FEATURED COMPANY

Southern Company: 23 Consecutive Years of Dividend Increases

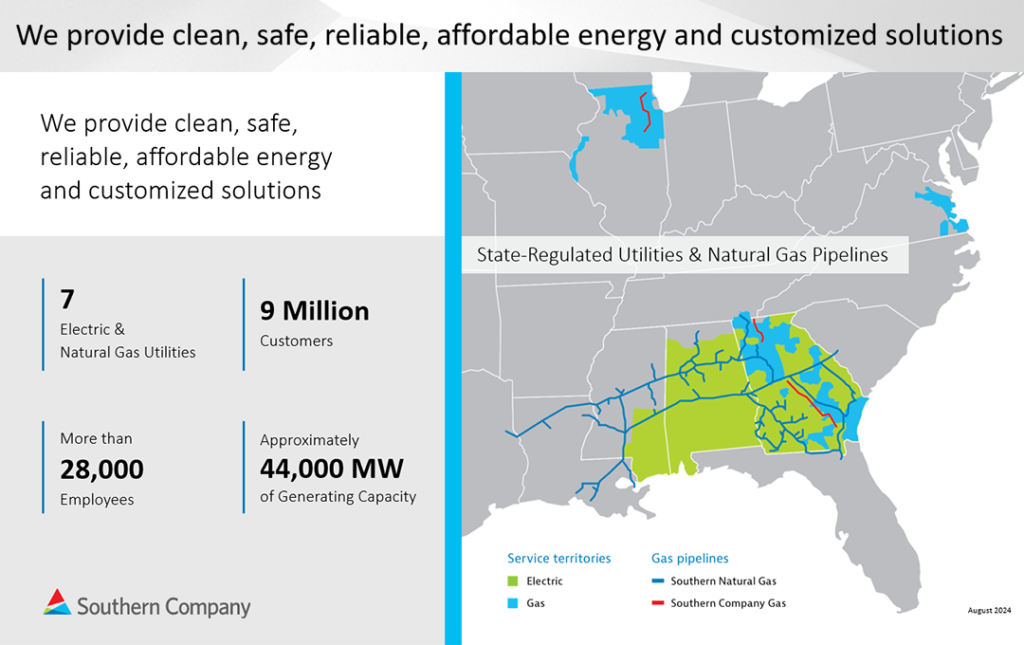

Southern Company (NYSE: SO) is an energy company providing electric and gas service to nine million customers across the United States through its subsidiaries. The company is focused on making, moving and selling reliable, low-cost energy solutions from traditional and renewable power sources, as well as providing superior customer service. Recognizing the rapid evolution of the energy sector, including new technologies, customer preferences, and environmental, social, and governance initiatives, Southern Company is working to advance its solar, wind, and nuclear holdings, develop microgrids and significantly reduce its system’s greenhouse gas emissions.

Click HERE to View the Southern Company Investor Presentation.

Click HERE to View the Southern Company Fact Sheet.

Advisor Access spoke with Southern Company’s chairman, president and CEO, Chris Womack, about the company’s business model, culture and plans for future growth.

Advisor Access: For readers unfamiliar with Southern Company, would you share an overview of the company?

Chris Womack: Southern Company is one of the largest utility holding companies in the United States. We are focused on providing clean, safe, reliable, and affordable energy to customers through vertically integrated, state-regulated electric utilities in three states, state-regulated natural gas distribution utilities in four states, and a competitive wholesale generation business that serves customers throughout the country.

