FEATURED COMPANY

Click HERE to download a printable version of this newsletter.

Who Says You Can’t Mix Water and Gas?

Over more than 130 years, Aqua America (NYSE: WTR) has grown to become a leader in the water and wastewater utility industry, serving more than three million people across eight states. With the acquisition of the Pittsburgh-based natural gas distribution company, Peoples, Aqua is building on its expertise in infrastructure investment, regulatory compliance and operational excellence with a new platform for growth. With complementary service territories focused primarily in Pennsylvania and a long history of service to their communities as regulated utilities, the two companies are a strong fit that will provide many compelling opportunities for growth and investment. The Peoples acquisition puts Aqua in a strong position to continue to deliver shareholder value while also serving the company’s mission of improving the lives of customers through investing in infrastructure for safe and reliable service.

- Acquisition of Peoples natural gas utility adds more than 740,000 customers and increases rate base by nearly 50%

- Delivered 73 consecutive years of dividend payments and 28 dividend increases in the last 27 years

- Plans to invest more than $500 million in improving water and wastewater infrastructure in 2018

- Resulting company will be approximately 70% water and 30% gas and maintain strong municipal water and wastewater acquisition strategy

Advisor Access spoke with Aqua America CEO Chris Franklin.

Advisor Access: Please describe Aqua America and what led the company, after more than 130 years of successful growth as a regulated water utility, to decide to expand into natural gas distribution?

Chris Franklin: To understand the rationale behind our transformative acquisition of Peoples, a natural gas distribution utility based in Pittsburgh with more than 740,000 customers, I think it’s helpful to provide some context around Aqua, our industry, and our history of growth.

The vast majority of our nation’s population is served by disparate municipal water and wastewater systems, and many of these systems are deteriorating and in dire need of investment. As cities and towns struggle to maintain their water systems’ infrastructure, compliance requirements and service quality, Aqua is providing a solution. We have the expertise and capital to improve the safety and reliability of water systems. In fact, we plan to invest approximately $1.4 billion in infrastructure improvements through 2020.

Additionally, Aqua has acquired over 300 systems over the last 20 years, consolidating small and midsize private and municipal systems and leveraging our expertise, process efficiencies, and access to capital.

While the acquisition of municipal water and wastewater systems is a solid growth strategy, it takes time to build relationships, earn trust and provide education about the benefits of these solutions. Because of this, our leadership team set out to evaluate supplementary platforms for growth that could build on our deep expertise in infrastructure and utility service. We found the natural gas distribution business integrates many of our existing core competencies. Both water and natural gas companies use the same regulatory process for rates, and both spend a vast portion of their capital each year on pipe and main replacement.

Peoples is a remarkably good fit for Aqua. Both Aqua and Peoples have more than 130 years of service and proven track records of operational efficiency and regulatory compliance. Both have complementary service territories focused primarily in Pennsylvania, one of the most constructive regulatory states in the country. We are very excited to welcome Peoples to the Aqua family because it adds a significant new platform for growth and expansion, and will enhance our mission of improving infrastructure and quality of life in the communities we serve. The combined company will serve more than 5 million people and increase our rate base by nearly 50% to $7.2 billion in 2019. Rate base for the water business will grow at 7% per year, and rate base for the gas business will grow at 8-10% per year.

AA: What is it about Peoples’ location in western Pennsylvania that makes the company particularly attractive to Aqua?

CF: The vast majority of Peoples’ operations, and 77% of the combined company’s rate base, is in Pennsylvania. Peoples also operates in Kentucky and West Virginia, but this focus on Pennsylvania is a key feature of the acquisition because of the state’s constructive regulatory environment. Aqua pioneered the Distribution System Improvement Charge mechanism in Pennsylvania that allows utilities to recover capital expenditures between base rate cases. Similar legislation has spread to other states and industries.

Peoples’ location is also beneficial because the company’s service area sits on top of the Marcellus Shale, one of the largest natural gas deposits in the world. While Peoples is not involved in exploration or drilling for natural gas, by sourcing the gas locally, Peoples, and ultimately customers, have lower costs.

Peoples is headquartered in Pittsburgh, a growing and dynamic city where abundant, low-cost energy is jumpstarting manufacturing and other industries. There’s also a strong technology, medical and educational presence in the region.

Additionally, Peoples has made proposals to provide a solution to the city of Pittsburgh’s troubled water system and, though this was not the rationale for the acquisition, Aqua welcomes the opportunity to be involved in solving Pittsburgh’s water challenges.

