The REIT Newsletter for Advisors • Fall 2017

Click HERE to download a printable version of this newsletter.

As an investment advisor, you have been subscribed to the REIT newsletter so that you and your clients can stay abreast of this powerful income-generating sector. Published quarterly, the REIT Newsletter includes valuable information about REITs that you cannot get anywhere else.

The National Association of Real Estate Investment Trusts (NAREIT®) is the worldwide representative voice for REITs and publicly traded real estate companies with an interest in U.S. real estate and capital markets.

The Fall 2017 issue features an article by the Public Securities Group at Brookfield Asset Management.

Insights on the Retail Real Estate Sector

by the Public Securities Group1

Headlines surrounding retail store closures and bankruptcies have dominated the news over the last 12 months. As a result, share prices of retail REITs have declined meaningfully as investor perceptions have largely been shaped by these headlines. We believe concerns about the impending demise of publicly traded retail REITs are overblown. Despite the ongoing disruption e-commerce has had on the retail real estate landscape, the dislocations in security prices of retail REITs over the past year have created very attractive investment opportunities. Our view is supported by the following points:

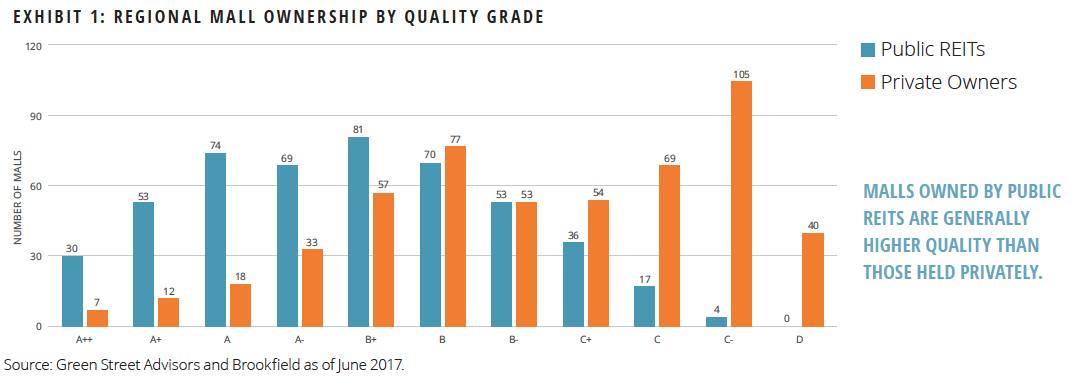

- Not all retail is created equal—malls owned by public REITs are generally higher quality than those held privately, and we believe REITs have very limited exposure to malls at risk of closure.

- Successful retailers are embracing omnichannel retailing as they realize the importance of combining their brick-and-mortar presence with e-commerce strategies. We believe evolving consumer preferences, as they pertain to the integration of these channels, are likely to benefit owners of higher-quality properties.

