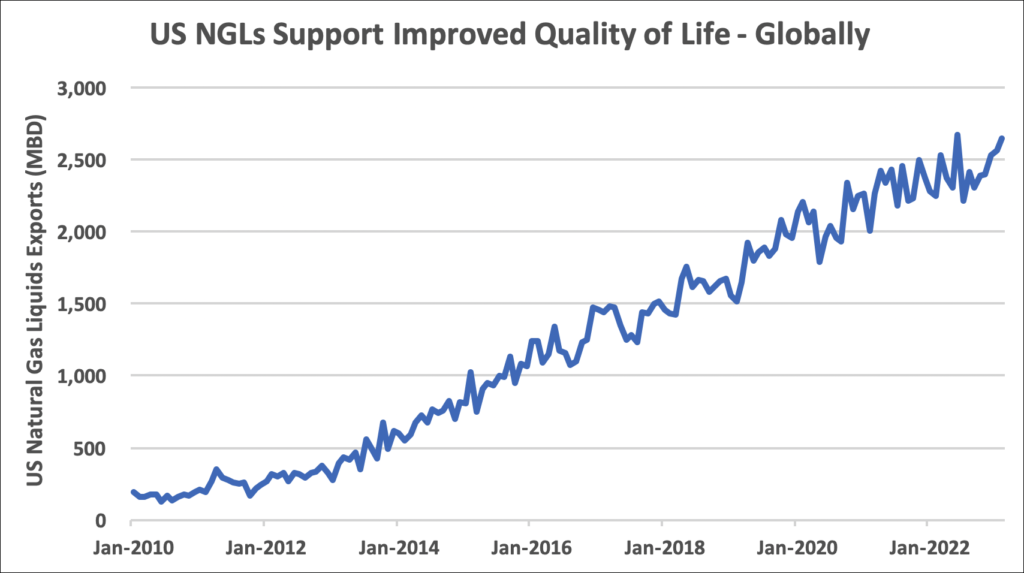

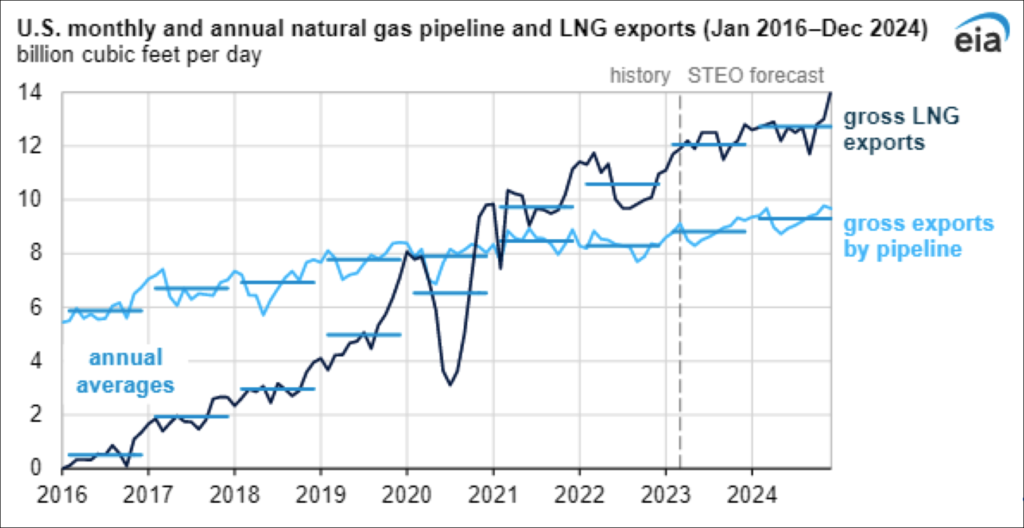

U.S. midstream enables the global economy to access U.S. hydrocarbons, whether natural gas, natural gas liquids, or refined products. As we look forward, demand for hydrocarbons will continue to rise as nearly 1.2 billion people enter the middle class by 2030 (as per the Brookings Institute), about a 35% increase from today. There remain ~3.5 billion people in energy poverty worldwide (as per the International Energy Agency [IEA]). When 80% of the global population lives in Africa, India, and Asia in 2050, the U.S. midstream industry should continue to be the conduit to provide access to a large amount of the natural gas, propane, natural gasoline, and butane that these economies use for reliable, low-cost power. The value of U.S. hydrocarbons and U.S. midstream to enable global economic growth cannot be overstated, as shown in the charts below.

These infrastructure assets are relatively new and will generate significant free cash flow for the foreseeable future. That free cash flow is the opportunity for investors today, as these assets will continue to pay out attractive cash yields on equity as they return capital to unitholders through cash distributions or dividends, share repurchases, and debt retirement.