AA: What opportunities for infrastructure investment and regulatory mechanisms does Peoples have? Are they similar to Aqua’s opportunities in water?

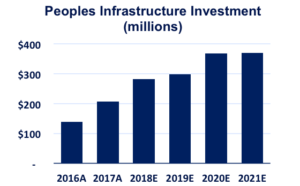

CF: Aqua has an incredible record of replacing hundreds of miles of main for service reliability, which strengthens communities and increases our rate base. Peoples has significant opportunities for similar investments, which will increase the safety and reliability of the company’s natural gas infrastructure as well as grow rate base. The company has identified over 3,000 miles of mains to be replaced by 2034 in Pennsylvania alone. Peoples plans to replace approximately 150 miles of pipe per year, and to substantially increase overall capital spending of the next several years. Approximately 70 percent of Peoples’ capital expense is covered by the Distribution System Improvement Charge or similar mechanisms, which allows more timely return of capital outside of rate cases. We pioneered this mechanism over 20 years ago and utilize it in the water business.

Another significant opportunity for growth and investment is to expand service into rural areas of Pennsylvania, where customers are currently served by more expensive energy sources such as oil, propane, and electricity. Peoples is targeting approximately 370,000 potential customer conversions over time. According to the American Gas Association, households using natural gas save an average of $874 per year compared to electricity.

AA: Will the Peoples acquisition have any impact on Aqua’s long-standing policy of paying increasing dividends?

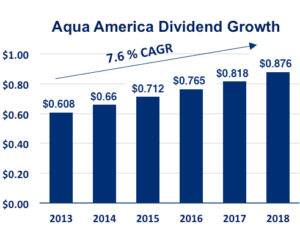

CF: Nearly half of Aqua’s stock is owned by retail shareholders, and many of these investors value our long history of paying dividends. In fact, Aqua is among an elite group of dividend payers known as “Dividend Aristocrats” that have increased payments for more than 25 years in a row. Our most recent increase of 7% was the 28th in 27 years. Aqua has paid a quarterly dividend for 73 consecutive years.

The Peoples acquisition will increase our long-term earnings potential and our ability to continue to maintain a strong dividend growth rate. Our dividend payout ratio target remains in the 60-70% range.

AA: This year Aqua has announced several new municipal acquisitions and purchase agreements. What is behind this uptick in new deals and do you expect it to continue after the Peoples acquisition?

CF: Aqua really values the trust elected officials and other decision-makers put in us when they turn over their responsibilities for their water and wastewater systems. We recently closed two municipal acquisitions in Illinois and one in Pennsylvania totaling over 12,000 new customers, and have a pipeline of seven additional signed asset purchase agreements for water and wastewater systems with approximately 21,000 customers. This totals nearly 33,000 new customers, and over $200 million in rate base. We expect these closed acquisitions, when added to organic growth, will increase our customer base between 2-3% in 2018. We also recently reached the significant milestone of one million customer connections.

This uptick in acquisitions is largely a result of new “fair market value legislation.” This legislation allows companies like Aqua to pay and earn a return on the full market value of its acquired water or wastewater assets. Previously, in most states, only the depreciated original cost of the acquired assets was included in rate base. We are now able to pay a price that assigns an appropriate value to the municipalities’ assets and gives them greater incentive to sell. With this legislation in six of Aqua’s states, we are confident we will be able to provide a solution to many more communities whose municipal water or wastewater systems are in need of investment.

Fair market value is a relatively recent development, and it continues to spread with laws passed in Illinois and North Carolina this year, and additional legislation in progress in Ohio. We believe it will be a significant catalyst for our growth strategy for many years to come.

AA: What key takeaways would you like investors to know about Aqua America?

CF: We are a more than 130-year-old company providing essential services, operating as a nearly 100% regulated business, and paying a steady, growing dividend. The leadership team is focused on delivering shareholder value. All of this gives our company a stable, defensive quality.

But what makes Aqua truly exceptional is that in addition to this stability, we have a proven growth strategy. The acquisition of Peoples gives our company an additional platform for growth and investment, as well as increased optionality and scale.

The final—and perhaps the most important point I would add—is that we are a mission-based company, and our employees bring a sense of purpose to work every day to protect and provide the earth’s most essential resources. At a time when investors are increasingly focused on environmental, social, and governance (ESG) principles, Aqua is a leader in key environmental themes of preventing water scarcity and contamination, and providing a low-cost energy source that has substantially lower emissions than oil, coal, and propane. In October we released our inaugural Corporate Sustainability Report, which further describes our ESG initiatives and our commitment to sustainability and transparency.

