The REIT Newsletter for Advisors • Spring 2023

REITs: Prepared to Navigate

Ongoing Economic Uncertainty

by Savannah DeLullo, Manager, Research & Industry Information, Nareit and Ed Pierzak, PhD, Senior Vice President, Research, Nareit

The U.S. economy has been marked by mixed economic growth results, elevated inflation, and higher interest rates. The confluence of these factors has resulted in increased uncertainty surrounding the economic outlook. At the end of 2022, the Bloomberg consensus forecast survey placed the odds of a U.S. recession within the next 12 months at 70%. Noting that economic growth is a key driver of real estate operational and investment performance, some property investors are increasingly concerned about downside risk.

The U.S. economy has been marked by mixed economic growth results, elevated inflation, and higher interest rates. The confluence of these factors has resulted in increased uncertainty surrounding the economic outlook. At the end of 2022, the Bloomberg consensus forecast survey placed the odds of a U.S. recession within the next 12 months at 70%. Noting that economic growth is a key driver of real estate operational and investment performance, some property investors are increasingly concerned about downside risk.

Amid this economic uncertainty, property fundamentals across most sectors have generally remained solid, but there has been some evidence of softening. The industrial, retail, and apartment property types have maintained occupancy and four-quarter rent growth rates akin to or higher than their respective pre-pandemic levels; office has struggled. Higher interest rates and debt costs have also been throttling commercial real estate transaction volume. The silver lining of this situation is that new development has been curtailed as well.

REITs Have Outperformed Their Equity Market Counterpart

Before, During, & After Recessions

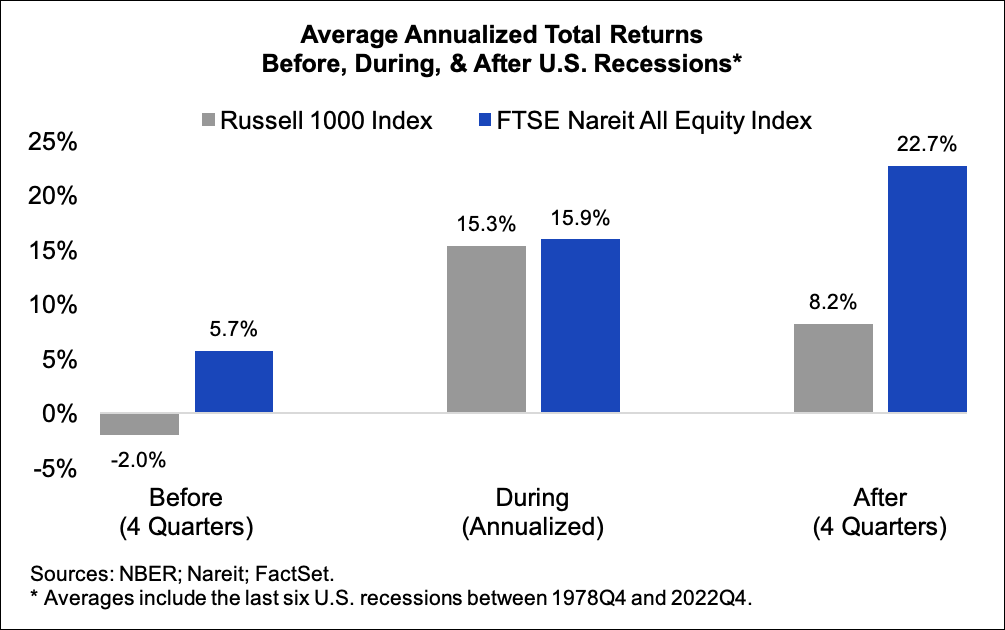

While the U.S. has not entered a recession thus far in 2023, the current economic climate is creating headwinds for future property performance. Although past performance may not be indicative of future results, a review of historical public real estate and equity market total returns before, during, and after recessions may help alleviate some concerns for REIT investors.