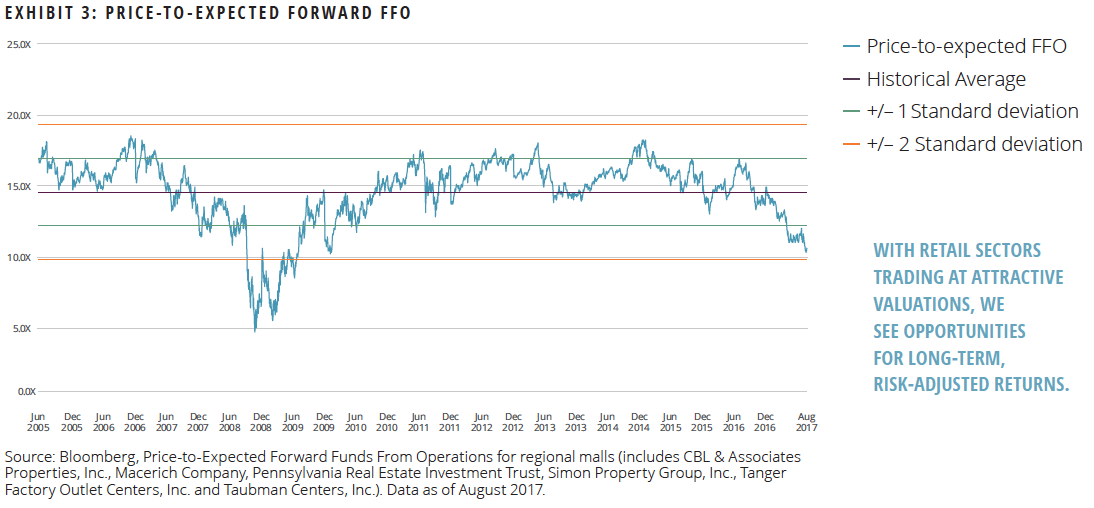

- Investor perceptions about the changing retail landscape have created deep value opportunities to invest in many publicly traded retail REITs. Despite the near-term challenges facing the industry, pricing is very attractive as some of the best managed retail REITs—and those with the most attractive real estate portfolios—are trading at very compelling discounts to net asset value (NAV).

Not All Retail Real Estate Is Created Equal

Over the past 12 months, regional mall stocks have declined meaningfully as investor perceptions have been shaped by negative headlines about weak retail sales and department store closures. The retail market segment is clearly undergoing fundamental changes, and we do expect more store closures. However, not all retail landlords are created equal, and we believe public REITs are well positioned to adapt and withstand the pressures in this evolving landscape.

Publicly and privately owned malls are evaluated for quality by research providers on a number of metrics, including sales per square foot, surrounding demographics, tenant mix, and alternative land use, among other factors. As shown in Exhibit 1, publicly traded REITs typically own higher-quality centers compared to private owners.

We highlight this point for a number of reasons. First, lower-quality centers have a much greater risk of failing as they are more likely to experience vacancies when department stores and other retailers announce closures. For example, of the 138 J.C. Penney stores that have closed, only eight of them were in public REIT portfolios. Additionally, despite their large footprint, department stores pay very little rent per square foot and represent a small portion of public REITs’ overall revenue. At Simon Property Group, for example, Macy’s, Sears, and J.C. Penney represent only 0.4%, 0.4%, and 0.3% of the rents generated by the company’s U.S. properties.

Second, higher-quality properties will generally have greater tenant demand if they are required to redevelop a vacated department store. Landlords will thus have better prospects to upgrade their tenant mix, which can result in higher rents. Management teams of publicly traded REITs are experienced in the redevelopment of vacated stores with more appealing concepts, such as restaurants and theaters. They generally have better access to capital and more extensive industry contacts than smaller private peers, making them better equipped to successfully execute these redevelopment strategies.

At many properties, the closure of a department store can actually represent an attractive redevelopment opportunity for the landlord. As underperforming locations are closed, the landlord has the ability to redevelop the property and can generally increase rents significantly, while also improving the tenant quality. For example, inline stores and freestanding (i.e., non-anchor) spaces at Simon Property Group pay $51.55 per square foot in minimum base rent, while anchor tenants pay $6.06 per square foot in minimum base rent2.