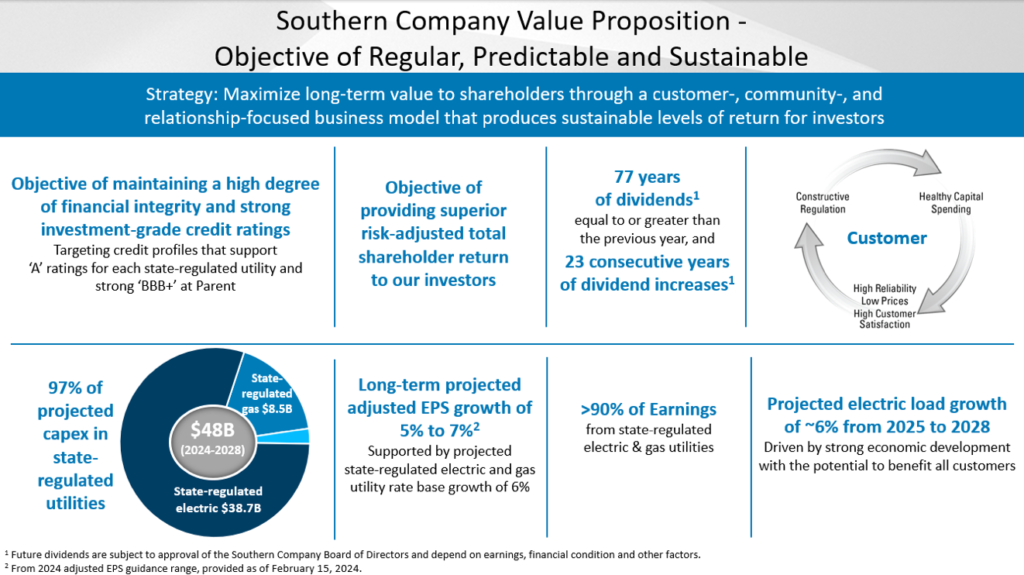

We serve over nine million customers in our state-regulated utilities through a customer-focused business model that is designed to deliver outstanding reliability and affordable service to the homes, businesses and communities we are privileged to serve. Keeping customers at the center of everything we do helps to maintain the constructive regulatory environments in which we operate and supports a healthy level of ongoing utility investments. We plan to invest more than $48 billion over the next five years to transition our generating fleet to cleaner energy sources, to help ensure the long-term reliability and resiliency our transmission and distribution systems, and to serve the unprecedented growth that we’re projecting in our Southeast service territories. We believe the capital investment in our forecast provides a solid foundation for our projected long-term earnings per share growth rate of 5% to 7%.

For more than a century, we have delivered the energy resources and solutions that our customers and communities have needed to support economic growth and prosperity. We understand that reliable and affordable electricity and natural gas are essential services that can also improve the quality of life of customers and that we must be bigger than our bottom line to make the communities that we are privileged to serve better off because we’re there.

AA: Since your transition to CEO over a year ago, what have your observations been and what are you excited about for the future?

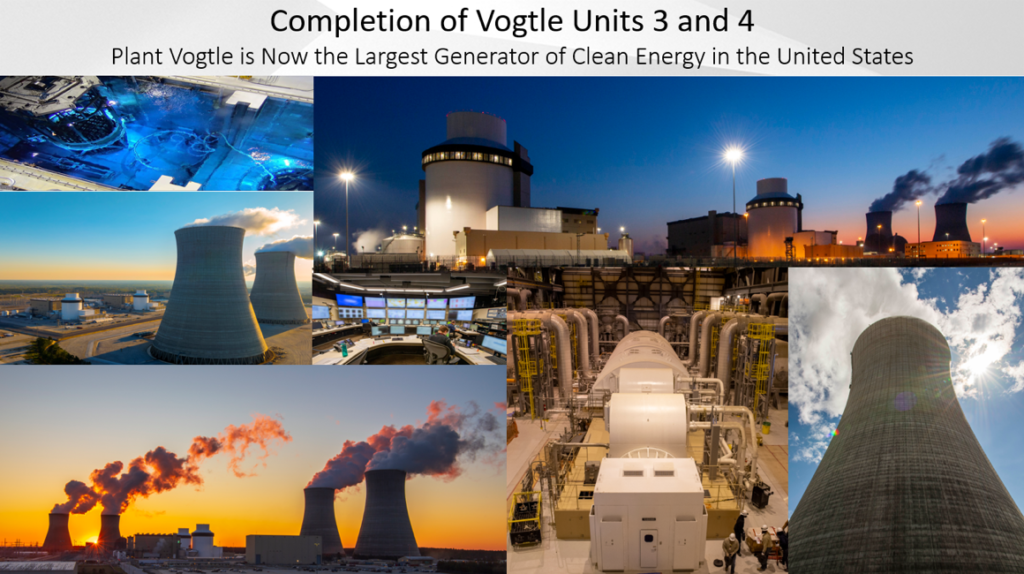

CW: Southern Company is a great company. I have a tremendous sense of pride in how our people have represented our company in our communities for more than a century – our culture revolves around what we have termed Our Values: Safety First, Intentional Inclusion, Act with Integrity, and Superior Performance. We know that how we approach our work is as important as the results we achieve. I am also incredibly proud of our team’s remarkable achievements. For example, we are very proud of the completion of Plant Vogtle Units 3 and 4, the first new nuclear units completed in the United States in over three decades, as this accomplishment serves as a great testament to our team’s perseverance and commitment.

