The REIT Newsletter for Advisors • Summer 2022

REITs Provide Access to the Real Estate that Houses the Modern Economy

by John Barwick

Nareit Vice President, Index Management & Industry Information

Over the past two decades, the structure of the economy has changed dramatically, and we see this most clearly in how work, shopping, and leisure are increasingly connected to the digital economy. As the economy has changed, so too has the real estate that houses the economy. REITs have been on the leading edge of this change and today provide investors with access to a broad range of property types.

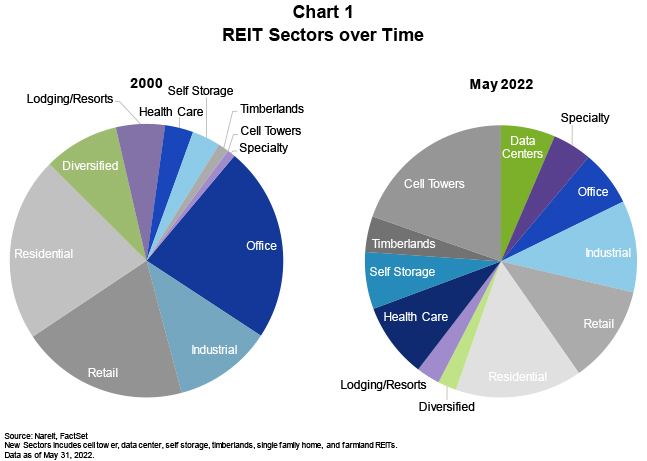

Access to new and emerging property sectors has given rise to an important new dimension of portfolio diversification, one in which REITs are uniquely positioned. The REIT universe has expanded greatly beyond the property sectors institutional investors traditionally owned—Retail, Office, Residential, and Industrial. In 2000, these sectors comprised over 80% of the market capitalization of equity REITs.

Over the past decade, new property types have been introduced and have grown rapidly as have mature, but non-core, sectors. Today, these property types outside of the traditional four property sectors account for 53% of total equity market capitalization. Of special interest are REITs that invest in real estate that supports the rapidly growing technology sectors of the economy.

New economy and high-tech real estate

Technology has changed nearly every aspect of the U.S. and the global economy. Two of the most prominent areas are the spread of internet communications and the rise of e-commerce. According to Cisco, global internet traffic has expanded ten-fold since 2010 and there will be 5.3 billion total internet users (66% of global population) by 2023, up from 3.9 billion (51% of global population) in 2018.1 E-commerce has nearly tripled over this period, rising much more rapidly than in-store sales.

The common adage, “real estate houses the economy,” applies to the new tech economy, as well. Internet communications and e-commerce both depend on tech-related real estate, and REITs are active in owning and developing real estate that supports the tech economy.

In particular, the Infrastructure sector comprises REITs that own cell towers that transmit voice and data messages, the Data Center sector provides the facilities that house servers enabling online communication and storage of data, and the Industrial sector provides logistics space, which is essential for the rapid delivery of goods bought via e-commerce. In the Industrial sector, logistics space has overtaken traditional warehouse and flex space as the dominant form of industrial real estate. The e-commerce sectors now account for 36% of the market capitalization of all equity REITs.

The diversity of REIT property types can translate directly into improved diversification for the investor who holds the full range of commercial real estate sectors. On an annualized basis total investment returns for Industrial/Logistics, Cell Tower, and Data Center REITs were 19.9%, 18.0%, and 15.4%, respectively, since 2015. 2

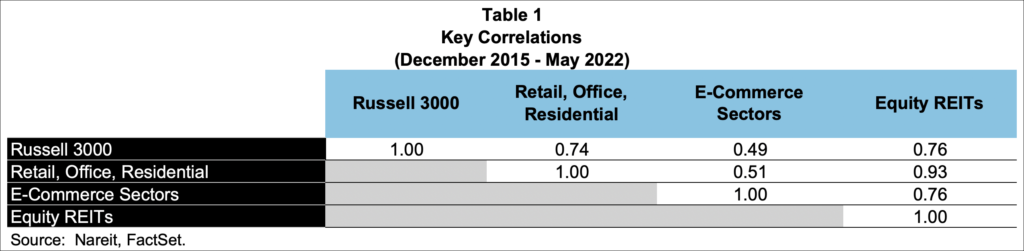

Returns of different REIT sectors do not typically move in lockstep with one another, especially among the newer property types, so incorporating the newer sectors into a portfolio can provide additional diversification and reduced risk. As shown in Table 1, the correlation between a portfolio of Retail, Office, and Residential sectors and a portfolio of tech-related REIT sectors (Cell Towers, Data Center, and Industrial/Logistics) is .51, while the correlation of Retail, Office, and Residential with All Equity REITs climbs to .93. This low correlation between the traditional Retail, Office, and Residential property types and the tech-related sectors means combining the property types can yield significant diversification benefits.