Retailers Are Shifting Strategies Amid the Growth of E-Commerce

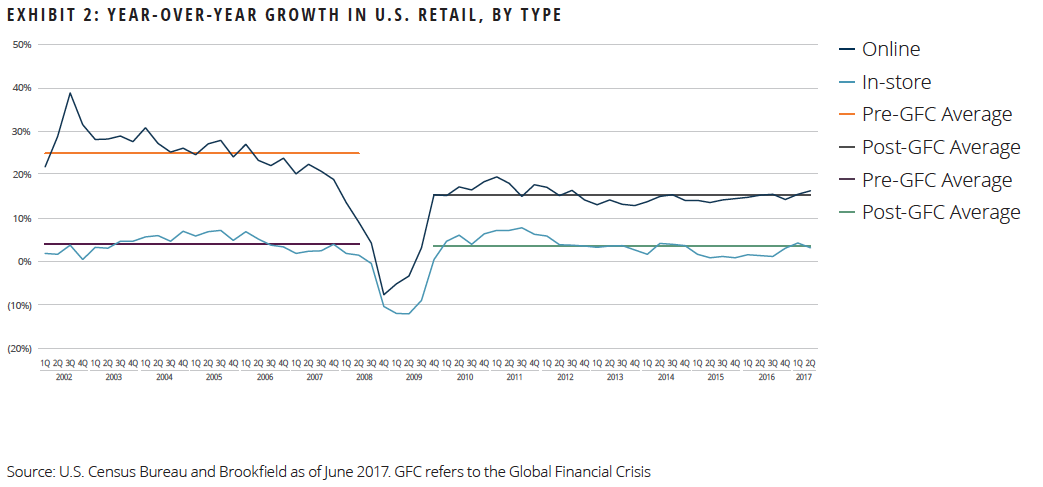

We recognize that department stores are struggling and many retailers are rationalizing store counts. However, we believe high-quality retail locations can continue to perform well even as e-commerce continues to grow. And while e-commerce sales are the fastest growing segment of the retail sector, Exhibit 2 points out that the growth rate has moderated in recent years. Additionally, e-commerce sales still represent a small poriton of overall retail sales.

As a result, retailers are reevaluating strategies as they realize brick-and-mortar locations are essential to their success. Companies are embracing the omnichannel operating model that integrates online and in-store purchases and experiences. In fact, some online-only retailers are now opening physical stores, notably Amazon, Tesla, Warby Parker, and Bonobos. Additionally, high-quality and high-credit traditional retailers continue to expand their physical footprints as they recognize the importance of the in-store experience. Examples include H&M, Inditex (Zara), ULTA Beauty, and TJX Companies.

Shoppers are also viewing retail locations as places to go for experiences. A Westfield Corporation report on the future of shopping highlights that “nearly one-third of shoppers (32%) are interested in attending a lifestyle lesson at their favorite store.” Examples include personal services at beauty stores, classes (cooking, home improvement, etc.) and fitness analysis, among others. A recent study showed that the more channels customers use, the more valuable they are to retailers3. The most innovative and successful companies will effectively engage customers at all channels, including physical stores, and we believe this trend will benefit owners of high-quality portfolios like those owned by publicly traded REITs.

Sentiment-Driven Declines Have Led to Compelling Valuations

Investor sentiment spurred by fears of the impending demise of brick-and-mortar retail has exerted meaningful pressure on retail REIT securities. Over the one-year period ended June 30, 2017, the U.S. Retail segment of the FTSE EPRA/NAREIT Developed Index was down 23.4%. This has led to some very compelling valuations in the group. As shown in Exhibit 3, price-to-expected forward funds from operations (FFO) multiples are meaningfully below historical averages.

At these levels, we believe there are very attractive opportunities for long-term, risk-adjusted returns. These companies are run by highly capable management teams, many of whom have experience navigating the impact e-commerce has had on retail real estate over the last 20 years; and have adapted their firms’ strategies accordingly.

Conclusion

The retail sector has been experiencing secular changes continually since the advent of e-commerce in the late 1990s. We believe the recent narrative around the doom and gloom for publicly traded retail REITs is overblown. As previously discussed, not all retail real estate is created equal. Public REITs are less exposed to recent store closures—many of which have taken place among retailers whose brands and/or business models are less relevant and out of favor with consumers. Innovative retailers are modifying their strategies to optimize all consumer touchpoints—including brick-and-mortar retail—and we believe this benefits owners of higher-quality real estate portfolios, notably public REITs. Lastly, investor sentiment has driven pricing of retail REIT securities to levels we view as very appealing; and we believe this presents attractive risk-adjusted return potential for patient capital.