We are even more excited about our future. Our company was founded to serve the growing electricity needs during the industrialization of the Southeast United States. While industrial activity continues to grow and thrive within our service territories, we’re also seeing significantly higher demands as the economy and our society become increasingly electrified. Electric transportation and battery manufacturing, as well as data centers for both cloud computing and artificial intelligence, are contributing to these increased demands. I believe we are well positioned with the experienced team, the constructive state regulatory frameworks, and the institutional wherewithal to capture the value of this significant growth in electricity demand and to do so in manner that creates economic benefits for all stakeholders – customers and investors alike.

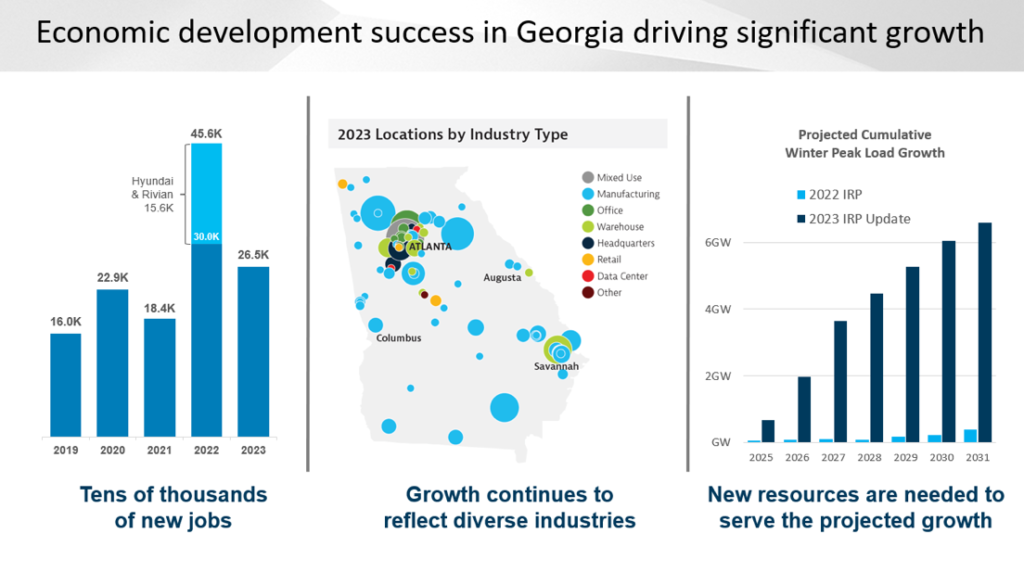

AA: How has the manufacturing renaissance in the Southeast affected Southern Company’s core business operations and how does the company manage this growth?

CW: The strong Southeast economy, including favorable business climates and expansions in manufacturing, continues to drive net in-migration and customer growth into our service territories. We’ve seen several years of extraordinary success in attracting new and expanding businesses to our states leading to a long-term electric sales forecast that is higher than we’ve seen in over a generation. For the past few decades, our industry has experienced electric sales growth of flat to 1%. With the outsized economic development success that we’ve recently experienced, we project electric sales growth to be 1% to 2% for 2024 and 2025, before accelerating to 6% annually from 2025 to 2028 – including 9% at our largest subsidiary, Georgia Power, over that same timeframe.

A substantial portion of the growth that we are projecting is coming from hyperscale data centers, with the balance from a very diverse mix of manufacturing customers including the addition of a Hyundai electric vehicle manufacturing facility, an SK Battery factory, a QCells solar panel manufacturing facility, and the expansion of Gulfstream Aerospace. We continue to execute on our disciplined approach to attracting, serving, and forecasting this potential incremental electric demand, and expect that our approach to pricing this new load should result in revenues that cover the incremental costs to serve these new customers while also providing economic benefits to existing customers.

AA: With the recent achievement of commercial operation of Units 3 and 4, the four-unit Vogtle nuclear site is now the largest generator of clean energy in the U.S. Would you discuss Southern Company’s outlook for building new generation to serve the growth that you’re seeing?

