The Energy Infrastructure Newsletter • Winter 2023

As an investment advisor, you have been subscribed to the Energy Infrastructure Newsletter so that you and your clients can stay abreast of this powerful emerging subsector. Formerly the MLP Newsletter, the Energy Infrastructure Newsletter is published in partnership with the Energy Infrastructure Council, a nonprofit trade association dedicated to advancing the interests of companies that develop and operate energy infrastructure. EIC addresses core public policy issues critical to investment in America’s energy infrastructure.

Dirty Little Secrets 2024:

The Volatility Will Continue Until Morale Improves

Advisor Access spoke with Justin Carlson, Chief Commercial Officer of East Daley Analytics.

Advisor Access: The energy landscape has gone through a tremendous amount of change in the last few years. What additional volatility do you see on the horizon?

Justin Carlson: As an analytics organization, East Daley focuses on driving transparency in the energy space by connecting supply, demand, and profitability through infrastructure data and market analytics. In connecting all these factors, we find ourselves having to address volatility on virtually every front.

Justin Carlson: As an analytics organization, East Daley focuses on driving transparency in the energy space by connecting supply, demand, and profitability through infrastructure data and market analytics. In connecting all these factors, we find ourselves having to address volatility on virtually every front.

The shift in focus towards the energy transition, and the impact that transition has on traditional hydrocarbons, is one big driver. The energy transition is an ever-present concern, along with a greater appreciation for reliability and energy security. The reality is overall demand for energy is climbing, including record levels for gas-fired power in the U.S., as well as record exports of natural gas, crude, and natural gas liquids (NGLs). Growth often leads to volatility, as well as seasonal volatility from weather events.

Supply continues to hit record levels, and we expect to see greater geographic diversity of that supply growth as prices climb into the future. At the same time, capital discipline still matters, and energy infrastructure development has shifted to a more just-in-time approach as opposed to the usual overbuild. These factors have tightened the supply and demand balance in energy commodities, which will translate into increased volatility as investors and market participants adjust to infrastructure announcements, shifting supply dynamics, unexpected demand needs, and the resulting volatility in commodity prices.

AA: Speaking of prices, natural gas saw a wild fluctuation in price over the last two years and you all made a bold $2.00 gas call when prices were at $8.00. What’s the future hold?

JC: The gas market has become more complicated due to growth in power demand, the impact of intermittent renewables, and the need for more storage and pipeline infrastructure to connect supply growth to new demand from liquefied natural gas (LNG).

To declutter that story a bit, LNG is the main driver. Prices are likely to remain under pressure to start 2024 given that no new LNG facilities are due to start and absorb additional supply until Golden Pass and Plaquemines LNG come online. These projects will add 5 billion cubic feet/day of additional demand, ramping up by the end of the year. Additional LNG demand growth in 2025 and beyond will continue to increase prices to pull more supply into the market. Longer term, we believe the forward curve for gas is not high enough because the market is waiting on more certainty around some new LNG facilities that have not reached final investment decision (FID). Several of those announcements are expected in 2024, which will drive some volatility into the forward curve.

With regard to power demand, forecasting is made difficult by intermittent renewable sources and normal weather variance. Given how tight the market is, these factors will drive up price volatility, especially given the more limited ability of storage facilities to manage those imbalances. From an equity perspective, volatility could create some investment opportunities in an environment that looks very promising for natural gas-weighted infrastructure companies.

AA: From a geographic perspective, the Natural Gas Liquids sector seems less complicated. Where is volatility expected in this market?

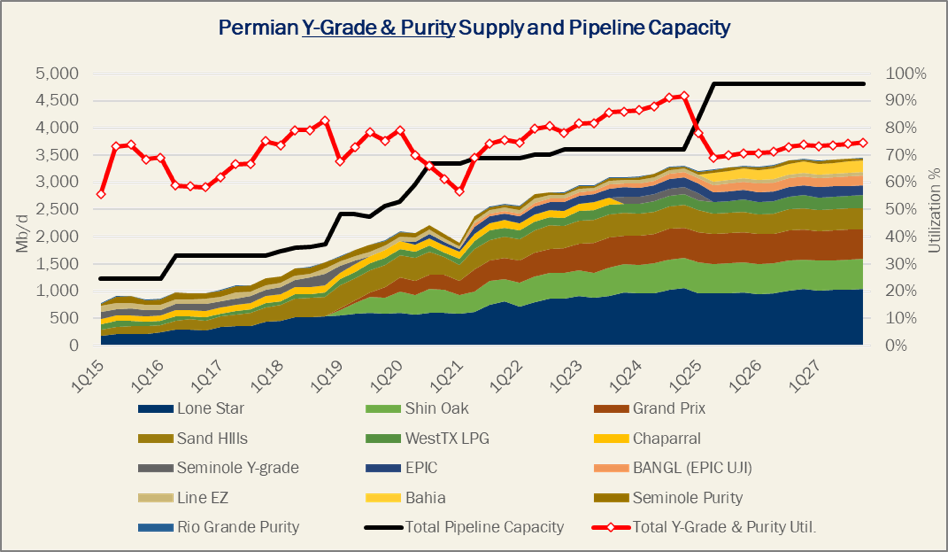

JC: Understanding markets for NGLs is primarily about understanding how supply from the Permian Basin makes its way to export facilities. The Permian accounts for 44% of US NGLs, plus nearly all future growth.