The chart above displays the average annualized total returns for the public real estate and equity markets before, during, and after U.S. recessions. The FTSE Nareit All Equity Index and the Russell 1000 Index are used to measure REIT and stock market performances, respectively. An analysis of the last six recessions reveals that, on average, REITs outperformed their equity market counterpart before, during, and after recessions.

It is important to note that recessions do not have to equate to negative real estate performance. Furthermore, REITs have traditionally been well-positioned to take advantage of economic recoveries.

REIT Operational Performance Remains Solid

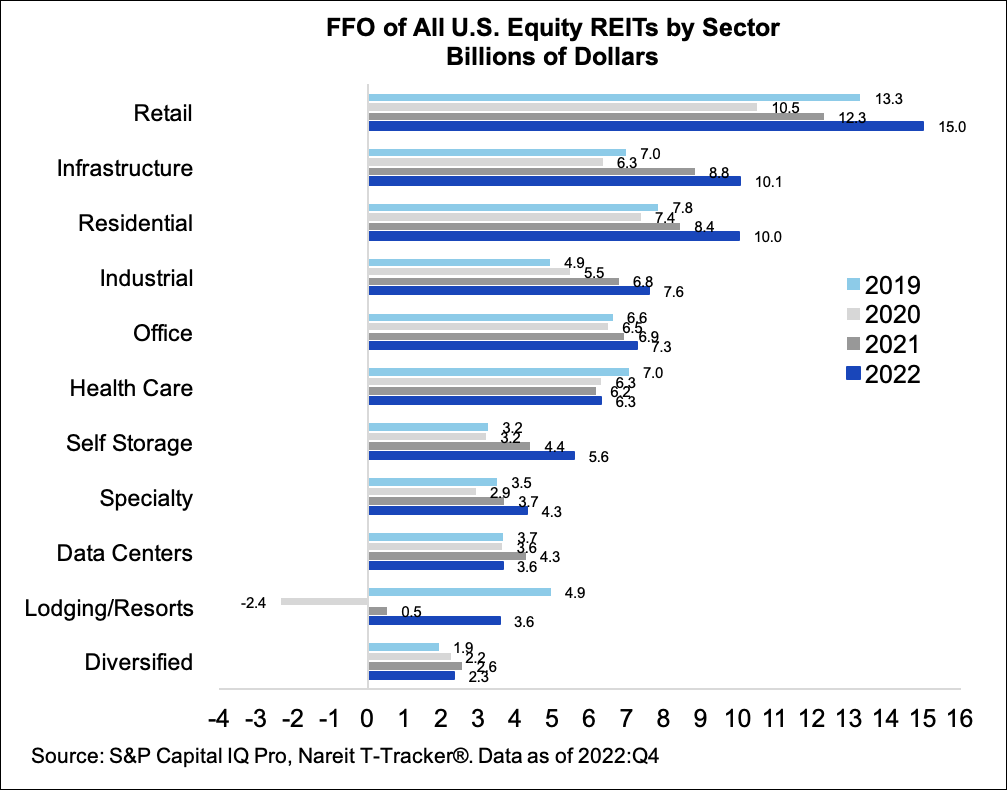

Despite economic headwinds, equity REITs have displayed strength from an operational perspective. Data from the Nareit T-Tracker® in the fourth quarter of 2022 (the most recent data available) highlighted solid year-over-year growth in aggregate funds from operations (FFO), net operating income (NOI), and same-store NOI (SS NOI). It also reported an average occupancy rate gain. Specifically, T-Tracker® data show that:

- FFO increased by 10.1% year-over-year.

- Keeping up with inflation, NOI and SS NOI experienced 6.8% and 6.5% year-over-year gains, respectively.

- The average occupancy rate increased to 6%.

The chart above displays annual FFOs by property sector for all U.S. equity REITs in billions of dollars from 2019 to 2022. The COVID-19 pandemic had a negative impact on operational performance across all U.S. equity REIT sectors, except industrial, which was driven by the rapid growth of e-commerce-based demand and diversified. The magnitude of the impact of COVID-19 differed greatly depending on real estate sector, providing an example of the value of the broad diversity of property types that REIT investment provides. The recoveries from pandemic (2020) operational performance levels are evident across all U.S. equity REIT property sectors as of the fourth quarter of 2022. Furthermore, eight of the 11 property types surpassed their pre-pandemic (2019) FFO levels, with health care, data centers, and lodging/resorts lagging. In the current economic climate, these gains are noteworthy. They are a testament to the operational performance strength of U.S. equity REITs.