AA: Thank you, Chris.

Chris Franklin was appointed CEO of Aqua America in July 2015 and became chairman of the board in December 2017. He was previously president and chief operating officer. A 25-plus-year veteran of Aqua, Franklin has held executive roles in public affairs, customer operations and as regional president of the company’s southern and Midwestern operations. While serving as senior vice president of Aqua America’s corporate and public affairs, he was responsible for federal, state and municipal legislative affairs, investor relations and communications. Before joining Aqua, Franklin worked in the public affairs division at PECO Energy Co. Franklin earned his bachelor’s degree from West Chester University and his MBA from Villanova University. He serves on numerous nonprofit boards and is president of the board of the National Association of Water Companies.

Analyst Commentary

“Aqua has a long history as a pioneer in the utility industry, and we believe the Peoples deal will ultimately prove another example.”

—Ryan Conners, Boenning & Scattergood

November 6, 2018

“2018 has been quite a year for WTR, and its acquisition machine appears to be firing on all cylinders. While Peoples Gas certainly (and deservedly) gets the lion’s share of the attention (740,000 new customers), the company has also added nearly 33,000 new water and wastewater customers in recently announced transactions. . . . [Pittsburgh] opportunity aside, the pipeline for other new deals is robust, with 250,000 potential new customers highlighted as evidence of the M&A environment WTR is currently a part of.”

—Michael Gaugler, Janney Montgomery Scott

November 6, 2018

“We see the long-term opportunities for privatized utilities as compelling and believe that eventually there will be multiple catalysts to drive outperformance.”

—Andy Cohen, Northcoast Research

November 7, 2018

Disclosures

Forward-Looking Statements

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others: the company’s growth and investment opportunities, the company’s position to deliver shareholder value, the amount of capital investment that the company plans to invest through 2020, the addition of Peoples creating a significant growth and expansion platform, the Peoples’ acquisition enhancing and improving the quality of life in the communities the company provides service, Peoples’ opportunities to invest capital including replacing hundreds of miles of gas mains, Peoples’ ability to replace over 3,000 miles of gas mains by 2034, Peoples’ plans to replace 150 miles of gas pipe per year, Peoples’ plans to substantially increase capital spending, the company’s ability to expand service into rural areas of Pennsylvania, the company’s ability to increase its long-term earnings potential and maintain a strong dividend rate, and the company’s increase in optionality and scale. There are important factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements including: the company’s ability to successfully close the Peoples’ acquisition, the company’s ability to obtain financing on favorable terms and conditions, the company’s ability to receive approvals from all governmental agencies on favorable terms and conditions, the ability to successfully integrate the Peoples’ operations, the continuation of the company’s growth-through-acquisition program, the company’s continued ability to adapt itself for the future; general economic business conditions; the company’s ability to fund needed infrastructure; housing and customer growth trends; changes in regulations or regulatory treatment; availability and access to capital; the cost of capital; disruptions in the credit markets; the success of growth initiatives; the company’s ability to continue to deliver strong results; the company’s ability to grow its dividend, add shareholder value and to grow earnings; the company’s ability to control expenses and create and maintain efficiencies; and other factors discussed in our Annual Report on Form 10-K and our Quarterly Report on Form 10-Q, which is filed with the Securities and Exchange Commission. For more information regarding risks and uncertainties associated with Aqua America’s business, please refer to Aqua America’s annual, quarterly and other SEC filings. Aqua America is not under any obligation – and expressly disclaims any such obligation – to update or alter its forward-looking statements whether as a result of new information, future events or otherwise. Investors and others should note that Aqua America, Inc. posts important financial information using the investor relations section of the Aqua America, Inc. website, www.aquaamerica.com/, and Securities and Exchange Commission filings.

Investors and others should note that Aqua America, Inc. posts important financial information using the investor relations section of the Aqua America, Inc. website, www.aquaamerica.com/, and Securities and Exchange Commission filings.

The information contained in this facsimile message is intended only for the use of the individuals to whom it is addressed and may contain information that is privileged and confidential. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone at (707) 933-8500.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry, or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors, and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates, and projections about the industry and markets in which Aqua America, Inc. operates, management’s beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. Aqua America, Inc. has paid Advisor Access a fee to distribute this email. By clicking on any of the links in this email you agree that your contact information may be shared with Aqua America, Inc. Aqua America, Inc. had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online