The Energy Infrastructure Newsletter • Summer 2024

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

US Natural Gas Demand Is About to Take Off

Advisor Access spoke with Michael J. Blum, a managing director at Wells Fargo Securities.

Advisor Access: There are so many articles and news features about the growth of Artificial Intelligence (AI) and the coming boom in datacenter growth. What does this have to do with energy stocks?

Michael J. Blum: The launch of ChatGPT by OpenAI in November 2022 marked a significant leap forward in the field of artificial intelligence (AI). ChatGPT and other AI applications are large language models that train on vast amounts of text, images, and data so that when a user asks the AI interface a question or tasked AI to generate a report or an image, it can do so almost instantaneously. This new generation of AI requires significant computing power. The graphical processing units or GPU chips made by Nvidia and others are the engine that makes AI go and these new chips are power hungry! And they are only getting more power hungry. For example, Nvidia’s latest GPU consumes 30% more power than its predecessor AND each server has more GPUs than the previous generation.

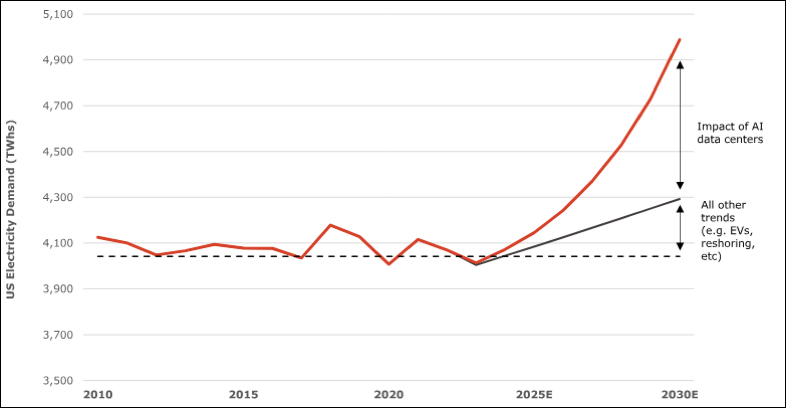

Our analysis suggests that the buildout of AI data centers will drive a step change in U.S. power growth. We calculate AI will require almost 700 TWhs [terawatt-hours] of incremental power by 2030E on an unconstrained basis. To put that in perspective, the U.S. power market today consumes about 4,000 TWhs of electricity. Over the past 15 years, U.S. power demand has been relatively flat. But AI datacenters and other trends (e.g., EVs, reshoring) could increase demand by 20% through 2030, or at a 3% compound annual growth rate (and keep growing beyond that).

Source: Wells Fargo Securities, LLC Estimates

AA: That all sounds great but I’ve read that the hyperscalers building this next generation AI want to use “green” power exclusively for these new data centers. How does this impact natural gas demand?

MB: It’s true that Google, Microsoft, Amazon and the like have made public statements about their desire to power their new AI data centers exclusively with green electrons. But we believe this is mostly aspirational. The reality is that renewables will likely not be able to keep pace given permitting and regulatory hurdles (for example, the wait time to connect new renewable projects to the existing electric grid is five years). Then there’s also the challenge of intermittency. AI data centers will require 24/7 power, whereas wind and solar, even with battery storage, can only provide power when the wind is blowing and the sun is shining. So, while we do expect the renewable industry to capture a sizable share of AI datacenter growth, we think natural gas will make up most of the difference.

AA: How much incremental natural gas demand are we talking about?

MB: Of the 700 TWh of incremental power demand we forecast through 2030, we assume 40% of incremental demand is met by natural gas, 30% by wind and 30% by solar. This translates into +7 billion cubic feet/day (Bcf/d) of incremental gross natural gas demand, +31 GWs gigawatts [GWs) of annual solar installments and +21 GWs of annual wind. For context, the U.S. market today consumes ~106 Bcf/d of natural gas and of that amount, ~35 Bcf/d is consumed in the power sector. Therefore, datacenter demand alone represents 20% growth potential.

AA: Are there any other changes to U.S. natural gas markets we should focus on?

MB: Yes! The AI datacenter buildout is just one driver of the rapid growth in natural gas demand we project. There are several other drivers of accelerating U.S. natural gas demand over the next five+ years. First and foremost is liquefied natural gas (LNG) (which represents demand to export natural gas from a U.S. demand perspective). Based on projects that are definitely moving forward (i.e., have reached final investment decision), we project 13 Bcf/d of incremental LNG demand by 2030. The reshoring of manufacturing to U.S. shores, electrification trends, and the growing adoption of electric vehicles will also contribute to higher natural gas demand. We estimate these trends will add 3 Bcf/d of natural gas demand by 2030. Taken together, that’s 23 Bcf/d of incremental natural gas demand on a base of 106 Bcf/d (or 22% growth!).

AA: What’s the best way to invest in this theme?

MB: We see the large natural gas midstream and pipeline operators as best positioned to benefit from this trend. Growing natural gas demand from new power generation should spur incremental opportunities to expand pipeline networks over time. Companies that gather natural gas in the primary gas basins that will experience growth in supply (which includes the Marcellus share in the northeast United States and the Haynesville share in North Louisiana) should also benefit via higher utilization of assets. We expect natural gas midstream stocks to see multiple expansion (expanding valuations) as the market begins to recognize the long-term staying power of natural gas that will be required for decades.

AA: Why shouldn’t I just buy natural gas producers? Won’t all this new demand cause prices to increase?

MB: While it’s quite possible that all this new natural gas demand will lead to higher prices, it’s also possible that it won’t. That’s because the U.S. has abundant supplies of natural gas. So incremental demand will certainly spur new drilling activity causing volumes to rise but because the U.S. can meet the new demand with abundant supply, the price of natural gas might not rise that steeply. What we do know is that this incremental supply will flow on pipelines to end markets, boosting the profits for natural gas pipeline companies.

AA: Any last thoughts on the topic before we go?

MB: Our last thought to leave you with is that we still think we’re in the early innings of a multi-year investment theme. Natural gas pipeline stocks have slightly outperformed the overall midstream sector this year, driven, in part, by the themes we’ve been discussing but we think there’s plenty more room for additional outperformance over the coming years. Investors are just starting to appreciate the transformation taking place in the natural gas market with growing domestic demand likely to provide midstream gas assets with years of secular tailwinds.

AA: Thank you for your insights.