CW: We could not be prouder of the team’s perseverance and commitment to successfully complete the new nuclear units at Plant Vogtle. These new units now deliver more than 2,200 megawatts of reliable, 24/7, carbon-free energy and will continue to for decades to come.

It has long been our belief that the diversification offered by an “all of the above” energy strategy is in the best interest of our customers. Including the addition of Vogtle Units 3 and 4, we are currently projecting to add nearly 10,000 megawatts of new resources in our Southeast service territory between 2023 and 2030. While natural gas generation is expected to continue to play an important role for reliably and economically serving our customers, we’re projecting 80% of new capacity additions to be zero carbon resources. As our load growth continues, we’ll work with each of our state regulatory commissions to build the optimal, diverse portfolio for the future.

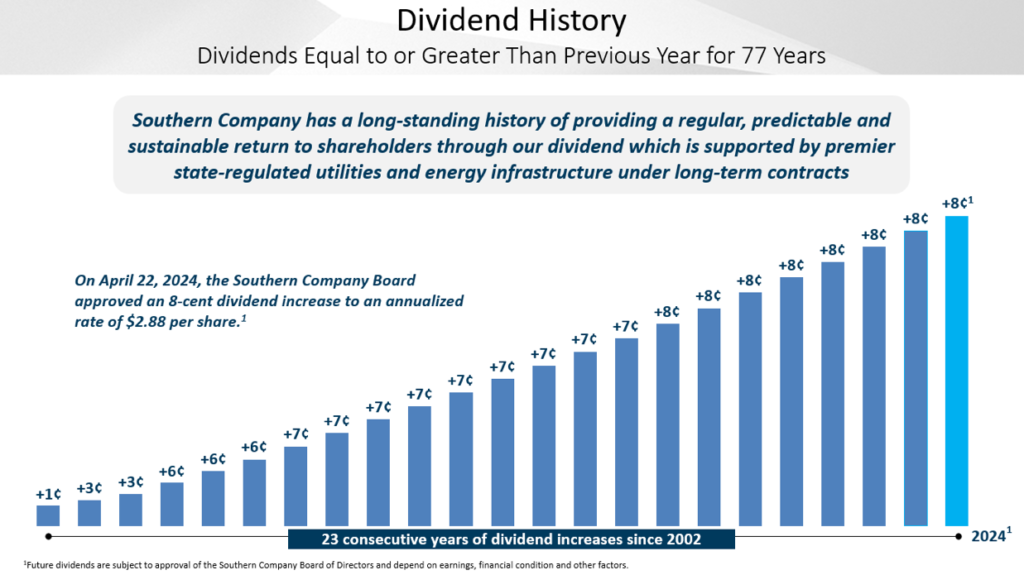

AA: On April 22, 2024, Southern Company announced an 8-cent dividend increase to an annualized rate of $2.88 per share, continuing 23 years of dividend increases. Why is the dividend so important to Southern Company?

CW: This year represents our 23rd consecutive annual dividend increase, and for the last 77 years – dating back to 1948 – Southern Company has paid a dividend that was equal to or greater than that of the previous year. This is a track record that we are extraordinarily proud of.

Cash dividends are one of the best ways for a company to sustainably deliver value to investors – in fact, over the 20-year period ending 12/31/2023, dividends represented approximately 72% of Southern Company’s total shareholder return. Our track record on dividends is not only a testament to our financial strength over the past 75 years, but also a testament to our discipline. We pride ourselves on maintaining a high degree of financial integrity and strong investment grade credit ratings coupled with our track record of regular, predictable, and sustainable earnings per share and dividend growth. This supports our objective of providing a superior risk-adjusted total shareholder return to investors over the long term.

AA: Southern Company boasts one of the stronger balance sheets and credit metric outlooks for the utility industry. Why is this important to you?

CW: It has long been our philosophy that value is a function of risk and return and that in order to be a high-quality equity, you must have strong credit. Our business is very capital intensive and access to the capital markets is essential. As a result, we view strong credit quality as an important buffer against adversity and not as something that is to be cashed in or consumed for short-term financial gain. Our objective is for the parent company to have credit metrics supportive of a strong “BBB+” rating and for each of our state-regulated utilities to have credit metrics consistent with a rating in the “A” category.