REITs Maintain Strong Balance Sheets

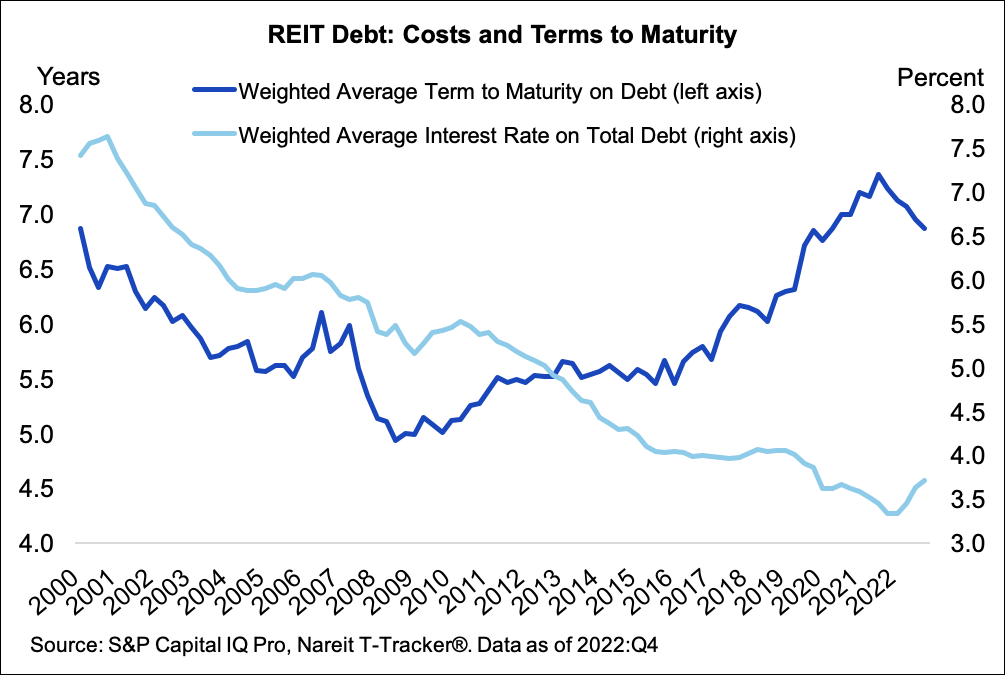

The 10-year Treasury yield has surged. From the end of December 2021 to the end of February 2023, the 10-year Treasury yield increased by 240 basis points. REITs remain well prepared for a period of higher interest rates by having maintained historically low levels of leverage along with well-structured, long-term debt. As of the fourth quarter of 2022, T-Tracker® data show that:

- The leverage ratio remained low at 33.7%.

- Fixed rate debt accounted for 86.3% of total debt.

- Net interest expense as a percent of NOI was low at 19.9%.

The chart above presents the weighted average interest rate and weighted average term to maturity on debt for all U.S. equity REITs from the first quarter of 2000 to the fourth quarter of 2022. The term to maturity and cost of debt data show that REITs have been mindful of their experiences through the Great Financial Crisis. With their use of fixed rate debt to lock in low interest rates for long terms, REITs have established a long runway to manage leverage. As of the fourth quarter of 2022, the weighted average term to maturity of REIT debt was nearly seven years. While REITs have not been immune from rising interest rates, their debt costs only increased marginally compared to the 10-year Treasury. The weighted average interest rate on total debt was 3.7% in the fourth quarter of 2022; it was 3.3% at the beginning of the year.

Given their current market valuations, strong operational performance, and solid balance sheets, REITs are well positioned to navigate the expected economic and market uncertainty in 2023.