What is fascinating in this market is that midstream operators have announced several new NGL pipelines. In our view, we see an overbuild relative to new gathering and processing infrastructure being built, and downstream, the ability to fractionate NGLs into purity products like ethane, propane, and butane. Unless production grows more than our models or supporting infrastructure suggests, there will either be empty pipes or a lot of competition for molecules. This could create quite a bit of variability for earnings in NGLs, as well as heavy competition in the merger and acquisition (M&A) space to secure upstream infrastructure to capture more market share.

AA: Crude is the last leg of the hydrocarbon stool. Is there a more dynamic Permian story here as well?

JC: The Permian Basin certainly plays a critical role in crude oil as the largest source of U.S. supply and future production growth. However, the Permian is not the only story.

The market is also closely monitoring the start of the Transmountain Pipeline expansion in Canada, which will push crude to Canada’s only export dock. The project will boost Pacific exports by over 500 million barrels/day, or 10% of heavy crude supplied to the U.S. by Canada. We expect nearly half of this supply will impact U.S. refinery feedstock, and will not be easily replaced with lighter barrels coming from the Permian. Thus, we may see an uptick in heavy imports in the short term, and potentially more Gulf of Mexico or Canadian drilling in the longer term. The other half will impact what we export from the Gulf Coast.

The U.S. is also more influenced by global market dynamics, since refinery demand is not growing while exports have increased from zero in 2015, when export authorization was granted, to 22% of demand by 2025. The crude market is expected to remain tight as the Organization of the Petroleum Exporting Countries (OPEC) continues to stabilize crude prices through cuts. Thus, any rumor of supply or demand changes will create volatility and influence the valuation of midstream companies.

AA: From a capital markets perspective, how is the midstream space positioned relative to all this volatility and what should investors expect?

JC: Of course, volatility in commodity markets affects earnings for midstream companies and influences the market’s expectation of future profitability. East Daley also expects volatility to arise as midstream companies continue to pursue M&A opportunities for the next several years.

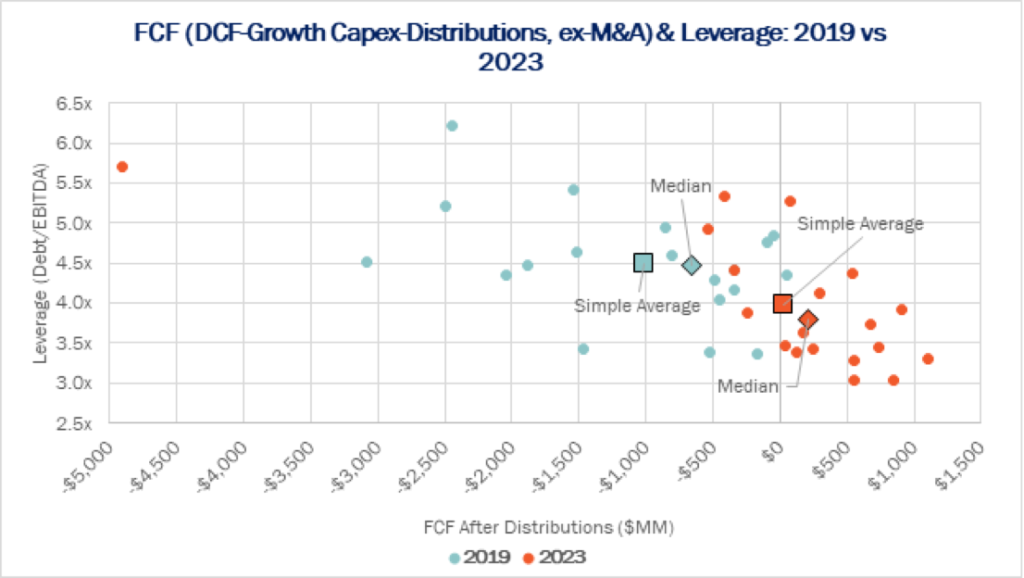

We see several factors pushing more M&A. On one hand, midstream is in a position where it can afford to go on a buying spree. Growth capex (ex-M&A) has declined 30% from 2019 to 2023, from $42 billion to $29 billion. Free cash flow after distributions has swung from negative to positive, and leverage has trended below 4.0x across our coverage.

Additionally, there are a lot of projects already on the books that will meet current growth expectations. With excess free cash flow and less need for more big-ticket greenfield projects, companies will have to look to M&A to drive growth and improve their competitive positioning. Building greenfield projects is not getting easier, which increases the value of owning assets already in the ground. Finally, there is an opportunity now to buy assets in Tier 2 basins and other underappreciated areas, prior to their value being more fully appreciated in the next 5–10 years as export demand continues to expand.

In the coming weeks, look to East Daley’s annual Dirty Little Secrets report, where we will expand on our commodity market expectations and the impact to public midstream companies in much greater detail.

AA: Thanks for your insights, Justin.