AA: Is there anything else you’d like investors to know about Southern Company?

CW: I’ll just repeat: Southern Company is a great company. Our focus on our customers, our bigger-than-our bottom-line values that guide our every action, and our financial discipline all underpin our strong value proposition for investors. I’m so proud of our team for their unrelenting focus on providing clean, safe, reliable and affordable energy and I am very excited about the burgeoning demand for energy that is providing continued opportunities to capture value for stakeholders.

Chris Womack is the chairman, president and chief executive officer of Southern Company, one of the nation’s leading energy providers serving 9 million customers nationwide.

Prior to his current role, since 2021 he served as chairman, president and CEO of Georgia Power, leading Southern Company’s largest subsidiary.

He assumed leadership of Georgia Power after serving as executive vice president and president of external affairs for Southern Company where he led overall external positioning and branding efforts including the company’s public policy strategies and oversaw the company’s governmental and regulatory affairs, corporate communication initiatives and other external and strategic business engagements.

A native of Greenville, Alabama, Womack joined Southern Company in 1988 and has held several leadership positions within Southern Company and its subsidiaries. He has served as executive vice president of external affairs at Georgia Power and senior vice president and senior production officer of Southern Company Generation, where he was responsible for coal, gas, and hydro generation for Georgia Power and Savannah Electric. Womack also served as senior vice president of human resources and chief people officer at Southern Company, as well as senior vice president of public relations and corporate services at Alabama Power.

Prior to joining Southern Company, Womack worked on Capitol Hill for the U.S. House of Representatives in Washington DC. He served as a legislative aide for former Congressman Leon E. Panetta and as staff director for the Subcommittee on Personnel and Police for the Committee on House Administration.

Womack is chair of the Metro Atlanta Chamber of Commerce, co-chair of the Edison Electric Institute (EEI) Customer Solutions Policy Committee and a member of the board of directors of Electric Power Research Institute (EPRI), Invesco Ltd. and the Georgia Ports Authority. He is past chair of the board of the East Lake Foundation and is on the national board of The First Tee. Womack has chaired the Atlanta Convention and Visitors Bureau board and the Atlanta Sports Council. He has received numerous honors, awards and recognitions.

He holds a bachelor’s degree from Western Michigan University and a master’s degree from The American University and completed the Stanford Executive Program in 2001.

DISCLOSURES

Investors and others should note that The Southern Company (“Southern Company”) posts important financial information, including non-GAAP reconciliations, using the investor relations section of the Southern Company website, https://investor.southerncompany.com/home/default.aspx, and Securities and Exchange Commission filings.