Completion Portfolios

A portfolio that holds assets and property types in the same proportions as a decade ago would miss out on the diversification that can be achieved by investing in these newer and more rapidly growing REIT types. One idea is to use REITs to create a “completion portfolio” that consists of these new sectors to complement the traditional real estate types in order to achieve more robust diversification.

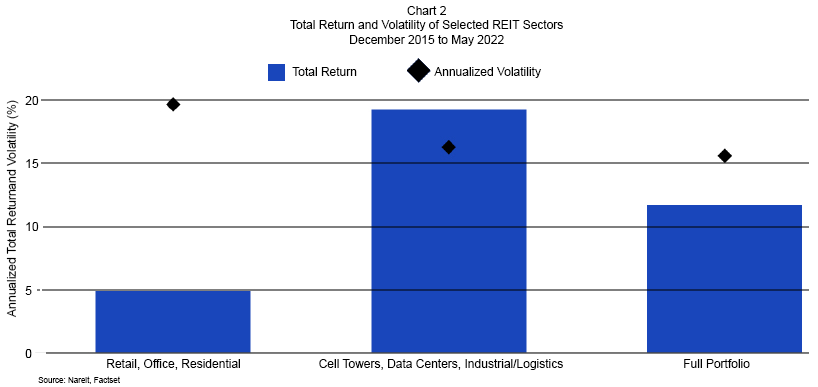

Consider the impact of including a completion portfolio of tech-related REIT sectors to a traditional Retail, Office, and Residential portfolio. The chart below shows the impact of adding these sectors to a core portfolio of Retail, Office, and Residential REITs for the period December 2015 – May 2022. Total return on the Retail, Office, and Residential portfolio was an annualized 4.9% over this period. A completion portfolio consisting of the Cell Tower, Data Center, and Industrial/Logistics REITs, however, provided a total return of 19.2% over this period. The combined portfolio of Retail, Office, and Residential REITs plus the completion portfolio, with each weighted by market capitalization, returned 11.7%.

It is important to consider the impact of adding these new sectors on the volatility of the portfolio. The standard deviation of monthly returns on the Retail, Office, and Residential REITs portfolio was 19.6% over this period. Returns on the completion portfolio consisting of Cell Tower, Data Center, and Industrial/Logistics REITs served to reduce volatility, with a standard deviation of 16.2%. Importantly, while returns rise on the full portfolio, the volatility declines slightly to 15.6%. This reflects the fact that the greater diversification of the portfolio results in more stable returns.

Pandemic-Era Performance

COVID-19 accelerated some market forces, such as the growth of e-commerce, and introduced new trends, as people worked and shopped from home. The performance of real estate through the pandemic era reinforces the importance of a fully diversified real estate portfolio that captures the full scope of the modern economy.

Like other equity investments, REITs were hit hard by the onset of the pandemic but have generally rebounded as the world learns to live with COVID-19. Not all property sectors were impacted as negatively, nor have they bounced back uniformly. Work from home trends and e-commerce behavior during the pandemic have benefited the digital economy sectors of the real estate market and presented new opportunities for investors to capitalize on.

Many Americans will be unsurprised to see that the Self Storage sector was the strongest-performing sector of the pandemic era, with a total return of 61.9% since February 2020, as demand came from new and prospective homeowners as well as existing homeowners who needed more space. Further, many homeowners and renters alike found that work from home required that space previously used for storage be used differently.

REITs Belong in a Well-Diversified Portfolio

Investing in REITs offers versatile ways to positively impact the risk/return profile of investment portfolios. COVID-19 changed the way we live our lives, do our shopping, and conduct our business. Some of the changes may prove to be temporary, while others are likely to be permanent, but as the trends of the pandemic era continue to emerge, REITs offer a flexible and liquid approach to investing in the real estate around which we build our lives.

1 Cisco Annual Internet Report (2018–2023)

2 Nareit analysis of FTSE Nareit All Equity REITs returns as of May 2022.