Historically, midstream companies were comfortable carrying higher levels of debt, and degrees of leverage, due to the longevity of the cash flows associated with the assets. However, following the pandemic in 2020, many management teams began aggressively reducing their debt levels; the less debt on hand, the higher the quality of the equity. Economics also supports this new mantra as the cost of debt has risen by nearly 400 basis points in the last year; management teams are incentivized to attack the debt in the capitalization stack and will be more inclined to pay off the debt with cash.

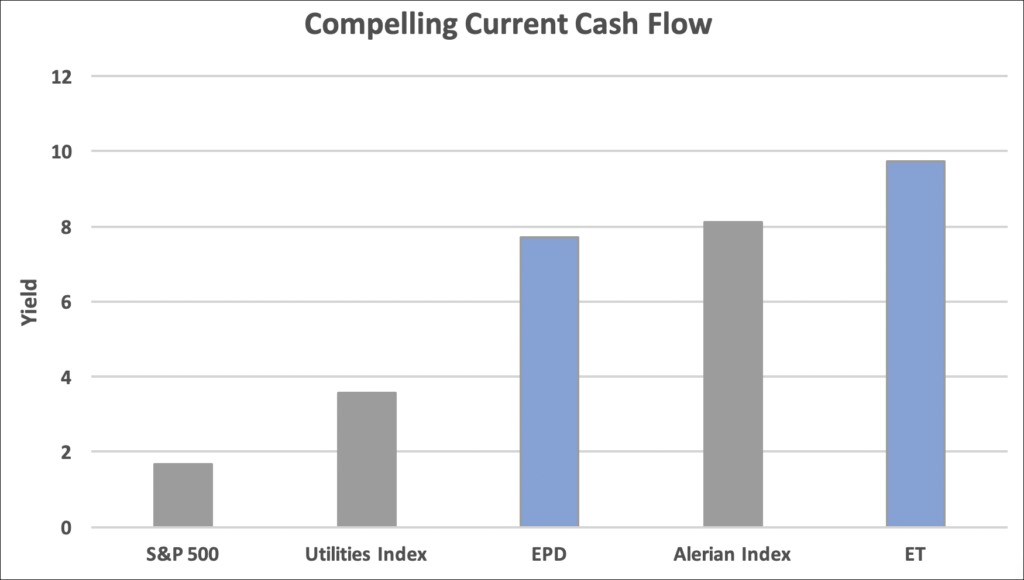

Generally speaking, the quality of cash flows also improves as midstream companies consolidate due to asset (cash flow) diversification, (producer) optionality, and (lower borrowing costs) balance sheet improvement. From a valuation perspective, many midstream companies currently yield 2–3x the S&P 500, as shown in the exhibit below. At the same time, coverage ratios are ~2x what they were in 2010–2014 based on company reporting and analyst expectations. While the risk to their future cash flows is primarily around specific asset-related issues or the lack of use of hydrocarbons in the next 20 years, a 2x buffer on a yield that is 2x higher than the market seems conservative – in my view.

Exhibit 6

Source: Bloomberg

None of this should suggest that Midstream companies are sitting on their hands. Significant work is being done to optimize their systems for economic and environmental benefits, which often go hand in hand. Midstream companies facilitate change from within by enhancing efficiency, improving asset utilization via automation, and endeavoring to use assets in new ways. The expertise within these companies is without parallel, and they are taking advantage of the opportunity to harness the engineers within these organizations to continue improving every day – without sacrificing safety. One needs to look no further than Enterprise Products’ bold Project $9.0 billion EBITDA internal company goal in 2022. This was raised to Project $9.3 billion in 2023 – excellence never sleeps.

Every midstream company is unique, and as the number of companies continues to decline, the importance of stock selection via deliberate, active management increases. Midstream management teams are fastidious in their focus on safety, and their balance sheet leverage continues to decline via debt reduction. Today, and for the foreseeable future, management teams will be proactive, as they are not beholden to the equity capital markets for financing; they are free cash flow positive.

Today, ~20 midstream companies are worth over $400 billion in market value. Two companies are valued at more than $50 billion, and 10 are less than $10 billion in market value. As indices are forced to buy all – or nearly all – securities, there is little ability to avoid those not as well positioned, thereby diluting returns. Investors must be selective and know what they own and why. Diversifying in a shrinking universe of available investments merely means return degradation.

Exhibit 7

Source: Energy Information Agency

Exhibit 8

Source: Energy Information Agency

In summary, it is my assertion that the Golden Age of Midstream is at hand, as these companies, integral to global economic growth and demand, have already spent $100s of billions on building the infrastructure necessary to get current production growth to the worldwide market. The industry was built by pioneers like Dan Duncan and Rich Kinder and continues to evolve.

Still, the message is as vital as ever: touch the molecule as often as possible in the transmission from producer to consumer and buy value when the market is chasing growth. Today, in midstream, an attractive opportunity exists for stable, long-lived cash flows in a market pursuing “growth” over “value.” The industry has matured rapidly over the past 20 years, but with spending slowing, cash flow stable and rising, and management discipline reigning, the Golden Age of Midstream is entirely underway.