FEATURED COMPANY

Federal Realty Investment Trust (NYSE: FRT): 55 Years of Consecutive Annual Dividend Increases

Federal Realty owns, operates and redevelops high-quality retail-based properties located primarily in major coastal markets from Washington, D.C., to Boston, as well as San Francisco and Los Angeles. Founded in 1962, Federal Realty’s mission is to deliver long-term, sustainable growth through investing in communities where retail demand exceeds supply. Its expertise includes creating urban, mixed-use neighborhoods like Santana Row in San Jose, California, Pike & Rose in North Bethesda, Maryland, and Assembly Row in Somerville, Massachusetts. These unique and vibrant environments that combine shopping, dining, living and working provide a destination experience valued by their respective communities. Federal Realty’s 102 properties include approximately 3,200 tenants, in 26 million square feet, and approximately 3,100 residential units.

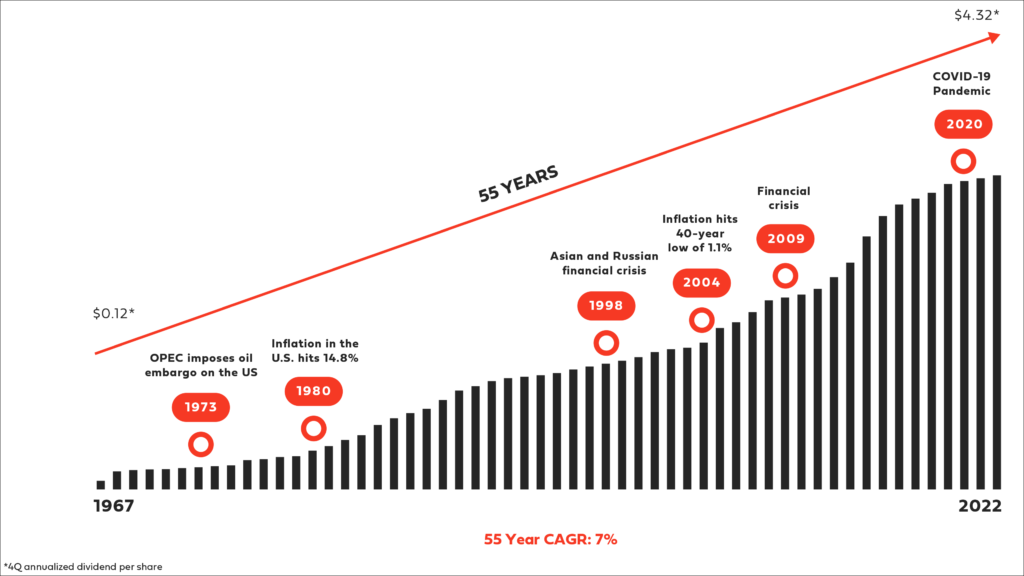

Federal Realty has increased its quarterly dividends to its shareholders for 55 consecutive years, the longest record in the REIT industry. Federal Realty is an S&P 500 index member and its shares are traded on the NYSE under the symbol FRT.

Click HERE to View the Federal Realty Fact Sheet.

Click HERE to View the Federal Realty Investor Presentation.

Advisor Access spoke with Donald C. Wood, CEO of Federal Realty.

Advisor Access: Would you provide us with a brief overview of Federal Realty Investment Trust (NYSE: FRT)?

Don Wood: Federal is one of the oldest REITs [real estate investment trusts] in the country. We celebrated our 60th anniversary in 2022 and have raised our dividends to shareholders every year since 1967. That’s 55 years in a row of dividend increases; we’re the only REIT that’s been able accomplish such a thing. Our real estate is retail-based. With the exclusion of malls, our portfolio includes power centers, mixed-use projects, and grocery-anchored centers in areas where demand exceeds supply. Location is everything in real estate, which is why we operate in inner suburbs of nine strategically selected metropolitan markets across the coastal U.S. We do all of that with a very strong balance sheet, which is critical in real estate because it is a cyclical business. Having a strong BBB+ rated balance sheet is a source of strength and pride for our company and has been for many years.

AA: What sets Federal apart from other REITs in your sector?

DW: An essential component of retail real estate is understanding your customer. To that end, we make sure our assets are in densely populated areas with high levels of disposable income, as well as barriers to entry to reduce the risk of market cannibalization. Our demographics suggest that within three miles of any Federal Realty property you’ll find around 175,000 people whose average household income amounts to roughly $150,000. The result is $10+ billion worth of spending power within three miles of our shopping centers. In addition, our multifaceted business plan presents a wealth of growth opportunities. Whether through leasing, operations, development and acquisitions, our fully integrated approach to real estate differentiates us from our competitors.

AA: Federal Realty boasts 55 consecutive years of increasing annual dividends. How has the company been able to accomplish this, qualifying for the prestigious Dividend Aristocrats list?