The material, information and facts discussed in this report are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. This is not an offer or solicitation of the securities discussed. Advisor-Access LLC and/or its employees, contractors and owners, may purchase or sell the securities mentioned in this report from time to time. Any opinions or estimates in this report are subject to change without notice. Certain information contained in this report is forward-looking information based on current expectations and plans that involve risks and uncertainties. Forward-looking information includes, among other things, financial objectives, projected capital expenditures, projected capacity additions, long-term projected adjusted EPS growth, and load growth projections of Southern Company and its subsidiaries. Southern Company cautions that there are certain factors that can cause actual results to differ materially from the forward-looking information that has been provided. The reader is cautioned not to put undue reliance on this forward-looking information, which is not a guarantee of future performance and is subject to a number of uncertainties and other factors, many of which are outside the control of Southern Company; accordingly, there can be no assurance that such suggested results will be realized. The following factors, in addition to those discussed in Southern Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, and subsequent securities filings, could cause actual results to differ materially from management expectations as suggested by such forward-looking information: the impact of recent and future federal and state regulatory changes, including tax, environmental and other laws and regulations to which Southern Company and its subsidiaries are subject, as well as changes in application of existing laws and regulations; the extent and timing of costs and legal requirements related to coal combustion residuals; current and future litigation or regulatory investigations, proceedings, or inquiries, including litigation and other disputes related to the Kemper County energy facility and Plant Vogtle Units 3 and 4; the effects, extent, and timing of the entry of additional competition in the markets in which Southern Company’s subsidiaries operate, including from the development and deployment of alternative energy sources; variations in demand for electricity and natural gas; available sources and costs of natural gas and other fuels and commodities; the ability to complete necessary or desirable pipeline expansion or infrastructure projects, limits on pipeline capacity, public and policymaker support for such projects, and operational interruptions to natural gas distribution and transmission activities; transmission constraints; the ability to control costs and avoid cost and schedule overruns during the development, construction, and operation of facilities or other projects due to challenges which include, but are not limited to, changes in labor costs, availability, and productivity, challenges with the management of contractors or vendors, subcontractor performance, adverse weather conditions, shortages, delays, increased costs, or inconsistent quality of equipment, materials, and labor, contractor or supplier delay, the impacts of inflation, delays due to judicial or regulatory action, nonperformance under construction, operating, or other agreements, operational readiness, including specialized operator training and required site safety programs, engineering or design problems or any remediation related thereto, design and other licensing-based compliance matters, challenges with start-up activities, including major equipment failure or system integration, and/or operational performance, challenges related to pandemic health events, continued public and policymaker support for projects, environmental and geological conditions, delays or increased costs to interconnect facilities to transmission grids, and increased financing costs as a result of changes in interest rates or as a result of project delays; legal proceedings and regulatory approvals and actions related to past, ongoing and proposed construction projects, including Public Service Commission approvals and Federal Energy Regulatory Commission and U.S. Nuclear Regulatory Commission actions; the ability to construct facilities in accordance with the requirements of permits and licenses, to satisfy any environmental performance standards and the requirements of tax credits and other incentives, and to integrate facilities into the Southern Company system upon completion of construction; investment performance of the employee and retiree benefit plans and nuclear decommissioning trust funds; advances in technology, including the pace and extent of development of low- to no-carbon energy and battery energy storage technologies and negative carbon concepts; performance of counterparties under ongoing renewable energy partnerships and development agreements; state and federal rate regulations and the impact of pending and future rate cases and negotiations, including rate actions relating to return on equity, equity ratios, additional generating capacity, and fuel and other cost recovery mechanisms; the ability to successfully operate the electric utilities’ generation, transmission, and distribution facilities, Southern Power Company’s generation facilities and Southern Company Gas’ natural gas distribution and storage facilities and the successful performance of necessary corporate functions; the inherent risks involved in operating nuclear generating facilities; the inherent risks involved in generation, transmission and distribution of electricity and transportation and storage of natural gas, including accidents, explosions, fires, mechanical problems, discharges or releases of toxic or hazardous substances or gases and other environmental risks; the performance of projects undertaken by the non-utility businesses and the success of efforts to invest in and develop new opportunities; internal restructuring or other restructuring options that may be pursued; potential business strategies, including acquisitions or dispositions of assets or businesses, which cannot be assured to be completed or beneficial to Southern Company; the ability of counterparties of Southern Company and its subsidiaries to make payments as and when due and to perform as required; the ability to obtain new short- and long-term contracts with wholesale customers; the direct or indirect effect on the Southern Company system’s business resulting from cyber intrusion or physical attack and the threat of cyber and physical attacks; global and U.S. economic conditions, including impacts from geopolitical conflicts, recession, inflation, tariffs, interest rate fluctuations and financial market conditions, and the results of financing efforts; access to capital markets and other financing sources; changes in Southern Company’s and any of its subsidiaries’ credit ratings; the ability of Southern Company’s electric utilities to obtain additional generating capacity (or sell excess generating capacity) at competitive prices; catastrophic events such as fires, earthquakes, explosions, floods, tornadoes, hurricanes and other storms, droughts, pandemic health events, political unrest, wars or other similar occurrences; the direct or indirect effects on the Southern Company system’s business resulting from incidents affecting the U.S. electric grid, natural gas pipeline infrastructure, or operation of generating or storage resources; impairments of goodwill or long-lived assets; and the effect of accounting pronouncements issued periodically by standard-setting bodies. Southern Company expressly disclaims any obligation to update any forward-looking information. The securities discussed may involve a high degree of risk and may not be suitable for all investors. Southern Company has paid Advisor Access a fee to distribute this email. Southern Company had final approval of the content and is wholly responsible for the validity of the statements and opinions.

About Advisor Access

Advisor-Access LLC was designed to bring compelling investment ideas to investors in the form of in-depth interviews with company management and the latest fact sheets and corporate presentations, in a concise format: the critical pieces of information an investor needs to make an informed investment decision. Read the Advisor-Access Full Disclosure Online.