DW: It’s quite a feat to be part of the Dividend Aristocrat group, let alone becoming a Dividend King, which we achieved five years ago after 50 years of increased dividends. Out of over 200 publicly traded REITs, Federal alone holds the distinction of Dividend King. We’ve managed to achieve our status by leveraging our best-in-class portfolio and having a balanced business plan focused on diversification. This allows our properties to perform well regardless of the economic environment. Whether that means 20% interest rates in the 1970s, the global financial crisis of the late-2000s, or the COVID-19 global pandemic, Federal has been able to increase its dividend. That can only happen with great properties and and a multifaceted business plan focused on earnings growth.

AA: How has Federal Realty positioned itself for growth and how have rising interest rates affected that strategy?

DW: It’s true that rising interest rates can hit real estate businesses hard, but our company doesn’t require low interest rates to thrive. Federal has long been able to withstand industry challenges thanks to our multifaceted business plan and our ability to adjust. For instance, we reduce development efforts during periods of instability while monitoring the market for opportunities of acquisitions. Again, our properties are in places that are resilient in inflationary environments. That enables us to extend increased rent for our tenants, who in turn can afford heightened rates by extending costs to their financially stable customers. Our model is so effective in part due to our center locations and the affluence of our customer demographics.

AA: How has the pandemic changed the leasing landscape and what is the company doing to address these changes?

DW: One of the best things to have come out of the pandemic was that it reminded people that we are social creatures. In the years preceding the pandemic, there was much talk of a cultural transition away from brick-and-mortar shops to an online only marketplace. Why would you need brick-and-mortar real estate anymore if you can have anything you need delivered to your home? Well, that novel notion’s been put to bed because consumers now know that they love to shop, they love to eat out, they love to exercise out. It’s been a powerful change. In addition, our inner suburb locations have greatly benefited from the new work from home trend, which has made it easier than ever for people to enjoy our properties on days away from the office. The combination has changed the retail real estate landscape for the better.

AA: Is there anything else you’d like our readers to know?

DW: I’d like you to consider that a lot of what has happened over the last couple years through the pandemic is artificial. It’s artificial in the sense of unprecedented government subsidies: $5.5 trillion has been put into the economy over the last couple years by the federal government. The industry effect of that is that it makes all real estate look similar, a rising tide lifts all boats, if you will. Most of that stimulus money has been spent, and accordingly some of the more traditional trends in retail real estate will likely begin to reappear without that financial cushion. That’s where demographics matter, they matter a lot.

AA: Thank you, Don.

Donald C. Wood, Chief Executive Officer of Federal Realty, has been with the firm since 1998, where he is a trustee and has served in positions from chief financial officer to chief operating officer to president before being named its chief executive in 2003. Prior to joining Federal, Don spent eight years at New York-based ITT Corporation, where he served in various capacities, including deputy controller and chief financial officer of wholly owned subsidiary Caesars World, Inc. The first seven years of his career were spent at accounting firm Arthur Andersen, leaving in 1989 to work for client Donald Trump as the vice president of finance for the then newly acquired Trump Taj Mahal casino in Atlantic City, N.J. Don received his Bachelor of Science degree from Montclair State College in 1982, where he graduated with honors and subsequently received his CPA from the state of New Jersey. He is a past chair of the National Association of Real Estate Investment Trusts (NAREIT), has served as a member of the executive committee of the International Council of Shopping Centers (ICSC), and on the board of Quality Care Properties (NYSE:QCP), a Maryland healthcare REIT. He is also a member of the U.S. Capital Chapter of the World President’s Organization (WPO) and was previously named “Entrepreneur of the Year in Real Estate” by professional services firm Ernst and Young.

ANALYST COMMENTARY

“We continue to believe FRT has a high-quality portfolio with customers likely better able to absorb macro pressures given leading demographics, including with small shops. Reiterate Outperform and maintain quality bias amidst macro uncertainty.”

—Juan C. Sanabria, BMO Capital Markets

May 4, 2023

“2022 was a pretty good year. FRT hit record leasing volume in 2022 (over 2 million sq. ft.) with average cash spreads of 6% (15% straight-line). Same-store POI was up 7.7%. FFO per share was up over 13% yr/yr and is now at pre-pandemic levels with expectations for a record year of FFO in 2023. Given the quality of FRT’s real estate, we expect continued outperformance vs. peers.”

—R. J. Milligan, Raymond James

February 8, 2023

DISCLOSURES

Investors and others should note that Federal Realty posts important financial information using the investor relations section of the Federal Realty website, https://ir.federalrealty.com/financial-information, and Securities and Exchange Commission filings.

The information contained in this message is intended only for the use of the individuals to whom it is addressed and may contain information that is privileged and confidential. If the reader of this message is not the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone at (707) 933-8500.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. This report contains forward-looking statements. This information may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. The securities discussed may involve a high degree of risk and may not be suitable for all investors. Federal Realty has paid Advisor Access a fee to distribute this email. Federal Realty had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.